Although many financing options exist for the trucking industry, few are expressly designed for freight brokerages. One exception is freight broker factoring, a unique funding solution that allows you to pay carriers, cover overhead, grow your business, and more, all without taking on debt. Our guide to freight factoring walks you through how it works, including benefits and qualification process, as well as how it compares to other transportation industry finance options.

One alternative financing solution businesses may explore is reverse factoring, which enables companies to optimize supply chain payments and enhance supplier relationships by facilitating early payments through a third-party financial institution. Comparing freight broker factoring with reverse factoring can help brokers determine the most effective financial strategy for their operational and cash flow needs.

How Freight Broker Factoring Works

America is home to more than 90,000 freight forwarding brokerages and agencies, according to IBISWorld. You fill a crucial role, serving as a liaison between roughly 750,000 trucking companies and shippers, ensuring freight arrives safely and on time while helping carriers build thriving businesses.

However, the typical trucking business has tight margins and often cannot afford fuel and other expenses associated with accepting new loads until previous loads are paid. They turn to you, the broker, for advance payment, even though you’re also waiting weeks or months for final payment from shippers and have your own overhead to cover.

That’s where freight broker factoring comes in. It accelerates payment on freight bills, so you can focus more on running a profitable and efficient business and less on cash flow.

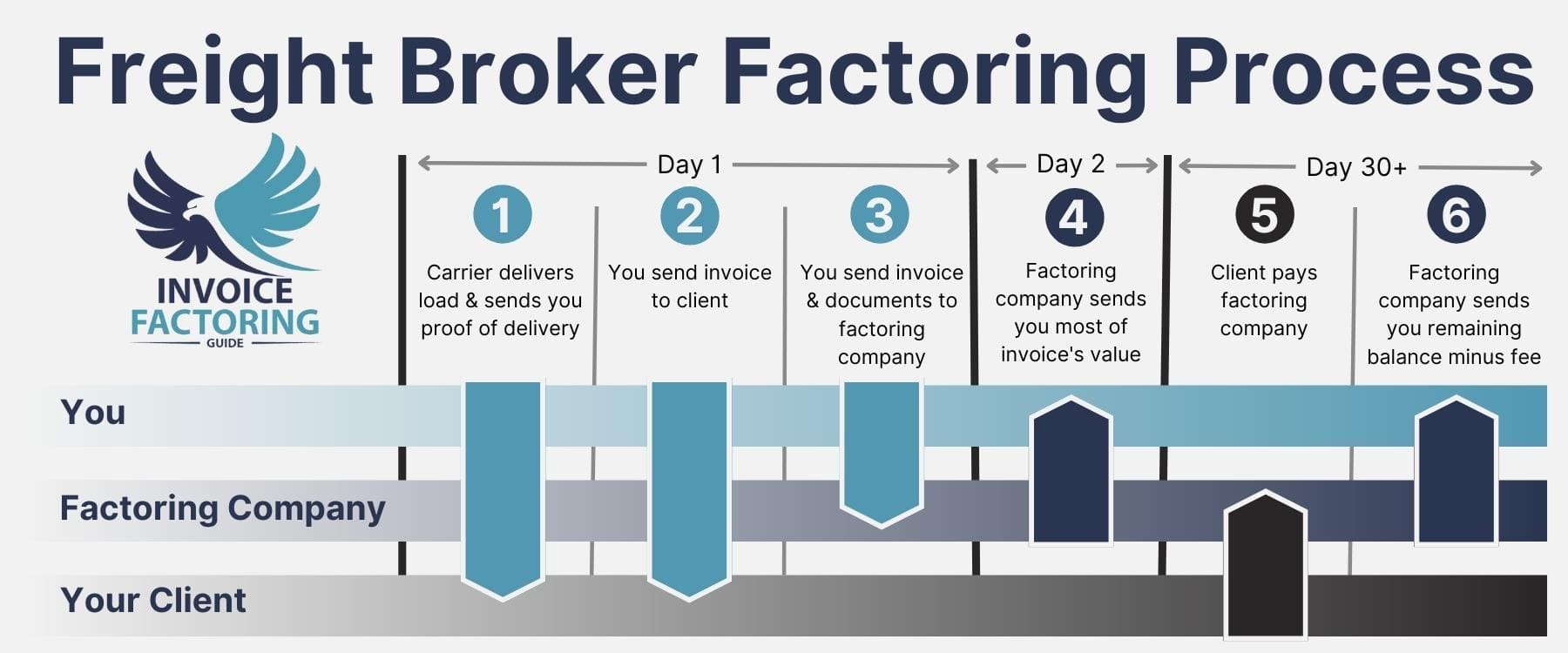

Freight Broker Factoring Process

The freight broker factoring process is quick and easy.

1. The Carrier Delivers the Load

Your carrier delivers the load as usual, then sends you proof of delivery and any other related documents.

2. You Invoice the Client

Generally speaking, you’ll invoice your client as usual. However, some freight factoring companies will take care of this step for you.

3. You Send Documentation to the Factoring Company

Next, you’ll send the invoice or freight bill, proof of delivery, and any other necessary documents to the factoring company.

4. The Factoring Company Sends You Most of the Invoice’s Value

Your factoring company immediately sends you up to 95 percent of the invoice’s value. Funds are usually sent via ACH and hit your bank account in about two business days. However, some factoring companies offer same-day and next-day expedited services. You can use the cash however you like.

5. The Client Pays the Factoring Company

The factoring company waits for the shipper’s payment and handles the collection process.

6. The Factoring Company Sends You the Remaining Balance

Once the shipper pays its invoice, the factoring company sends you the remaining invoice value minus a small factoring fee.

Ways Freight Brokers Use Factoring Advances

