Considering a transition to invoice factoring from traditional loans? While this might have seemed like a step backward to previous generations, modern businesses are eager to get away from debt and recognize that smaller companies are often underserved by the banking industry, making the decision to switch a strategic choice that helps the business stabilize and grow. Below, we’ll explore the benefits of factoring, key differences in how it works, and how to streamline the transition, so you can move forward with confidence.

Benefits of Switching to Factoring

If you’re used to relying on traditional loans, switching to invoice factoring can feel like a big shift, but it’s often a smarter, more flexible way to manage cash flow. Instead of taking on debt, you’re unlocking the working capital that’s already tied up in unpaid invoices.

For many businesses, this is quite transformative, especially if you’re struggling with slow-paying clients or unpredictable cash flow. Unlike a loan, where you receive a lump sum and then pay it back in fixed installments, often with interest piling up, factoring gives you ongoing access to cash whenever you need it without adding debt to your balance sheet.

The Flexibility of Factoring vs. Loan Repayment Schedules

One of the biggest pain points of traditional loans is rigid repayment schedules. With a loan, you’re locked into fixed monthly payments, whether your business had a profitable month or a slow one. If cash flow is tight, that repayment can put serious strain on your finances.

Factoring, on the other hand, adapts to your revenue. You’re not stuck making fixed payments. Instead, you get cash as you issue invoices, and the factoring company gets paid when your client settles their bill. This scales with your business. If you have more invoices, you get more funding. If business slows down, you’re not stuck with a debt payment that doesn’t adjust.

Immediate Access to Cash Flow

One of the most underrated benefits of factoring is the speed of funding. Traditional loans can take weeks or months to secure, requiring extensive paperwork, credit checks, and approval processes.

With factoring, you typically get funds in 24 to 48 hours once approved. There’s no waiting game. It’s your money, unlocked when you need it. Because factoring companies focus on your clients’ creditworthiness and not yours, it’s an option even if your business has limited credit history or has faced financial challenges.

Steps to Make a Smooth Transition to Invoice Factoring

Shifting from traditional loans to invoice factoring isn’t just about switching funding methods. It’s about adopting a more flexible, cash-efficient mindset. The key to a successful transition is preparation. You want to ensure your business is factoring-ready and that you’re working with the right partner. Let’s break down the steps to start invoice factoring.

1. Assess Your Current Financial Needs and Cash Flow Situation

Before jumping into factoring, take a step back and analyze your business’s financial health. Factoring isn’t a one-size-fits-all solution, so understanding your cash flow patterns, invoice cycle, and financial bottlenecks will help you use it effectively.

What to Evaluate

- Your Average Invoice Turnaround Time: How long do customers take to pay? If it’s 30 or more days, factoring could bridge that gap.

- Your Cash Flow Gaps: Identify periods where expenses outpace revenue. Factoring is especially useful if cash flow is unpredictable or tied up in large invoices.

- Your Current Debt Obligations: Unlike loans, factoring doesn’t add debt. If you’re carrying existing loans, factoring could help you reduce reliance on credit lines.

- Your Client Payment Reliability: Since factoring companies assess your clients’ creditworthiness, strong-paying customers make for a smoother transition.

For instance, a manufacturing company with large orders but slow-paying customers may struggle with payroll and supplier payments. Instead of waiting 60 to 90 days for payments, factoring allows them to access working capital immediately and take on new projects.

2. Choose the Right Factoring Partner

Factoring companies may operate in different ways, so choosing the right one is crucial. The goal is to find a provider that aligns with your industry, business size, and cash flow needs while also offering fair terms and transparent fees.

Key Factors to Consider

- Industry Expertise: Some factors specialize in trucking, staffing, manufacturing, healthcare, or construction. A specialized partner understands your industry’s billing cycles and challenges.

- Advance Rates and Fees: Most factors advance 70 to 95 percent of the invoice value upfront, with the rest, minus fees, paid after customer payment. Compare rates and watch out for hidden fees.

