Potential supply chain disruptions are up 30 percent year-on-year, Resilinc research shows. With more than 10,600 potential disruptions, ranging from factory fires to labor disruptions, it’s clear that supply chain resiliency remains a major concern for businesses. But, developing it doesn’t have to be an uphill battle. Below, we’ll explore how invoice factoring can strengthen your supply chain, creating stability and opening doors for sustainable growth.

The Importance of Supply Chain Stability

A stable supply chain keeps your business running smoothly. When every link in the chain, from sourcing raw materials to delivering finished products, functions as expected, you can meet customer demands, maintain efficiency, and avoid costly disruptions.

Instability, on the other hand, can ripple through your operations. Late supplier payments, inventory shortages, or delays in customer payments can lead to production halts, missed deadlines, and damaged relationships.

Supply chain stability isn’t just about avoiding chaos; it’s about creating a reliable foundation for growth. Businesses with steady supply chains are better positioned to weather challenges, seize opportunities, and build trust with partners and customers. It’s the backbone of operational success.

How Invoice Factoring Works

Invoice factoring is a financial tool that helps businesses unlock cash that’s tied up in unpaid invoices. Instead of waiting 30 to 90 days for your customers to pay, you sell those invoices to a factoring company. They pay you most of the invoice amount upfront, usually around 80 to 90 percent, and then collect payment from your customer later. Once the invoice is paid, the factoring company gives you the remaining balance minus a small fee for their services.

It’s not a loan, so you’re not taking on debt. You’re just converting your accounts receivable into immediate cash.

Let’s go over a quick example. Imagine you run a small distribution company. A big client places a large order, but their payment terms are net 60. You need cash now to pay your suppliers and manage operations. By factoring the invoice, you get most of that money right away. There’s no waiting and no stress about covering expenses.

Why Businesses Use Factoring

Factoring is especially helpful for businesses with slow-paying customers, rapid growth, or tight margins. It’s popular in industries like manufacturing, trucking, staffing, and distribution, or anywhere cash flow gaps can disrupt day-to-day operations. Plus, factoring scales with your business. As your sales grow, so does the availability of cash through factoring.

