Invoice factoring and invoice discounting sound similar, and both can turn your receivables into cash instantly, but they’re very different business funding solutions at their core. In this guide, we’ll walk you through how each works, where they fit in the spectrum of invoice funding solutions, and provide a detailed comparison of factoring vs. invoice discounting, so it’s easier to make the right choice for your business.

Unlocking the Cash in Your Invoices: Why Invoice Funding Matters

Invoices represent more than just a record of sales. They’re a critical piece of the cash flow puzzle. Once you’ve delivered goods or services, waiting weeks or months to get paid can put a serious strain on your finances. Payroll needs to be met, suppliers demand payment, and growth opportunities don’t wait.

That’s where invoice funding comes in. Whether you’re navigating seasonal fluctuations, expanding your operations, or simply dealing with slow-paying customers, invoice funding offers a way to unlock the working capital trapped in your receivables.

Why Businesses Turn to Invoice Funding

Invoice funding solutions work because they leverage an asset you already have—your unpaid invoices. Instead of waiting for customer payments to trickle in, these solutions give you access to cash when you need it most. Here’s why businesses find this approach so effective.

- Smooth Out Cash Flow: Keep operations running seamlessly, even during slow periods or when customers take their time to pay.

- Fuel Growth: Invest in expansion, take on bigger orders, or launch new projects without waiting for receivables to clear.

- Avoid Traditional Loans: Since funding is based on your invoices, your credit score or business history isn’t always the deciding factor.

The Big Two: Factoring and Discounting

When it comes to invoice funding, the two most common methods are factoring and invoice discounting. These solutions dominate the market because they’re versatile and accessible for businesses of all sizes.

- Factoring: This involves selling your invoices to a third party (a factoring company), which advances you a portion of the invoice value and takes over the collection process.

- Invoice Discounting: Here, you use your invoices as collateral for a loan, borrowing against their value while continuing to manage collections yourself.

Other Types of Invoice Funding

While factoring and discounting are the most widely used options, there are niche solutions designed for specific business needs.

- Selective Invoice Financing: Fund individual invoices instead of your entire receivables portfolio.

- Reverse Factoring: Where your customer initiates early payment through a financier to support your cash flow.

- Invoice Auction Platforms: Auction your invoices to investors for competitive funding terms.

There are also broader funding options, such as trade finance, supply chain finance, and asset-based lending, which use invoices as part of a larger financing solution. While these can be valuable for businesses with complex needs, factoring and discounting remain the most common approaches for unlocking cash directly tied to receivables.

Invoice Factoring: How it Works and What You Need to Know

Invoice factoring, also known as factoring or accounts receivable factoring, is one of the most popular ways to unlock the cash tied up in your unpaid invoices. By selling your invoices to a factoring company, you can get access to a large percentage of their value upfront, ensuring your business has the cash flow it needs to thrive.

How Factoring Works

The process is straightforward and typically follows the steps below.

- Submit Invoices: You sell one or more unpaid invoices to a factoring company.

- Receive an Advance: The factoring company pays you a percentage of the invoice value upfront. This is typically between 60 and 95 percent of the invoice value.

- Factoring Company Collects Payment: The factoring company takes over collections and deals directly with your customers to get paid.

- Receive Remaining Funds: Once your customer pays, you’ll receive the remaining balance of the invoice, minus the factoring fees.

Example of Factoring in Action

Let’s say you have a $10,000 invoice, and the factoring company offers you an 85 percent advance. You’ll get $8,500 upfront. When your customer pays the full $10,000, the factoring company deducts their fee, let’s say $500, and sends you the remaining $1,000.

What to Expect from Factoring Fees and Cost Structures

Understanding factoring fees is essential as you explore the best solution for your needs. Factoring fees are usually charged as a percentage of the invoice value and can vary depending on factors like your industry, customer creditworthiness, and the time it takes for invoices to be paid.

Factoring Fees Breakdown

- Discount Rate: This is the primary fee, ranging from one to five percent of the invoice value per month.

- Additional Fees: Some factoring companies charge extra for things like account setup, wire transfer fees, or monthly minimum fees.

