Nearly nine in ten mid-sized businesses report that late payments prevent them from growing, according to QuickBooks surveys. That’s no surprise when a typical business is owed as much as $300,000 in late payments. These delays often disrupt cash flow, making it hard to cover operational expenses or invest in growth. To cope, many businesses turn to external funding and face a tough decision: give up equity for investor capital or take on debt with hefty interest payments.

But what if there was a third option? One that doesn’t require you to relinquish control or pile on debt. Enter invoice factoring.

In this guide, we’ll explore the ins and outs of factoring vs. debt financing, breaking down how each works, the funding processes, and key signs that will help you determine which is the right choice for your business.

Invoice Factoring: The Basics

Invoice factoring is a financial tool that helps businesses unlock cash tied up in unpaid invoices. Rather than waiting weeks or months for customers to pay, you sell those invoices to a factoring company, which advances you a portion of the value upfront. This is usually 60 to 95 percent of the invoice’s value. Once your customer pays the invoice, the factor gives you the remaining balance, minus their fee.

It’s not a loan, which means there’s no debt accumulation. Instead, factoring is all about selling a valuable asset—your invoices—for immediate cash flow.

How Factoring Works

Factoring is flexible, fast, and designed to give you access to the money you’ve already earned but haven’t received yet. Here’s a quick look at how the process typically works.

- Submit Your Invoices: You choose which invoices to factor. This could be all of them or just a select few—whatever fits your business needs.

- Get Advanced Cash: Once approved, the factoring company advances you a percentage of the invoice value.

- Factor Handles Collections: The factor usually takes over the task of collecting payments from your customers.

- Receive the Balance: When the invoice is paid, you’ll get the remaining funds minus the agreed-upon fee.

Types of Factoring

Not all factoring agreements are the same. We’ll review some of the most common types below.

Recourse Factoring

Even if your clients are usually good payers, there’s always some chance that one won’t pay. In a recourse agreement, you’re responsible for ensuring the factoring company doesn’t face a loss. This typically means you’ll substitute another invoice or buy the invoice back from the factor.

Non-Recourse Factoring

Non-recourse is essentially the opposite of recourse factoring. If a client doesn’t pay their invoice, the factoring company absorbs the loss. Naturally, this type of protection comes with slightly higher fees, so it’s the less common of the two.

Spot Factoring

With spot factoring, you factor one invoice at a time rather than entering into a long-term agreement. It’s best for businesses needing occasional cash infusions or those testing the waters with factoring.

For businesses interested in how supplier-oriented financing works, our guide, on Reverse Factoring Explained, offers valuable insights into this alternative approach.

Getting Approved for Factoring

By focusing on the quality of your invoices and the dependability of your customers, getting approved for factoring is much easier and faster than securing a traditional loan. Plus, once you’re approved, you can tap into ongoing cash flow as needed without reapplying each time.

Considerations for Approval

- Your Customers’ Creditworthiness: Factoring companies care more about your customers’ ability to pay their invoices than your credit history. If your clients are reliable and have good payment histories, you’re in great shape.

- The Quality of Your Invoices: Factoring is usually only an option for newer unpaid invoices that aren’t likely to be disputed.

- Your Business History: While factoring is often used by new businesses, established companies with a track record of steady sales tend to get better terms.

The Application Process

- Provide Basic Information: Be ready to share details about your business, customer base, and outstanding invoices.

- Submit Supporting Documents: This might include accounts receivable aging reports, recent invoices, proof of customer contracts or agreements, and other common documents.

- Credit Check on Your Customers: The factor will evaluate your clients’ payment histories and creditworthiness to assess risk.

- Approval and Contract: If everything checks out, you’ll receive an offer outlining the advance rate, fees, and terms.

Factoring Approval Timeline

The approval process is quick—sometimes as fast as 24-48 hours. This is night and day compared to bank loans, which can take weeks or even months.

Pro Tips for Fast Approval

- Organize Your Records: Clean, accurate invoices and updated customer payment records make a big difference.

- Work with Reliable Customers: If your customers have a habit of missing payments, it could hurt your approval odds or lead to higher fees.