- Recourse vs. Non-Recourse Factoring: Recourse factoring means you’re responsible if a client doesn’t pay. Conversely, non-recourse factoring shifts the risk to the factoring company but may have higher fees.

- Speed of Funding: Standard turnaround is 24 to 48 hours, but some factors offer same-day funding.

- Contract Terms and Exit Options: Some companies lock you into long-term agreements. Look for flexibility if you’re testing the waters.

Managing Client Relationships During the Transition

Switching to invoice factoring doesn’t just affect your internal cash flow. It also changes how your clients interact with your payment process. Since factoring companies take over collections, how you handle this transition with your customers matters.

The key is clear communication and proactive relationship management. When done right, your clients will see factoring as a natural part of doing business with you. Let’s break it down.

How Factoring Impacts Your Clients and Their Payment Processes

One of the biggest concerns business owners have when transitioning from traditional finance to factoring is how it will affect customers.

What Actually Happens

- Payments: Your invoices are still issued under your company’s name, but the payment instructions change. Instead of paying you directly, clients send payments to the factoring company.

- Collections: Your factoring partner verifies invoices and follows up on payments, but the level of involvement varies based on the agreement. Some factors take a more hands-off approach, while others actively manage collections.

- Notification: Clients typically receive a Notice of Assignment informing them of the new payment process. This is standard practice in B2B transactions and isn’t usually a red flag, especially in industries where factoring is common.

Maintaining Client Confidence While Outsourcing Collections

Clients are much more receptive if you position factoring as a benefit.

How to Frame the Conversation

- Reassure Them: Tell them that nothing else is changing. They’re receiving the same services and the same terms. It’s just a smoother payment process.

- Frame It: Emphasize the benefits to them. Factoring allows you to maintain stronger operations, invest in better service, and avoid disruptions due to cash flow shortages.

- Choose Well: Select a factoring company with professional collections practices. You want a partner who follows up respectfully and does not use aggressive tactics that could hurt client relationships.

What to Avoid

- Don’t Surprise Them: A sudden Notice of Assignment with no prior explanation can create unnecessary confusion.

- Don’t Frame it as a Financial Struggle: Instead of saying, “We need to factor invoices to stay afloat,” position it as “This allows us to reinvest in delivering even better service for you.”

- Don’t Assume Factoring is Unfamiliar to Them: Many businesses already deal with suppliers who factor invoices.

Key Differences in Documentation and Contracts

Switching from traditional loans to invoice factoring changes how your financing agreements are structured. If you’re used to bank loans or credit lines, the paperwork for factoring will feel different but often more straightforward.

Understanding these legal and administrative shifts before you sign a factoring agreement ensures you get the best deal while avoiding unexpected obligations. Let’s break it down.

Legal and Administrative Shifts from Loans to Factoring

With a traditional loan, your agreement is centered around debt. You borrow a lump sum and agree to repay it over time with interest. Factoring, however, isn’t a loan. It’s an advance on outstanding invoices, so the legal framework is different.