- Recourse vs. Non-Recourse: With recourse factoring, you’re responsible if your customer doesn’t pay. Non-recourse factoring transfers that risk to the factoring company, but it often comes at a higher cost.

- Flexibility Costs: If you opt for spot factoring (factoring only once or occasionally versus in bulk), you might pay higher fees for the added flexibility.

Advantages of Factoring

There are many factoring benefits that make it a powerful tool for businesses that want to manage cash flow.

- Quick Access to Cash: You can get cash within 24 to 48 hours of submitting your invoices, which helps cover immediate expenses like payroll or supplier payments.

- No Additional Debt: Factoring doesn’t involve taking on loans, so it won’t increase your liabilities or hurt your credit rating.

- Easier Qualification: Approval is based on your customers’ creditworthiness, not yours. This makes factoring a viable option for businesses with limited credit history or financial challenges.

- Outsourced Collections: The factoring company takes over chasing payments, saving you time and resources.

- Scales with You: As your sales and invoices grow, the available funding does, too.

Drawbacks of Factoring

While factoring is a valuable funding solution, there are a few things you should be aware of before jumping in.

- Cost: Factoring can be more expensive than other financing methods, particularly if your customers take a long time to pay. It’s essential to weigh the cost with the benefits you’re receiving to ensure it’s bringing value to your business.

- Customer Perception: Some businesses worry that handing over collections to a third party could damage customer relationships. Because most businesses are accustomed to factoring or at least outsourced billing, and factoring companies handle customer relationships with care, this is rarely a concern. However, it’s important to carefully vet any factor you’re considering for this reason.

- Loss of Control: By selling your invoices, you give up some control over how payments are managed and when funds are received. However, because factoring companies are quite adept at the invoicing process and white-glove collections, this typically means you’ll collect faster and more fully.

Invoice Discounting: How it Works and What You Need to Know

Invoice discounting, also referred to as invoice financing or accounts receivable financing, is another powerful tool for businesses looking to access the cash tied up in unpaid invoices. Unlike factoring, you don’t sell your invoices. Instead, you use them as collateral for a short-term loan. This method gives you quick access to funds while keeping control of your accounts receivable process.

How Invoice Discounting Works

Here’s how the invoice discounting process typically works.

- Submit Your Invoices: You provide your accounts receivable ledger to a discounting company or lender.

- Receive a Loan: The lender advances you a percentage of the total value of your invoices. This is usually between 80 and 95 percent.

- Manage Collections: You remain responsible for collecting payments from your customers.

- Repay the Loan: Once your customers pay their invoices, you repay the loan, along with the discounting fees and interest.

Example of Invoice Discounting in Action

Let’s say you have $50,000 in invoices, and the lender offers you a 90 percent advance. You’ll get $45,000 upfront. When your customers pay you the $50,000 owed, you pay the $45,000 back, plus their fee.

What to Expect from Invoice Discounting Fees and Cost Structures

With invoice discounting, the cost depends on the size of your receivables portfolio, the creditworthiness of your customers, and how quickly invoices are paid. Here’s a breakdown.

- Interest Rates: Often calculated daily or monthly as a percentage of the funds advanced. Rates generally range between one and three percent per month.

- Service Fees: Some lenders charge additional fees for setup, monthly maintenance, or minimum usage.

- Flexibility Costs: If you opt for selective discounting (choosing specific invoices), you might pay higher fees for the added flexibility.

Advantages of Invoice Discounting

There are many unique invoice discounting advantages that appeal to businesses looking for funding while maintaining control over their accounts receivable.

- Confidentiality: Your customers typically don’t know you’re using invoice discounting, as you’re still in charge of collections.

- Control: You retain full control of your customer relationships.

- Fast Access to Funds: Like factoring, discounting allows you to get cash within 24 to 48 hours of submitting your invoices.

- Scales with Sales: As your sales and invoices grow, so does the funding available to your business.

Drawbacks of Discounting

As with any funding method, there are challenges associated with invoice discounting.

