Are you sitting on a stack of older invoices and wondering if it will impact your invoice factoring deal? It might. Accounts receivable (AR) aging and factoring are intertwined. On this page, we’ll walk you through the fundamentals of AR aging and factoring, how AR aging affects your factoring deal, and what you can do to reduce your AR aging if it’s a concern.

AR Aging Explained

AR aging is a financial process that categorizes a company’s outstanding invoices based on the length of time they have been due. It helps businesses monitor and manage their receivables, ensuring timely collections and maintaining healthy cash flow.

How AR Aging is Tracked

If you use accounting software like QuickBooks or Xero, it will automatically track AR aging for you and can generate AR aging reports or schedules. These are detailed summaries showing each invoice’s age, amount, and the customer it is associated with. Invoices are typically grouped into categories such as 0-30 days, 31-60 days, 61-90 days, and over 90 days past due.

What’s Considered “Normal” AR Aging

- 0-30 Days: This range is generally considered current. Payments within this period are seen as standard and reflect good customer payment habits.

- 31-60 Days: Invoices in this bracket are slightly overdue but still within an acceptable range for many industries.

- 61-90 Days: Payments in this range are typically a cause for concern, indicating potential cash flow issues or customer disputes.

- Over 90 Days: Invoices older than 90 days are considered significantly overdue and may require collection efforts or provisions for bad debt.

How AR Aging Schedules Are Used

AR aging schedules are used by businesses to manage and optimize their accounts receivable processes. We’ll explore this a bit more below.

Cash Flow Management

- Forecasting: Helps businesses predict when they will receive payments, aiding in cash flow planning and ensuring they have sufficient funds to meet their obligations.

- Identifying Trends: By regularly reviewing AR aging schedules, companies can identify trends in customer payment behavior and adjust their cash flow projections accordingly.

Credit Control

- Assessing Customer Creditworthiness: Helps determine which customers consistently pay late, which can inform credit decisions and policies. Companies may choose to tighten credit terms for habitual late payers or require prepayment.

- Setting Credit Limits: Businesses can set or adjust credit limits based on customers’ payment histories as shown in the aging schedule.

Collection Efforts

- Prioritizing Collections: Highlights overdue accounts, enabling businesses to prioritize collection efforts on the most overdue invoices.

- Follow-Up: Provides a systematic way to follow up with customers. For instance, invoices in the 31-60 days category may trigger reminder emails, while those in the over 90 days category might result in more aggressive collection actions.

Financial Reporting and Analysis

- Evaluating Financial Health: Provides insights into the company’s financial health by showing the proportion of receivables that are current versus overdue.

- Provision for Bad Debts: Helps estimate the allowance for doubtful accounts by identifying receivables that are unlikely to be collected, which is essential for accurate financial reporting.

Operational Decision-Making

- Sales Strategies: Informs sales strategies by identifying which customers are more reliable and which may need more stringent payment terms.

- Negotiating Payment Terms: Provides a basis for negotiating payment terms with customers. For instance, businesses might offer discounts for early payment to improve cash flow.

Compliance and Audit

- Regulatory Compliance: Ensures compliance with accounting standards and regulations that require accurate reporting of receivables and potential bad debts.

- Audit Preparation: Facilitates external and internal audits by providing a clear, detailed record of outstanding receivables and their aging status.

Average AR Aging Explained

The concept of average AR aging, also known as the average collection period, represents the average number of days it takes for a business to collect payments from its customers after a sale has been made. This metric is crucial for understanding how efficiently a company is managing its accounts receivable and overall cash flow.

How Average AR Aging is Calculated

If you’re using accounting software, it will usually calculate your average AR aging for you. If you’re performing the calculation manually, use the following formula:

Average AR Aging = (Accounts Receivable ÷ Net Credit Sales) x Number of Days

What Your Average AR Age Represents

- Collection Efficiency: The average AR aging period indicates how efficiently a company collects its receivables. A shorter period suggests that the company is collecting payments quickly, which is generally positive for cash flow and liquidity. Conversely, a longer period may indicate potential issues with collections, requiring further investigation.

- Customer Payment Behavior: It reflects the payment behavior of customers. A longer average AR aging period may suggest that customers are taking longer to pay their invoices, which could be due to various factors such as longer credit terms or poor credit management.