- Be Transparent: Clearly communicate any potential risks or red flags upfront. Factors appreciate honesty and can often work with you to find solutions.

The Cost of Factoring

Factoring isn’t free, but when you understand how costs are calculated and what you’re paying for, it’s easier to decide if the benefits outweigh the expense. Here’s a breakdown of what factoring costs look like and how you can manage them.

How Factoring Costs Are Structured

- Factoring Fee: This is the primary cost and is typically charged as a percentage of the invoice value, usually between one and five percent.

- Additional Fees (If Applicable): Depending on your specific factoring agreement, you may also have monthly minimums with a charge if you don’t meet them, collection or administrative fees, costs for exiting a long-term contract early, or other fees.

Things That Influence Factoring Costs

- Customer Creditworthiness: Reliable customers with strong payment histories reduce the factor’s risk, leading to lower fees.

- Industry: Some industries, like trucking or construction, may have slightly higher fees due to greater payment variability.

- Factoring Type: Recourse factoring generally costs less because you’re taking on the risk of non-payment. Non-recourse factoring costs more since the factor assumes that risk.

- Invoice Terms: Shorter payment cycles typically result in lower fees since the factor’s money is tied up for less time.

How to Manage Factoring Costs

While factoring can seem more expensive than traditional financing, you have some control over the costs.

- Leverage Spot Factoring: Only factor invoices when you need a cash flow boost instead of factoring everything.

- Negotiate Fees: Established businesses or those with reliable clients may be able to negotiate lower rates.

- Shorten Customer Payment Cycles: Encourage customers to pay faster, reducing the time factors hold your invoices.

Benefits of Factoring

Invoice factoring is more than just a way to access quick cash. It’s a strategic tool that can help your business stay flexible, competitive, and focused on growth. Here are some key benefits of factoring and why so many businesses rely on it.

Immediate Access to Cash Flow

Waiting 30, 60, or 90 days for customers to pay can weaken or stall your business operations. Factoring eliminates that wait by providing funds upfront and streamlining cash flow management.

No New Debt

Unlike loans, factoring doesn’t add debt to your balance sheet. Instead, you’re simply selling an asset for immediate funds. This keeps your financial ratios healthy, which is crucial if you’re planning to secure other financing or attract investors.

Easier Approval Process

Factoring companies focus on your customers’ creditworthiness, not yours. This makes it an excellent option for:

- Startups without a long credit history.

- Businesses with fluctuating revenue or credit challenges.

- Companies that need funding faster than a traditional loan allows.

Flexible and Scalable Funding

Your funding grows as your sales grow. The more invoices you have, the more cash you can access. This flexibility makes factoring a great fit for businesses experiencing seasonal spikes or rapid growth.

Outsourcing Collections

Most factoring companies handle the collections process for you, saving time and reducing stress. This allows you to focus on building relationships with customers and growing your business instead of chasing payments. Plus, the professional approach can even improve customer relationships, as factors often handle collections tactfully and efficiently.

Mitigating Payment Risks

The credit checks your factoring company performs help ensure you’re only extending trade credit to those likely to pay in full and on time. You can also opt for non-recourse factoring to shift any remaining risk to the factoring company.

Fast Turnaround

Payment typically hits your bank account within 24 to 48 hours of the invoice’s approval. However, some factoring companies offer expedited service, including same-day payments.

Customizable Options

You’re not locked into rigid terms. Factoring can flex to meet your business’s changing demands.

Improves Cash Flow Predictability

Factoring turns uncertain payment cycles into predictable cash flow. This stability allows you to:

- Plan for growth.

- Invest in opportunities.

- Negotiate better terms with suppliers.

Builds Customer Confidence

Having consistent cash flow means you’re less likely to delay deliveries or fail to meet commitments. This boosts your reputation and strengthens customer trust.

Drawbacks of Factoring

While invoice factoring offers significant benefits, it’s important to consider its potential drawbacks to decide if it’s the right fit for your business. Here’s an honest look at some common challenges and how to navigate them.