Invoice Factoring vs. Supply Chain Financing: A Quick Breakdown

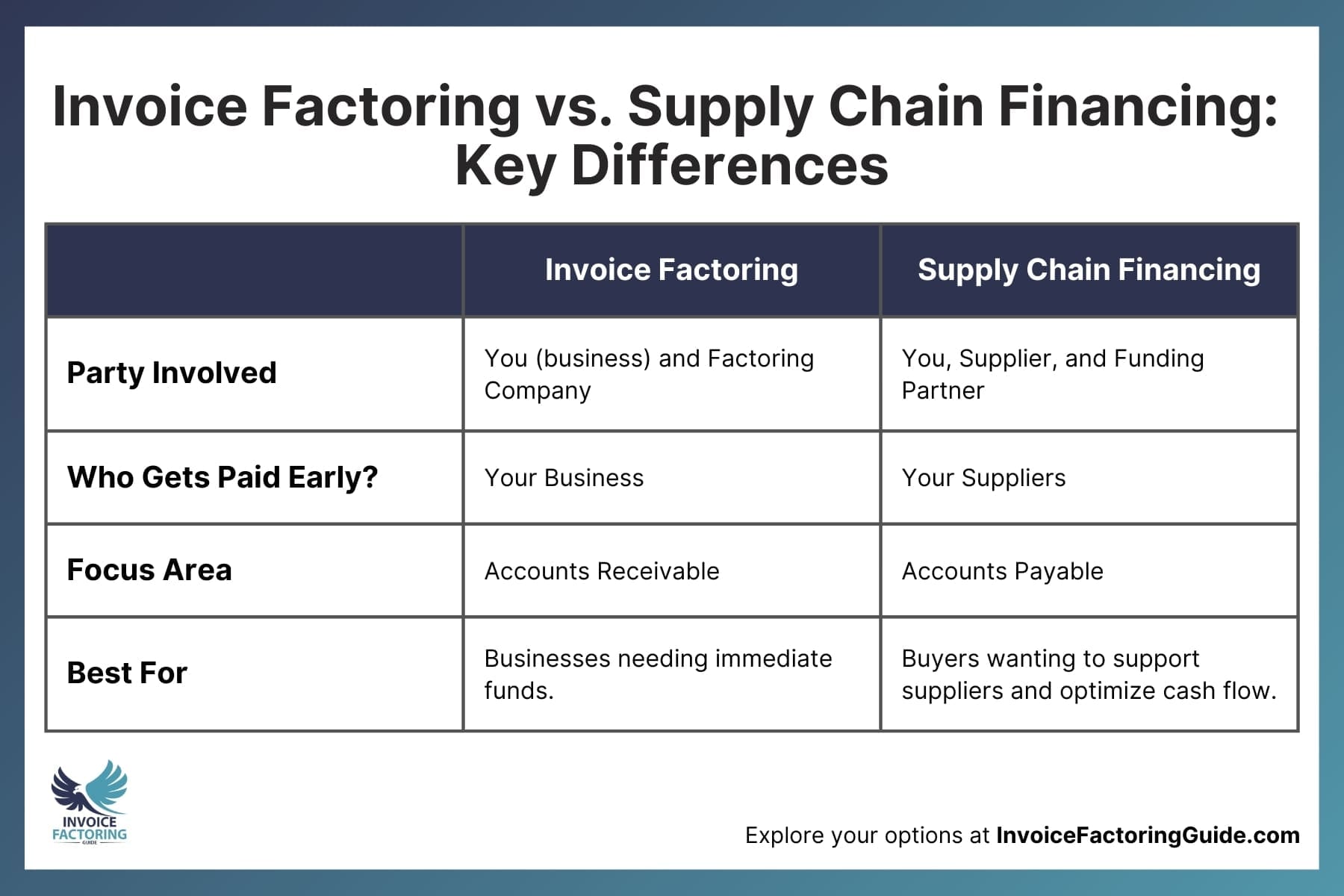

While both are financial tools designed to improve cash flow and stabilize supply chains, invoice factoring and supply chain financing work in different ways. Let’s explore the key differences.

Invoice Factoring

With factoring, you sell your unpaid invoices to a factoring company. They provide an advance on the value of those invoices, giving you immediate cash while they handle collecting payment from your customers. It’s ideal for businesses that need quick liquidity due to delayed customer payments or irregular cash flow, and the key focus is on turning accounts receivable into immediate cash.

Supply Chain Financing (Reverse Factoring)

With supply chain financing, also called reverse factoring, your supplier gets paid early by a financial institution, but the payment terms for you, the buyer, remain the same or are even extended. You repay the institution later under the agreed terms. It’s typically larger businesses with strong credit ratings that want to support their suppliers or negotiate better terms. The key focus is on optimizing the buyer-supplier relationship by ensuring suppliers get paid quickly without putting strain on the buyer’s cash flow.

For instance, a retailer might use supply chain financing to ensure their suppliers are paid promptly, even though the retailer takes 90 days to settle the payment.

Which is Right for You?

If you’re struggling to close cash flow gaps caused by slow-paying customers, invoice factoring is the ideal solution. However, if you’re a buyer who wants to keep suppliers happy while managing extended payment terms, supply chain financing might be a better fit. Both are powerful tools. They’re just tailored to different challenges. We’ll be focusing on invoice factoring for the remainder of the page.

How Invoice Factoring Can Help Stabilize Your Supply Chain

Now that we’ve covered the basics, let’s take a look at how factoring and supply chain stability go hand-in-hand.

Improved Cash Flow: Get Paid Faster

Cash flow challenges often come down to timing. You’ve completed the work and sent the invoice, but waiting for payment can leave your business in a tough spot. Factoring solves this by advancing most of the invoice value upfront, giving you access to the cash you’ve already earned.

This means you can handle expenses, invest in growth, or build a financial cushion without delays holding you back. It’s a straightforward way to keep your business moving.

On-Time Supplier Payments: Build Stronger Relationships

Paying your suppliers on time is crucial for keeping your supply chain running smoothly. Late payments can strain relationships and even lead to supply disruptions. Factoring helps by providing the cash you need. This solution is particularly beneficial in industries like freight brokerage and oilfield services, where operational stability and timely payments are essential for maintaining efficiency and growth.

For businesses in key economic hubs, access to reliable factoring services can make all the difference. Whether you operate in New York, Florida, or Texas, regional factoring solutions provide the localized expertise needed to navigate specific market conditions and supply chain challenges.

When you’re consistently reliable, suppliers are more likely to prioritize your business. This can lead to better terms, improved service, and a stronger foundation for long-term success. Reliable payments mean reliable partnerships.

Inventory Management: Keep Your Shelves Stocked

Running out of inventory can bring your business to a standstill but buying stock before customer payments come in isn’t always easy. Factoring helps bridge the gap by giving you quick access to cash, so you can replenish inventory as needed.