- Cash Flow Management: It provides insights into the company’s cash flow management practices. Efficient cash flow management typically results in a shorter average AR aging period.

Invoice Factoring Explained

Factoring is a financial transaction in which a business sells its accounts receivable to a third party, known as a factor, at a discount. This allows the business to receive immediate cash, improving its liquidity and cash flow. Factoring is commonly used by businesses that need to maintain a steady cash flow but have customers who take longer to pay their invoices.

How Factoring Works

Factoring is a straightforward process, as outlined below.

- Invoice Generation: A business sells goods or services and issues invoices to its customers.

- Selling Invoices: The business sells its outstanding invoices to a factoring company. The factor typically purchases the invoices for a percentage of their total value, providing immediate cash to the business.

- Advance Payment: The factoring company advances a portion of the invoice amount, usually 60 to 95 percent, to the business. The exact percentage depends on the agreement between the business and the factor.

- Collection: The factor takes over the responsibility of collecting payment from the customers. Once the customer pays the invoice, the factor releases the remaining balance to the business, minus a factoring fee.

- Factoring Fee: The factoring company charges a fee for its services, which can be a percentage of the invoice value. This fee covers the risk of non-payment and the administrative costs of managing the receivables.

When Factoring is Used

Businesses leverage factoring for lots of different reasons. A few common scenarios are outlined below.

- Cash Flow Management: Businesses that need immediate cash to cover expenses, payroll, or invest in growth but have long payment terms from their customers.

- Rapid Growth: Companies experiencing rapid growth that require working capital to scale operations without waiting for customers to pay.

- Startups and Small Businesses: Smaller or newer companies that may not qualify for traditional bank loans due to lack of credit history or collateral.

- Seasonal Businesses: Businesses with seasonal fluctuations in revenue that need to smooth out cash flow throughout the year.