Higher Cost Compared to Traditional Financing

Factoring fees can range from one to five percent of the invoice value, which might exceed the interest on a loan. However, you can use spot factoring strategically for high-value invoices or during cash flow crunches. You can also negotiate rates with your factor as your business and invoice volume grow.

Customer Credit Risk

Approval depends on your customers’ creditworthiness, not yours. If your clients have poor payment histories or unstable finances, factoring might not be an option or could come with higher fees.

Potential Impact on Customer Relationships

Factoring often involves the factor contacting your customers to collect payments, which could raise concerns about your business’s stability. Choose a factoring company known for professional, tactful communication, and be transparent with customers about why you’re factoring.

Contract Commitments

Some factoring agreements require you to factor a minimum number of invoices or enter into long-term contracts. That means you could find yourself locked into terms that no longer suit your business if your cash flow needs change. Be sure to look for flexible agreements or use spot factoring to avoid unnecessary obligations.

Not Suitable for All Businesses

Factoring works best for businesses with reliable customers and consistent invoicing. It’s less effective for industries with unpredictable sales cycles or customers that pay on delivery. Evaluate your business model and payment cycles to determine if factoring aligns with your needs.

Debt Financing: The Basics

Debt financing is one of the most common ways businesses raise capital. Essentially, it’s borrowing money with the agreement to repay it over time, typically with interest. Think of it as a partnership with a lender where you gain immediate access to funds to grow your business, and in return, you commit to regular repayments.

Unlike equity financing, you’re not giving away a piece of your company. You’re simply taking on a financial obligation to be paid off in the future.

How Debt Financing Works

Debt financing is straightforward, but it requires careful planning to ensure you can meet repayment obligations without overextending your business.

- Apply for a Loan or Line of Credit: You’ll approach a lender, such as a bank, credit union, or online loan provider, and provide detailed financial information about your business.

- Loan Approval and Terms: If approved, the lender will offer you a loan amount with terms that specify the repayment schedule, interest rate, and any fees.

- Receive Funds: Once the paperwork has been signed, the funds are typically deposited into your business account.

- Repay Over Time: Businesses typically make monthly repayments, which include both the loan principal and interest. Some forms, like lines of credit, allow more flexible repayment schedules.

Types of Debt Financing

There are several types of debt financing to suit different business needs. Here are the most common.

Term Loans

A term loan is a lump sum loan repaid over a fixed term with regular installments. It’s best for purchases like equipment, inventory, or expansions. However, qualifying for term loans can be challenging, especially for newer businesses or those with limited credit history. Lenders typically require a strong credit score (often 680 or higher), a proven financial track record, and several years in business.

Lines of Credit

A line of credit (LOC) is a flexible funding option where you borrow as needed up to a set limit and pay interest only on the amount used. This is best for short-term cash flow gaps or emergency expenses. However, interest rates on lines of credit can be higher than traditional loans, and lenders may reduce your credit limit unexpectedly if your financial situation changes.

SBA Loans

Loans backed by the Small Business Administration (SBA) tend to offer lower interest rates and favorable terms. They’re best for small businesses looking for affordable, long-term financing. With that said, the application process can be lengthy and complicated, often requiring detailed financial documentation, strong credit (typically 680+), and proof of business viability. Approval may take weeks or even months.

Equipment Financing

Equipment financing refers to a loan that’s specifically for purchasing equipment, with the equipment itself serving as collateral. It can work well for businesses needing vehicles, machinery, or technology. The catch here is that if you default, the lender can seize the equipment. Additionally, interest rates may be higher for businesses without strong credit histories or financial statements.

Invoice Financing (Not Factoring)

Although invoice financing is often confused with invoice factoring, they’re different concepts. Invoice financing involves borrowing against unpaid invoices without selling them outright as you would with factoring. Invoice financing tends to be used more by businesses with large accounts receivable needing short-term cash. However, interest rates can be steep, especially for businesses with lower-quality invoices or inconsistent cash flow. You’re also still responsible for collecting payments from customers, which could delay repayment.