There are no restrictions on how you can spend your factoring cash. Some of the most common ways brokers use their advances are covered below.

Carrier Payments

Provide carriers with accelerated payment so they can easily accept the new load.

Operating Expenses

Cover your own business expenses, like payroll and rent.

Growth

Invest in growth opportunities or market your brokerage to expand your business.

Qualifying for Freight Broker Factoring

Getting approved for freight broker factoring is fast and straightforward, and most brokerages qualify. This is because more weight is placed on the shipper’s creditworthiness than yours, so you can qualify even if you don’t have a strong credit score or wouldn’t meet the criteria for a traditional loan.

Cost of Freight Broker Factoring

The cost of freight factoring services shifts a bit based on the invoice amount, invoice volume, and other variables. However, most freight factoring rates sit between one and five percent of the invoice’s value.

Benefits of Freight Broker Factoring

Factoring can help you build a healthy freight brokerage in many ways.

Cash Flow Accelerates

Freight broker factoring turns unpaid invoices into cash instantly, so it’s easier to cover your expenses.

Cash Flow Becomes More Predictable

Eight in ten small business closures are tied to cash flow management issues, as the National Federation of Independent Businesses (NFIB) reports. It’s not necessarily a lack of profit or even working capital that creates issues. It’s inconsistent cash flow and slow-paying clients that make it challenging to predict inflows and budget accordingly. Factoring takes care of this for you, so cash flow management is more straightforward.

Carrier and Shipper Relationships Improve

Truck drivers need to be paid fast, but shippers often aren’t prepared to cover balances in a timely manner. Some even hold off on payment until shipped goods are resold. As the person in the middle of all this, it’s up to you to keep everyone happy. Factoring allows you to do this. You can give shippers more relaxed payment terms and lower your days to pay for carriers. This gives them more reasons to return to you for work and boosts your reputation, so you’re likely to have more carriers sign up with you too.

It’s Easier to Scale

When your brokerage is growing, you’re paying today’s increased expenses with yesterday’s lower revenues. That’s difficult to do, and sometimes brokers even turn down loads because they know they can’t float the related expenses. Factoring provides a quick cash injection that can minimize these cash flow gaps, making it easier to grow.

You Can Gain a Competitive Advantage

Opportunities can creep up at any time. Perhaps another brokerage closes down and their shippers must pivot quickly, or a new market opens. Small and midsized brokerages rarely have cash on hand to take advantage of these opportunities, and they tend to vanish before a bank loan can pay out. With factoring, you can immediately get the cash you need to gain a competitive advantage.