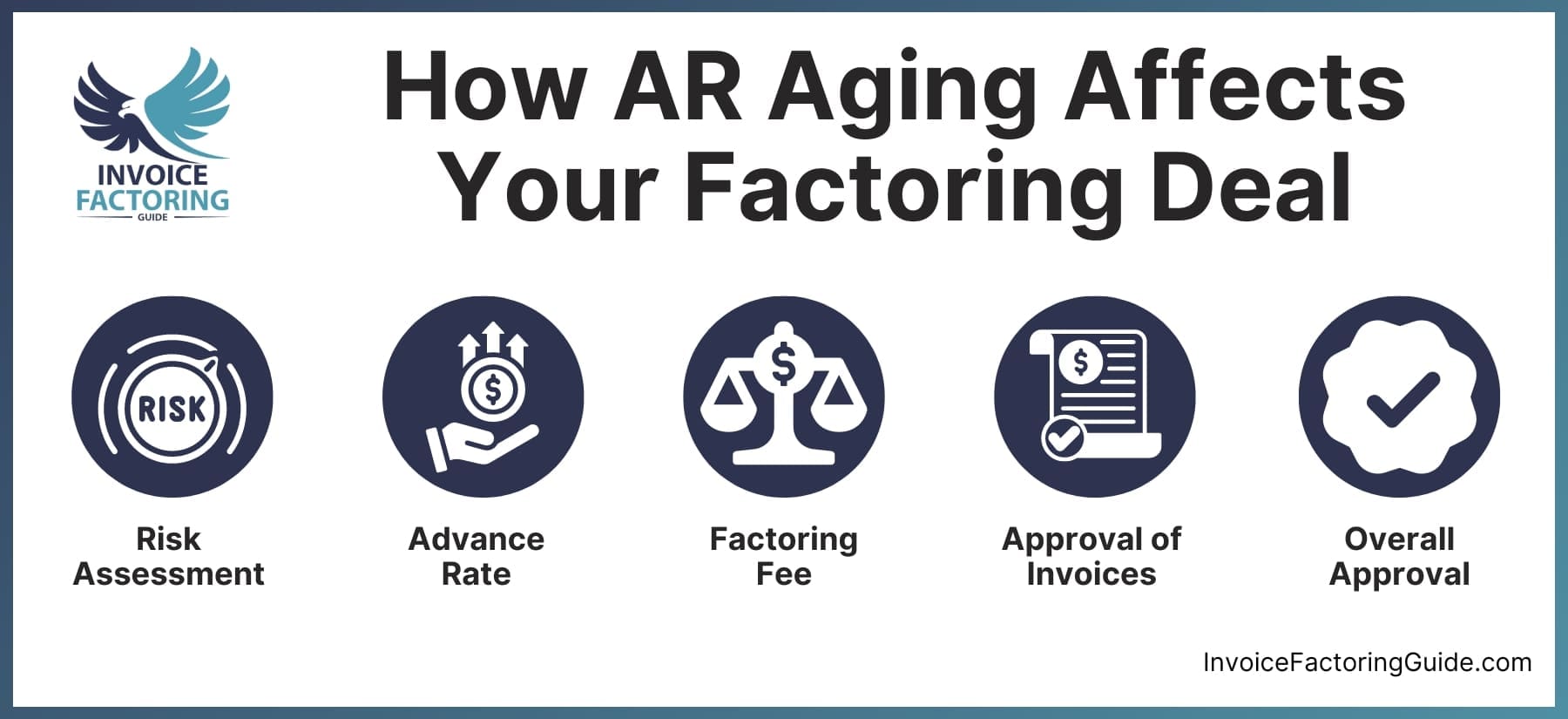

How AR Aging Affects Your Factoring Deal

Now that we’ve covered the background, let’s examine the impact of AR aging on factoring.

Risk Assessment

Factors assess the risk associated with the invoices they are purchasing. The older an invoice, the higher the perceived risk of non-payment. Invoices that are significantly past due, such as those over 90 days, are often seen as higher risk, and generally do not qualify for factoring.

Advance Rate

The age of the receivables can influence the advance rate that factors are willing to offer. For invoices that are current or only slightly overdue, such as 0-30 days, factors might offer a higher advance rate. As invoices age, the advance rate may decrease because of the increased risk.

Factoring Fee

Older receivables typically come with higher factoring fees. This is because factors charge more to compensate for the higher risk of non-payment associated with older invoices. For example, an invoice that is brand new might incur a lower fee compared to one that is 30 or 60 days old.

Approval of Invoices

Not all invoices may be accepted for factoring, especially those that are significantly aged. Factors usually have strict criteria and may refuse to purchase invoices that are over a certain age threshold, such as 90 days past due. This ensures they minimize their exposure to bad debts.

Overall Approval

A business with a well-maintained AR aging schedule, where most invoices are within the 0-30-day range, will find it easier to secure favorable factoring terms. Conversely, if a business has a large proportion of overdue invoices, it may face challenges in obtaining factoring or may receive less favorable terms.

Strategies to Reduce AR Aging Before Factoring

Reducing AR aging before factoring can improve your chances of securing better terms and rates from factoring companies. Below, we’ll cover some strategies for managing AR aging for better factoring terms.

Prompt and Accurate Invoicing

- Immediate Invoicing: Send invoices as soon as goods or services are delivered. The quicker your customers receive their invoices, the sooner they can process and pay them.

- Clear and Accurate Invoices: Ensure that invoices are clear, accurate, and free of errors. Include all necessary details such as payment terms, due dates, and itemized charges to avoid disputes and delays.

Set Clear Payment Terms

- Standardized Terms: Use standardized payment terms that are clearly communicated to your customers. For example, “Net 30” means payment is due within 30 days of the invoice date.

- Early Payment Discounts: Offer discounts for early payments, such as two percent off if paid within 10 days (2/10 Net 30). This can incentivize customers to pay sooner.

Improve Customer Communication

- Regular Reminders: Send regular payment reminders as the due date approaches and immediately after it passes. Use email, phone calls, and even automated systems to ensure consistent follow-up.

- Proactive Engagement: Engage with customers proactively to address any questions or concerns they may have about their invoices. This can prevent delays caused by misunderstandings or disputes.

Offer Multiple Payment Options

- Convenient Payment Methods: Offer various payment methods such as credit card payments, electronic funds transfers (EFT), ACH payments, and online payment portals. Making it easy for customers to pay can speed up the payment process.

- Installment Plans: For larger invoices, consider offering installment payment plans that allow customers to pay in smaller, more manageable amounts.

Customer Credit Management

- Credit Checks: Conduct thorough credit checks on new customers before extending credit. This helps ensure that you are dealing with customers who have a history of paying on time.

- Credit Limits: Set appropriate credit limits based on the customer’s creditworthiness and payment history. Regularly review and adjust these limits as needed.