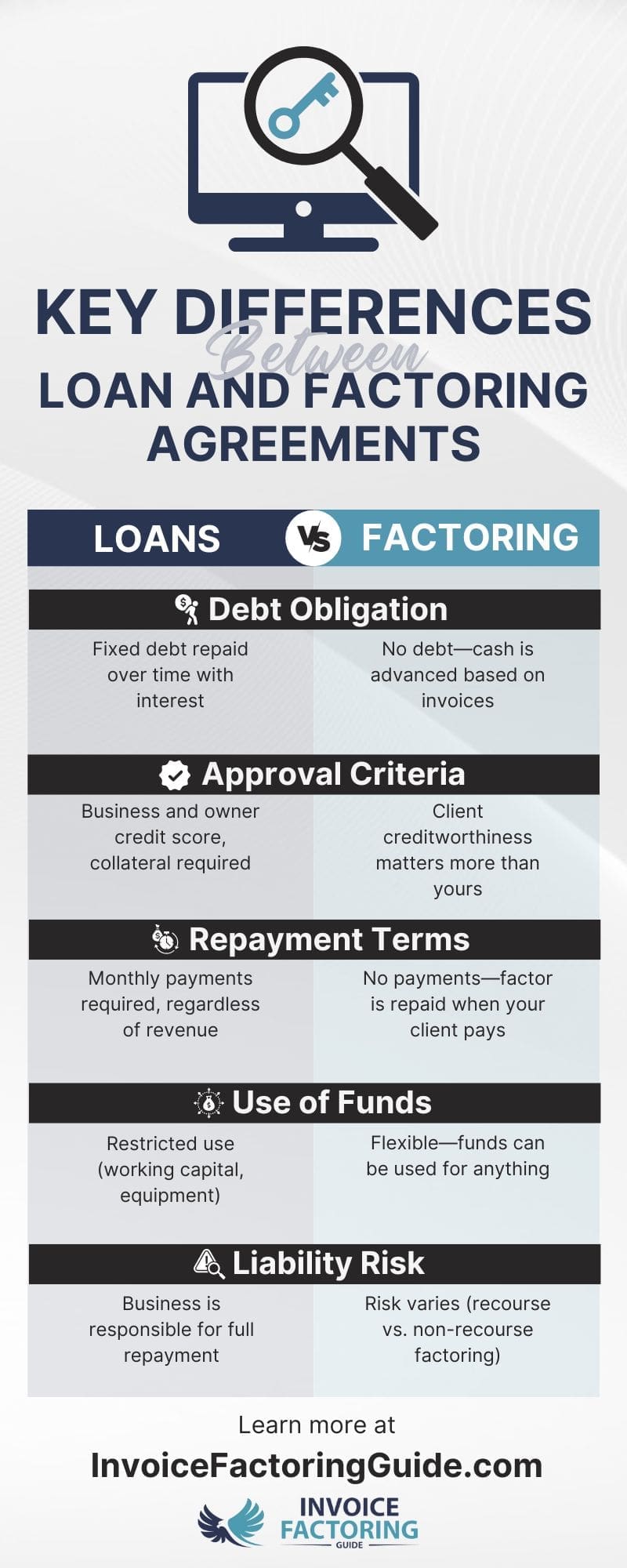

Key Differences Between Loan and Factoring Agreements

- Debt Obligation: A loan is a fixed debt that’s repaid over time with interest. Factoring does not create debt. Cash is advanced based on invoices.

- Approval Criteria: Traditional loans rely on the business and owner’s credit score, and collateral is often required. With factoring, your clients’ creditworthiness matters more than yours.

- Repayment Terms: Loans require monthly payments, regardless of your revenue. Factoring doesn’t involve payments from you. The factor is repaid when your client pays.

- Use of Funds: Oftentimes, loans have restrictions, such as using them only for equipment. However, factoring advances are flexible, and you can use them however you wish.

- Liability Risk: With a loan, your business is responsible for full repayment. With factoring, the risk varies. For instance, a non-recourse agreement transfers the risk to the factoring company.

Simplifying the Documentation Process with Factoring

Another major advantage of factoring is that there’s less paperwork compared to traditional loans.

Loans Require

- Detailed business financials

- Credit history reports

- Collateral agreements

- Loan repayment schedules

Factoring Requires

- A signed factoring agreement

- Proof of outstanding invoices

- A Notice of Assignment (sent to your clients)

- A customer credit check (handled by the factor)

Since the focus is on your invoices and your clients’ ability to pay, the process is faster and more accessible, especially for newer businesses or those with limited credit history.

Ensuring Long-Term Financial Health with Factoring

Switching to invoice factoring allows you to create a sustainable financial system that supports growth without relying on debt. But to make factoring work for you in the long run, you need a strategy.