Merchant Cash Advances (MCA)

An MCA is a lump sum provided in exchange for a percentage of future sales, usually repaid daily or weekly. It tends to be best for businesses with high credit card sales but limited access to traditional loans. However, MCAs are one of the most expensive financing options, with effective annual percentage rates (APRs) often exceeding 50 percent. The daily repayment schedule can also strain your cash flow, particularly during slow periods.

Getting Approved for Debt Financing

Securing debt financing can be a straightforward process or a bit of a challenge, depending on the type of financing you’re applying for and the financial health of your business. Let’s break it down so it’s easier to see what’s involved.

Considerations for Approval

- Credit Score: A higher credit score signals to lenders that you’re a reliable borrower. For term loans and SBA loans, scores of 680 or higher are often required. Lines of credit or equipment financing may have more lenient requirements, but lower scores mean higher interest rates.

- Time in Business: Established businesses, typically those that have been in operation for two or more years, are viewed as lower-risk. Startups may face additional hurdles, especially with traditional lenders.

- Revenue and Cash Flow: Lenders want proof that your business generates enough income to cover loan repayments. Debt service coverage ratios (DSCRs) are often used to assess this.

- Collateral: Many loans, like equipment financing, require collateral to reduce the lender’s risk.

The Application Process

- Gather Documentation: Be prepared to provide business financial statements, tax returns, proof of revenue, a business plan, and more.

- Choose the Right Lender: Banks tend to offer the lowest rates but have strict requirements and longer timelines. Online lenders tend to offer faster approvals but may have higher interest rates. Specialty lenders are focused on specific types of financing like equipment or invoice financing.

- Submit Your Application: Tailor your application to the lender’s requirements. For example, SBA loans demand detailed business plans, while online lenders may focus more on cash flow.

- Respond to Follow-Up Requests: Be prompt in supplying additional information or clarifications to keep the process moving.

Debt Financing Approval Timeline

The approval timeline can vary significantly depending on the type of loan. For example, traditional loans and SBA loans can take anywhere from several weeks to months. This is because there’s a detailed underwriting processes and government-backed requirements take time. Options like MCAs and invoice financing are on the shorter end because lenders are focused on immediate cash flow and sales, and there is minimal underwriting. These can come through in just a day or two.

The Cost of Debt Financing

Debt financing can provide the capital your business needs, but it’s important to understand the costs involved. These expenses can vary widely depending on the type of financing, the lender, and your financial situation. Here’s what to expect and how to keep costs in check.

How Debt Financing Costs Are Structured

- Interest Rates: Rates typically range from three to 25 percent, depending on the type of loan and the risk profile of the borrower. SBA loans, for instance, usually offer lower rates, around five to ten percent, while MCAs can carry effective APRs above 50 percent.

- Variable vs. Fixed Rates: Your loan agreement may involve fixed rates, where the interest rate remains consistent throughout the loan term, or be variable, meaning it fluctuates with market conditions. Fixed rates offer predictability. Variable rates can either raise or lower your overall costs.

- Origination Fees: An origination fee is a one-time fee charged by a lender to process your loan. It’s typically between one and five percent of the loan.

- Prepayment Penalties: Lenders sometimes charge a fee to make up for lost interest if you repay the loan early.

- Late Payment Fees: You’ll likely face additional costs if you miss or delay a payment. Late fees add up quickly and could damage your credit, leading to higher costs for future financing.

How Costs Differ by Type of Debt Financing

- Term Loans: Modest interest rates, usually ranging from five to 15 percent, with origination fees.

- Lines of Credit: Higher interest rates, usually ranging from ten to 25 percent, but you only pay interest on what you borrow.

- SBA Loans: Lower interest rates, usually ranging from five to ten percent, but higher upfront costs like guarantee fees, which can cost up to 3.75 percent of the loan.

- Equipment Financing: Competitive interest rates, usually ranging from five to 12 percent, but you risk losing the equipment if you default.

- Merchant Cash Advances: Very high APRs, which can exceed 50 percent, with daily or weekly repayments.

Things That Influence Debt Financing Costs

- Your Credit Score: Lenders may look at both business and personal credit scores. The higher your scores are, the less you’ll generally pay.

- Time in Business: Lenders prefer to work with seasoned businesses. The longer you’ve been in operation, the better your rates will generally be.