Maximize Working Capital

Many brokers pay carriers out of their own pockets. That may not be feasible all the time or as your brokerage grows. With factoring, you keep your money in your pocket and can fund carrier payments with the revenue they generate.

Reduce Bad Debt

If you’ve been in the business of freight brokerage for any length of time, you know that bad debts can seriously hurt your company. They may not happen often, but when they do, it’s rarely a small amount that you can just roll with. Your invoice factoring company will check the creditworthiness of your shippers, so you can make informed decisions about whether to accept loads and how much trade credit to extend. That way, your brokerage sees less bad debt overall.

Avoid Debt

One of the biggest challenges business face today is managing their debt payments. High debt levels also impact your credit and can make obtaining loans, insurance, and more impossible. Factoring doesn’t create debt because the balance is cleared when the shipper pays, so your business doesn’t face these struggles.

Control Funding and Expenses

You’re in control of which invoices you factor and when you factor them, so it’s easier to maintain control of your finances and tap into funding when it makes sense to do so.

Additional Services and Perks Provided by Freight Broker Factoring Companies

Factoring companies specializing in the freight industry often offer additional services to help your brokerage grow.

Credit Checks for Shippers

Most factoring companies perform credit checks on your clients, so it’s easier to make informed decisions about what work you accept.

Back-Office Support

Because factoring companies collect on invoices for you, collections services are part of a typical package. However, some offer invoice preparation and other services to relieve back-office burdens and allow you to focus on growing your business.

Load Boards

A handful of factoring companies have their own load boards or offer access to third-party boards, so it’s easy to post loads and expand your freight brokerage business.

Additional Funding Solutions

Some freight broker factoring companies offer additional funding solutions, such as:

- Asset-based lending

- Commercial credit cards

- Equipment leasing and financing

- Factoring line of credit

- Insurance premium financing

Financial Services Related to Freight Broker Factoring

There are many types of funding a freight company might leverage at any given time. Below, we’ll cover a few types of related funding and how freight broker factoring stacks up.

Freight Broker Factoring vs. Bank Loans

The difference between factoring and traditional bank loans is night and day. Bank loans are notoriously difficult to obtain. Interest rates vary but are usually somewhere between eight and 20 percent. You’ll pay interest, fees, and principal back in regular installments, usually over several years.

Conversely, most brokerages qualify for factoring. There’s no debt to pay back, and factoring fees are usually between one and five percent of an invoice’s value.

Freight Broker Factoring vs. QuickPay

QuickPay is very similar to freight broker factoring, but instead of you receiving the cash advance, the carriers of your choosing receive it, and the expense is usually transferred to them. Many factoring companies that offer freight broker factoring also offer QuickPay, so it’s easier to find the right solution for your needs.

Freight Broker Factoring vs. Freight Factoring

Also referred to as freight bill factoring or freight invoice factoring, the term “freight factoring” is usually specific to funding for carriers. However, some use it as a general industry term and lump freight broker factoring in with it.

For the most part, trucking factoring works like freight broker factoring, but it only involves the factoring company, carrier, and shipper. For instance, an owner-operator or someone with a large fleet of trucks might factor invoices. In these cases, they’ll invoice the shipper themselves, then send documentation to the factoring company and receive immediate payment directly.

Trucking factoring companies often offer perks to their clients, such as fuel cards to make managing fuel costs easy and reduce expenses, fuel advances, tire discount programs, and free load board access.

How to Choose a Freight Broker Factoring Company

While many factoring companies support the trucking industry, it’s generally best to go with a freight factoring company or one specializing in helping brokerages. They’ll understand your brokerage’s challenges and are more likely to provide tailored solutions. Additionally, you’ll want to consider the rates and additional services offered.

Get a Free Freight Broker Factoring Rate Quote

If it sounds like freight broker factoring is the ideal solution for your brokerage, we’re happy to help match you with a factoring company that offers competitive rates and can meet your needs. To learn more or get started, request a free freight broker factoring rate quote.

About Invoice Factoring Guide

Related Articles

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300