The key is to use factoring as a tool, not a crutch. Businesses that integrate factoring wisely gain financial stability, improve operations, and scale faster.

Invoice Factoring Supports Business Growth and Stability

A major advantage of factoring is cash flow predictability. Instead of waiting a month or more for customer payments, you can access funds almost immediately. This allows you to take on larger orders without stressing about working capital, cover payroll, suppliers, and operational costs without delays, reinvest in marketing, hiring, and expansion, avoid the cycle of debt and interest payments, and more.

However, long-term financial health requires balance. Factoring should be part of your overall funding strategy, not your only source of working capital.

Monitor Your Cash Flow After Making the Transition

Once you start factoring, cash flow becomes easier to manage, but only if you track it properly. Just because money is coming in faster doesn’t mean you should lose sight of where it’s going.

Best Practices for Managing Cash Flow with Factoring

- Review Your Margins Regularly: Factoring fees vary (typically 1-5% per invoice). Ensure your profit margins support the cost of factoring while keeping operations profitable.

- Optimize Your Invoicing Practices: The faster you invoice, the faster you get funded. Streamline your billing process to ensure smooth, consistent cash flow.

- Monitor Customer Payment Trends: If customers start paying late or disputing invoices, this can impact your factoring terms. Keep an eye on payment habits and address any issues early.

Make the Transition to Factoring

The right factoring partner will help ensure your transition goes smoothly. To take the first step and be matched with a suitable factoring company, request a complimentary rate quote.

FAQs on the Transition to Invoice Factoring

How can invoice factoring improve cash flow compared to a loan?

Factoring provides immediate access to funds tied up in unpaid invoices, eliminating the wait for customer payments. Unlike loans, which require fixed monthly payments, factoring allows cash flow to scale with revenue. This ensures steady working capital for payroll, inventory, and operations without accumulating long-term debt.

What steps should I take to transition my business from loans to factoring?

Start by assessing your cash flow needs and invoice payment cycles. Identify slow-paying clients and determine how much working capital you require. Then, research factoring companies, compare rates and terms, and notify your customers about the change. Finally, streamline invoicing practices to ensure faster funding.

Will switching to invoice factoring affect my business credit score?

No, factoring does not impact your business credit score because it’s not a loan. Since factoring companies focus on your customers' creditworthiness, your company’s financials aren’t the main concern. However, missing obligations under a recourse factoring agreement could lead to financial strain, indirectly affecting credit.

How do I choose the right factoring company when moving away from loans?

Look for a factoring company that specializes in your industry, offers competitive advance rates (typically 70 to 95 percent), and has transparent fee structures. Consider whether they provide recourse or non-recourse factoring, funding speed, contract flexibility, and customer service quality, as they will handle invoice collections on your behalf.

What documentation is required for factoring compared to traditional loans?

Factoring requires less paperwork than loans. Typically, you’ll need a factoring agreement, proof of outstanding invoices, and a Notice of Assignment for clients. Unlike loans, there’s no need for collateral, personal credit checks, or extensive financial records, making the approval process significantly faster.

How does invoice factoring impact client relationships and payment processes?

Your clients will send payments directly to the factoring company instead of your business. Some factoring companies actively manage collections, while others remain hands-off. To maintain strong relationships, notify clients in advance and position factoring as a way to ensure uninterrupted service and financial stability.

Are there financial risks in switching from a loan to invoice factoring?

The main risks include factoring fees reducing profit margins and potential recourse liability if a client fails to pay. Long-term contracts with factoring companies can also limit flexibility. However, choosing a reputable factor and managing customer payment reliability can minimize these risks.

How can I monitor my cash flow after switching from loans to factoring?

Regularly review factoring fees, invoice processing times, and customer payment trends. Optimize invoicing practices to ensure timely funding, and track how frequently you rely on factoring to identify opportunities to build cash reserves. Setting monthly financial checkpoints can help maintain stability.

About Invoice Factoring Guide

Related Articles

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300