- Revenue and Cash Flow: Higher revenues and consistent cash flow indicate stability and your ability to repay. Because this translates to less risk for the lender, you’ll usually get better rates.

- Current Economic Conditions: Lenders adjust interest rates and terms based on the overall economic climate. In times of low interest rates and strong economic growth, financing tends to be more affordable. However, during periods of high inflation or economic uncertainty, lenders may raise rates or tighten their lending criteria to mitigate risk. This means your borrowing costs can fluctuate depending on broader market trends, even if your business remains financially stable.

How to Manage Debt Financing Costs

- Improve Your Credit: Higher credit scores typically result in better terms and lower rates.

- Shop Around: Compare offers from multiple lenders to find the best fit.

- Borrow Only What You Need: Smaller loans mean less interest paid over time.

- Understand the Fine Print: Know the full cost of the loan, including fees and potential penalties, before signing.

Benefits of Debt Financing

Debt financing offers businesses a reliable and often cost-effective way to access the capital needed for growth, operations, or unexpected expenses. Let’s explore the key advantages of this funding method.

Maintain Ownership and Control

Unlike equity financing, debt financing doesn’t require you to give up a share of your business. You retain full ownership and decision-making authority.

Predictable Costs

Most debt financing options, like term loans or fixed-rate loans, come with predictable repayment schedules. This allows you to budget accurately without worrying about fluctuating costs.

Access to Larger Amounts of Capital

Debt financing often provides more significant funding than other options, such as factoring or MCAs, especially for established businesses.

Build Business Credit

Successfully managing debt can help build your business credit profile, making it easier to secure better financing terms in the future.

Flexible Use of Funds

Lenders rarely impose restrictions on how you use the money. You can invest in equipment, hire staff, boost marketing efforts, or cover unexpected expenses.

Lower Cost of Capital

Debt financing often has lower interest rates compared to other financing methods. However, this isn’t true across the board, as we’ve explored with MCAs.

Opportunity for Growth

By leveraging debt, you can take advantage of growth opportunities without waiting to save up the required capital.

Drawbacks of Debt Financing

While debt financing can be a powerful tool for growing your business, it’s not without its challenges. Understanding these potential drawbacks can help you make an informed decision and avoid pitfalls.

Repayment Obligations

Debt financing requires regular repayments, regardless of your business’s performance. Missing payments can lead to penalties, damaged credit, or even default.

Risk to Personal and Business Assets

Many loans require collateral, such as business equipment or even personal assets, which can be seized if you default.

Impact on Cash Flow

Loan repayments reduce your available cash flow, potentially limiting your ability to reinvest in the business or cover unexpected expenses.

Long-Term Costs

Interest payments and fees can add up significantly over the life of a loan, making it more expensive than it initially seems.

Strict Approval Requirements

Traditional loans often have high barriers to entry, including minimum credit scores, time in business, and revenue thresholds.

Potential for Overleveraging

Taking on too much debt can put your business in a precarious position, making it hard to secure additional financing or recover from setbacks.

Variable Interest Rates

Loans with variable rates can become more expensive if interest rates rise, leading to higher monthly payments.

Negative Impact on Credit

Why It Matters: Missing payments or carrying high balances can hurt your credit score, making future financing more expensive or harder to secure.