Streamline Internal Processes

- Efficient AR Management: Use accounting software to automate and streamline your accounts receivable processes. Tools like QuickBooks, Xero, and FreshBooks can help you manage invoices, send reminders, and track payments efficiently.

- AR Aging Reports: Regularly review AR aging reports to identify overdue accounts and take prompt action. This helps you stay on top of receivables and address issues before they become problematic.

Collections Strategy

- Tiered Collections Approach: Implement a tiered collections strategy that escalates as invoices age. Start with friendly reminders, then progress to more formal collection efforts if payments remain overdue.

- Collections Agencies: For severely overdue accounts, consider using professional collections agencies. While this can incur additional costs, it may be necessary to recover long-overdue payments.

Build Strong Customer Relationships

- Customer Relationship Management (CRM): Use CRM systems to maintain detailed records of customer interactions and payment histories. Strong relationships can lead to better communication and more timely payments.

- Personal Touch: Sometimes, a personal touch can make a difference. Personalized follow-ups and a good rapport with customers can encourage timely payments.

Get the Facts on How Your AR Aging Affects Your Factoring Deal

You should now have a firm grasp of the role of AR aging in factoring agreements and how to improve your factoring deal with AR management, but the only way to truly know if your AR will negatively impact your factoring deal, and by how much, is to speak with a factoring specialist. To take the next step, request a complimentary factoring quote.

FAQs About AR Aging and Factoring

Why is understanding AR aging in factoring important for your business?

Understanding AR aging in factoring is crucial as it affects approval rates, advance amounts, and fees. A clear grasp of AR aging helps businesses manage receivables effectively and secure favorable factoring terms.

How do AR aging reports and factoring decisions relate?

AR aging reports are crucial in factoring decisions as they help factors assess the risk of receivables. Detailed reports showing current and overdue invoices influence approval, rates, and terms of factoring deals.

What strategies are effective for optimizing AR aging for factoring success?

Optimizing AR aging for factoring success involves prompt invoicing, clear payment terms, effective collections, offering payment options, and maintaining accurate AR aging reports to enhance receivable attractiveness and secure favorable factoring terms.

What is AR aging and why is it important?

AR aging categorizes accounts receivable based on how long invoices have been outstanding. It helps businesses manage cash flow, assess customer payment behavior, and identify overdue invoices requiring collection efforts.

How does AR aging impact the approval process for factoring?

Factoring companies assess AR aging to gauge risk. Shorter average AR age indicates timely payments, leading to higher approval chances and better terms. Longer AR age suggests higher risk, potentially reducing approval likelihood and increasing fees.

What is a typical AR aging schedule used by businesses?

A typical AR aging schedule categorizes invoices into age groups such as 0-30 days, 31-60 days, 61-90 days, and over 90 days. This helps businesses track overdue accounts and prioritize collection efforts.

How is the average AR aging calculated?

Average AR aging is calculated by dividing the total accounts receivable by net credit sales and multiplying by the number of days in the period (usually 365 days for annual calculations).

What strategies can businesses use to reduce AR aging before factoring?

Strategies include prompt invoicing, clear payment terms, regular payment reminders, offering multiple payment options, conducting credit checks, setting credit limits, and using efficient AR management tools.

What are the benefits of maintaining a low average AR age for factoring deals?

A low average AR age improves cash flow, increases the likelihood of factoring approval, secures higher advance rates, and results in lower factoring fees due to reduced risk of non-payment.

How do factoring companies evaluate AR aging schedules?

Factoring companies evaluate AR aging schedules to determine the risk of non-payment. They prefer invoices that are current or slightly overdue and may reject or offer less favorable terms for older invoices.

What are the common terms and fees associated with factoring based on AR aging?

Common terms include advance rates of 60 to 95 percent and factoring fees of one to five percent. Fees and rates are influenced by the invoice age, with older invoices attracting higher fees and lower advance rates due to increased risk.

Can older invoices be factored, and how does their age affect the deal?

Older invoices can be factored, but they often come with higher fees and lower advance rates. Factors may also be more selective, approving only less aged invoices to minimize risk.

What are the risks of factoring invoices with a high average AR age?

Risks include higher factoring fees, lower advance rates, potential rejection of older invoices, and strained relationships with customers due to aggressive collection efforts by the factoring company.

About Invoice Factoring Guide

Related Articles

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300