- Costs Can Add Up: Discounting fees and interest can become expensive, especially if customers take a long time to pay.

- Repayment Risk: You remain responsible for repaying the loan, even if your customers fail to pay. This adds an element of financial risk, particularly for businesses with unpredictable clients.

- Requires Strong Internal Systems: Since you’re managing collections, you need a robust process for following up with customers and ensuring timely payments.

- Eligibility Can Be Strict: Discounting companies may have stricter requirements for client creditworthiness, invoice volume, or the size of your receivables portfolio compared to factoring.

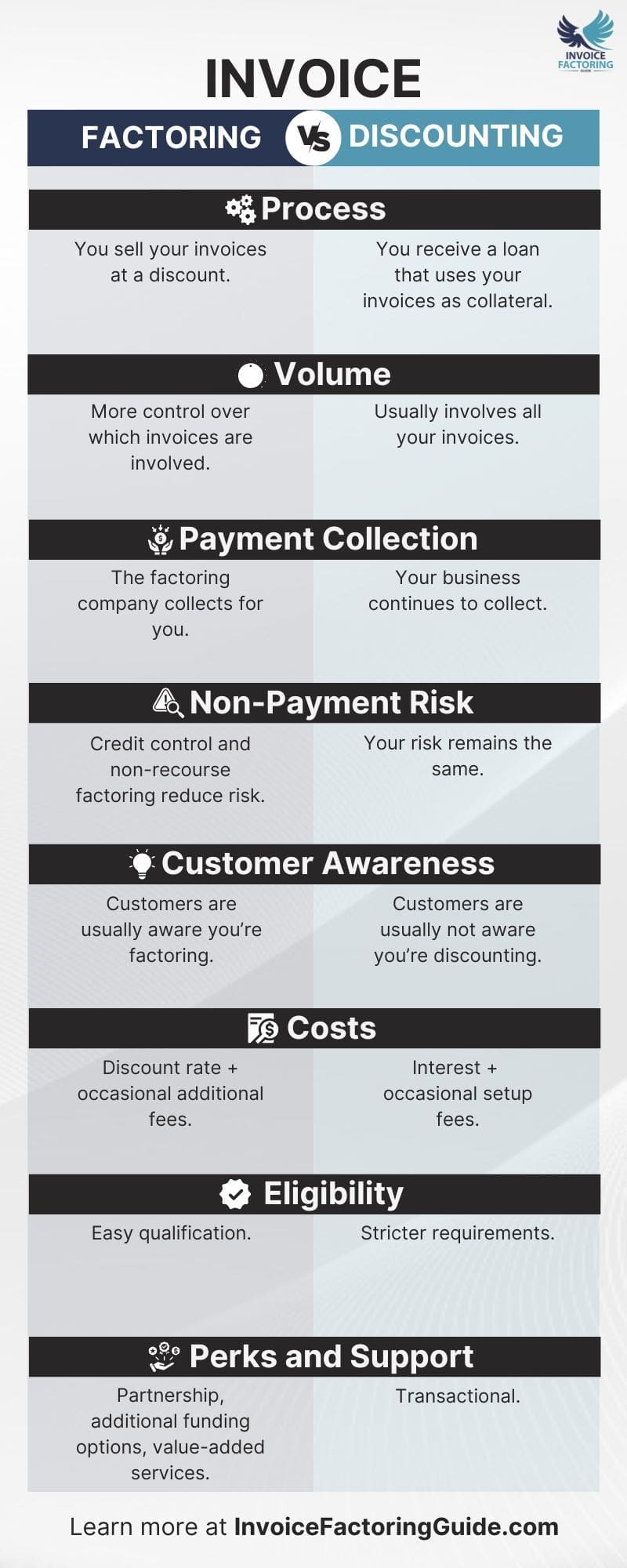

Factoring vs. Invoice Discounting: A Side-by-Side Comparison

At this stage, you should be familiar with the pros and cons of factoring and discounting and how they work. However, if you’re comparing factoring and invoice discounting to determine which is right for your business, it’s helpful to do a side-by-side comparison of the key differences.