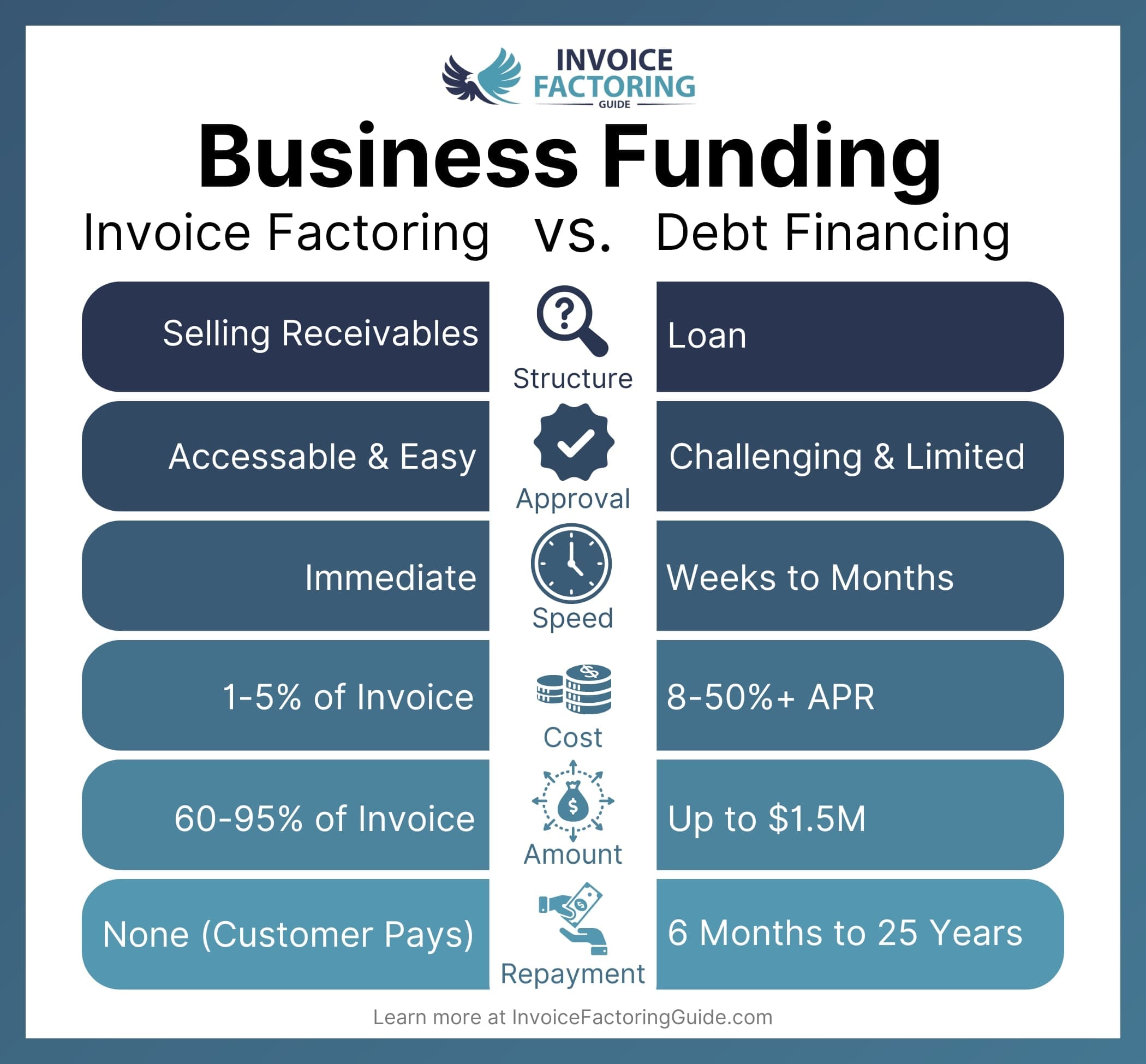

Invoice Factoring vs. Debt Financing

Now that we’ve covered the background, let’s do a quick comparison of factoring vs. debt financing and when each works best.

Key Differences Between Factoring and Debt Financing

Both options provide access to capital, but they work in fundamentally different ways.

Source of Funds

- Factoring: Funds come from selling your unpaid invoices to a factoring company.

- Debt Financing: Funds are borrowed from a lender, such as a bank or online loan provider, and repaid over time with interest.

Credit Evaluation

- Factoring: Approval depends on your customers’ creditworthiness since they’re responsible for paying the invoices.

- Debt Financing: Approval is based on your business’s financial health, including credit score, revenue, and cash flow.

For additional flexibility, some businesses also consider a factoring line of credit, which combines the immediate cash flow benefits of factoring with the revolving access of a credit facility.

Repayment Obligation

- Factoring: No repayment is required. You’re selling an asset rather than borrowing money.

- Debt Financing: You’re obligated to repay the loan or line of credit, often with fixed monthly payments.