With consistent access to funds, you can avoid stockouts, meet customer demand, and take advantage of supplier discounts for bulk purchases. Reliable cash flow means your shelves stay stocked, and your business stays ready for whatever comes next.

Flexibility for Growth: Scale Without Stress

Growth often comes with growing pains, especially when bigger orders or new opportunities stretch your cash flow thin. Factoring provides the flexibility to keep up by turning unpaid invoices into immediate working capital.

Instead of worrying about how to fund your next step, you can focus on taking it. Whether it’s expanding your operations, hiring more staff, or taking on larger clients, factoring gives you the financial breathing room to scale with confidence.

Risk Mitigation: Protect Your Business from Unpaid Invoices

One of the biggest challenges in managing a supply chain is the risk of customers delaying or defaulting on payments. If you opt for non-recourse factoring, you can reduce this risk by shifting the responsibility of collections to the factoring company.

Many factoring agreements also include credit checks on your customers, which can help you avoid doing business with clients who may struggle to pay. Simply by using factoring, you protect your cash flow and reduce the financial uncertainty that can disrupt your supply chain.

Predictable Budgeting: Take Control of Your Finances

Unpredictable cash flow makes it hard to plan ahead, especially when payments from customers are delayed. Factoring helps smooth out these ups and downs by providing consistent access to cash.

With a steady flow of funds, you can forecast expenses more accurately and allocate resources with confidence. This predictability makes it easier to manage supply chain costs, plan for growth, and avoid financial surprises.

Support During Economic Downturns: Keep Operations Moving

Economic slowdowns can hit cash flow hard, especially if customers take longer to pay or orders start to slow. Factoring provides a lifeline by turning your outstanding invoices into immediate cash, giving you the resources to keep your supply chain running smoothly.

This steady access to funds allows you to pay suppliers, manage overhead, and avoid disruptions, even in challenging market conditions. Factoring helps your business stay resilient when times are tough.

Focus on Core Operations: Spend Less Time Chasing Payments

Managing unpaid invoices can take up valuable time and energy, distracting you from running your business. In fact, a typical mid-size business spends nearly two days a week on invoice-related tasks, per Intuit. Factoring takes that burden off your plate by handling collections so you can concentrate on what matters most—growing your business and improving your supply chain.

With fewer distractions, you’ll have more bandwidth to focus on building customer relationships, streamlining operations, and making strategic decisions to move your business forward.

Start Improving Your Cash Flow and Supply Chain Stability with Factoring

Factoring is a versatile business finance tool because advances can be applied to whatever your business needs the most. However, maximizing its benefits to improve supply chain stability requires finding a factoring partner that understands your industry and provides prompt, reliable payments. We’re happy to match you with an experienced factor that offers tailored solutions and has a fast approval process. To get started, request a complimentary factoring quote.

FAQs on Invoice Factoring and Supply Chain Stability

Can factoring help my business pay suppliers on time?

Yes, factoring provides the funds you need to pay suppliers promptly. Instead of waiting for customers to pay their invoices, you receive an advance from the factoring company. On-time payments strengthen supplier relationships and may lead to better terms or discounts, ensuring your supply chain stays on track.

What are the benefits of factoring for managing inventory?

Factoring ensures you have the cash to restock inventory when needed, even if customer payments are delayed. This helps you avoid stockouts, meet customer demand, and take advantage of bulk purchase discounts. With consistent inventory levels, your supply chain operates without disruptions.

How does factoring reduce financial risks in a supply chain?

Factoring transfers the risk of unpaid invoices to the factoring company, protecting your business from financial setbacks caused by late payments or customer defaults. Many factoring providers also evaluate customer creditworthiness, helping you make informed decisions about who to do business with.

How does invoice factoring compare to supply chain financing?

Invoice factoring converts your receivables into cash, helping your business cover expenses. Supply chain financing, on the other hand, ensures your suppliers get paid early while you repay later. Factoring focuses on your accounts receivable, while supply chain financing addresses supplier payments. Both stabilize supply chains but in different ways.

What types of businesses benefit the most from invoice factoring?

Invoice factoring is especially beneficial for businesses with long customer payment terms, rapid growth, or tight cash flow margins. It’s commonly used in industries like manufacturing, trucking, staffing, and distribution—where delayed payments can disrupt operations and supply chain stability.

About Invoice Factoring Guide

Related Articles

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300