Process

With factoring, you’re selling your invoices at a discount and the factoring company assumes ownership of the invoices. With discounting, you’re receiving a loan that uses your invoices as collateral and you retain ownership of the invoices. This makes factoring the better choice for businesses that don’t want to add debt to their balance sheet.

Volume

Although some factoring agreements come with monthly minimums, factoring typically gives you more control over which invoices you turn into instant cash. You can also opt for spot factoring and factor selectively. Conversely, discounting is almost always done in bulk, and all invoices are considered. For this reason, factoring may be the better choice for businesses that want more control over which invoices are involved.

Payment Collection

With factoring, your factoring company collects balances for you. With discounting, you’re responsible for collecting. This means factoring is better if you want to let someone else chase your invoices and focus on your business.

Credit Control

Factoring companies look into the creditworthiness of your client before accepting an invoice for factoring. They’ll provide guidelines about how much credit can be extended without exposing your business to unnecessary risk. This can help ensure invoices are paid in full and in a timely manner. Invoice discounting companies don’t generally provide any assistance with credit control.

Risk of Non-Payment

Roughly eight percent of B2B invoices across the country are written off as bad debt, Atradius reports. The credit control services provided by factoring companies can help keep your risk low. Plus, you can opt for non-recourse factoring and transfer the risk entirely to the factoring company. With discounting, however, the risk stays with your business. You’ll still need to pay back the advance even if your customer doesn’t pay you.

Customer Awareness

With factoring, your customers typically receive a notice at the start of your engagement that they’re working with you and to inform them where to send future payments. They may engage with your customers while verifying invoices or during the collection process, too. The exception to this is non-notification factoring. With discounting, your lender does not engage with your customers or notify them of the arrangement.

Costs

Both factoring and discounting can come with additional fees. However, the base rate for factoring is usually between one and five percent of the invoice’s value, and discounting is usually between one and three percent of the invoice’s value. Because of this, the cost of discounting may be less, but you’ll be retaining the costs of in-house invoice management and collections, plus, you will likely face a greater risk of non-payment unless you have an airtight credit control process. This means the cost may balance out or you could even pay more with discounting overall.

Eligibility

Factoring is easier to qualify for, as approval is based on the creditworthiness of your customers rather than your business. This makes it a good option for newer businesses or those with limited credit history. Conversely, discounting may have stricter requirements, as lenders prefer businesses with a solid receivables portfolio and established systems for managing collections.

Perks and Support

Invoice factoring companies operate more like business funding and growth partners. They may offer additional services, such as invoice preparation, or provide other funding services, like equipment financing. Some offer industry-specific perks as well. For instance, a freight factoring company might provide its trucking businesses with fuel discount cards or load board access. On the other hand, invoice discounting tends to be more transactional and doesn’t come with additional services or perks.

Support Your Business Growth and Streamline Cash Flow by Factoring

If factoring seems like the ideal choice for your business, we can match you with a factoring company that offers competitive rates and top-notch support. To get started, request a complimentary rate quote.

Factoring vs. Invoice Discounting FAQs

Which is better: factoring or invoice discounting?

The best option depends on your business needs. Factoring is ideal for companies that want immediate cash flow and outsourced collections.

How is the invoice discounting cost structure different from factoring?

Invoice discounting typically charges interest on the amount advanced, similar to a short-term loan. Factoring involves a discount rate (a percentage of the invoice) plus potential. Factoring may cost more due to credit control and collections services, while discounting is often cheaper but requires businesses to manage receivables themselves.

What is the cost of factoring vs. invoice discounting?

Factoring fees range from one to five percent of the invoice value per month, depending on customer creditworthiness and payment terms. Invoice discounting costs are typically one to three percent per month as interest on the advance. Factoring fees are higher due to outsourced collections, whereas discounting is usually more cost-effective for businesses that already have strong credit control processes in place.

Is invoice discounting for established companies?

Yes, you can use invoice discounting for steady businesses. It, along with invoice factoring, are two of the most popular invoice funding solutions for established companies.

About Invoice Factoring Guide

Related Articles

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300