Cost Structure

- Factoring: Fees are based on a percentage of the invoice value, typically one to five percent.

- Debt Financing: Costs include interest rates and fees, which vary depending on the loan type and lender.

Speed

- Factoring: Funds can be available in as little as 24 hours once approved.

- Debt Financing: Traditional loans can take weeks or months for approval and funding, though online lenders may offer faster options.

Flexibility

- Factoring: Flexible. You can factor the invoices of your choosing.

- Debt Financing: More structured, with fixed repayment schedules and terms.

For additional flexibility, some businesses also consider a factoring line of credit, which combines the immediate cash flow benefits of factoring with the revolving access of a credit facility.

Times When Debt Financing May Be Best

Debt financing is often the better choice when:

- You Need Long-Term Funding: Loans or SBA financing are ideal for major projects like expanding facilities or purchasing expensive equipment.

- You Have Strong Credit and Financial Stability: If your business is well-established and can meet the lender’s requirements, you’re likely to secure lower-cost financing.

- You Want Predictable Costs: Fixed interest rates and repayment schedules make it easy to budget for debt financing.

- You Need Significant Capital: Debt financing often allows you to borrow larger amounts than you’d typically receive through factoring.

Times When Factoring May Be Best

Invoice factoring shines in scenarios where:

- You Need Immediate Cash Flow: Factoring provides quick access to funds for covering payroll, restocking inventory, or unexpected expenses.

- Your Customers Are Reliable: If you work with creditworthy customers who pay on time, factoring is a low-risk way to unlock cash.

- Your Business is New or Has Credit Challenges: Since approval is based on your customers’ credit, factoring is accessible even if your business lacks a long credit history.

- You Want to Avoid Debt: Factoring doesn’t require repayment, which keeps your balance sheet clean and avoids long-term obligations.

- You Have Seasonal or Cyclical Needs: Spot factoring lets you fund invoices only when you need a cash infusion, providing flexibility for seasonal businesses.

Go Debt-Free with Factoring

The decision between factoring and debt financing ultimately comes down to your business’s specific needs and circumstances. If you prioritize quick cash flow, flexibility, and avoiding debt, factoring is likely your best option. To explore personalized terms for your business, request a complimentary rate quote.

Factoring vs. Debt Financing FAQs

How do I decide whether factoring or debt financing is better for my business?

Choose factoring if you need quick cash, want to avoid debt, or have credit challenges. Opt for debt financing if you need long-term funding, can meet credit requirements, or require a larger amount of capital. Analyze your cash flow, credit history, and goals to decide.

Is invoice factoring more expensive than debt financing?

It depends on the type of debt financing being considered. For instance, bank loans and SBA loans tend to cost less than factoring, though factoring provides immediate cash flow without long-term debt, making it ideal for short-term needs. However, an option like a merchant cash advance (MCA) or credit card can wind up costing you more in the long run.

Can new businesses qualify for invoice factoring or debt financing?

New businesses often qualify for factoring because approval depends on customer creditworthiness, not your financial history. Debt financing is harder for startups due to strict credit and time-in-business requirements, though options like SBA microloans or MCAs may be available.

What credit score do I need to qualify for a business loan?

Most traditional lenders require a personal or business credit score of at least 680. SBA loans may accept slightly lower scores with strong financials. Online lenders or MCAs may approve lower scores but charge higher interest rates.

How fast can I get funding with invoice factoring compared to a loan?

Factoring is faster, with approvals in 24-48 hours and same-day funding after setup. Loans can take weeks to months, especially with traditional lenders like banks. Online loans may offer faster funding but often have higher costs.

Can I use both factoring and debt financing for my business?

Yes, many businesses combine factoring and debt financing to manage cash flow and fund growth. For example, factoring provides quick cash, while loans cover long-term investments. Monitor your overall costs and cash flow to avoid overleveraging.

Are invoice factoring fees tax-deductible?

Factoring fees are typically considered a business expense and are tax-deductible. Consult your accountant or tax advisor to confirm how to properly deduct factoring costs and maximize savings for your business.

About Invoice Factoring Guide

Related Articles

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300