More than half a million small businesses fail each year, according to the Chamber of Commerce. While this may seem grim, boosting your business resilience can help ensure yours doesn’t become one of them. On this page, we’ll explore the basics of business resilience, invoice factoring fundamentals, and how factoring provides a sound financial foundation to help future-proof your business.

What is Business Resilience?

Business resilience refers to a company’s ability to adapt to and recover from various challenges, disruptions, and crises. It’s about anticipating risks, whether from financial troubles, supply chain breakdowns, natural disasters, or even global pandemics, and having strategies to mitigate those risks. A resilient business can withstand shocks and stresses, maintain operations under adverse conditions or economic uncertainty, and quickly return to normal or find a new, more sustainable normal after a disruption.

At its core, business resilience is not just about survival but also about thriving. It encompasses aspects of business continuity planning, financial robustness, adaptability, and the ability to pivot or innovate in response to changing market or environmental conditions. For example, during the COVID-19 pandemic, businesses that could quickly shift to online sales or remote work were generally more resilient than those that couldn’t.

How Businesses Build Resilience

To build resilience and ensure sustained business health, companies often focus on diversifying their supply chains, developing contingency plans, investing in technology and infrastructure that support agility, and fostering a culture that values adaptability and continuous learning. Financial health, including access to capital and efficient cash flow management, is also a critical component, as it determines a company’s ability to invest in these areas and weather periods of reduced income.

What is Invoice Factoring?

Invoice factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable or invoices to a third party, called a factor, at a discount. This process allows companies to receive immediate cash flow from invoices that would otherwise be paid in the future, enhancing their liquidity and enabling them to reinvest in operations, cover expenses, or manage cash flow gaps without waiting for customers to pay.

How Invoice Factoring Works

The invoice factoring process is quick and simple.

- Invoice Issuance: The business provides goods or services to its customers and issues invoices for these, with payment terms that might extend 30, 60, or even 90 days.

- Sale to the Factor: Instead of waiting for the customer payments, the business sells these outstanding invoices to its factoring company.

- Advance Payment: Once the factor verifies the invoices, they advance a significant portion of the invoice value to the business, usually within 24 to 48 hours. This advance rate might be anywhere from 60 to 95 percent of the total invoice value, depending on various factors, including the industry, the creditworthiness of the clients, and the terms of the agreement.

- Customer Payment: The customers pay their invoice balances directly to the factor according to their original terms.

- Balance Payment: After receiving payment from the customers, the factor pays the remaining balance to the business minus a small fee for the factoring service. This fee, often referred to as a factoring fee or discount rate, can range from one to five percent of the invoice value, depending on the agreement.

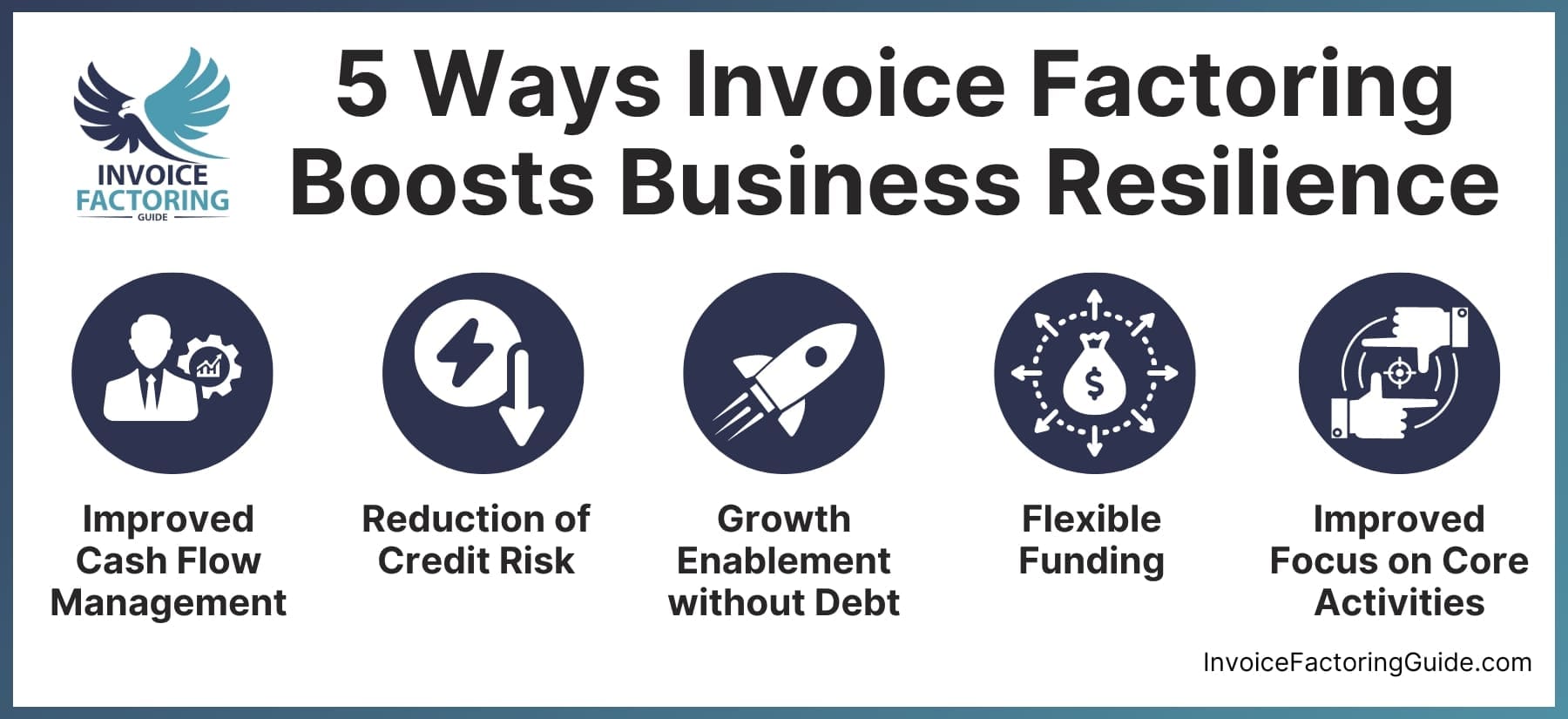

5 Ways Factoring Boosts Business Resilience

Invoice factoring can significantly boost business resilience in several ways, enhancing a company’s ability to navigate financial uncertainties, sustain operations during challenging times, and seize business growth opportunities. We’ll take a quick look at the mechanisms behind this below.

1. Improved Cash Flow Management

Factoring ensures that businesses have immediate access to cash rather than waiting for the payment terms of 30, 60, or even 90 days. This immediate liquidity is crucial for covering operational costs, such as payroll, rent, and inventory, especially in industries with long payment cycles. For example, a manufacturing company facing sudden demand for its products can use factoring to quickly pay for the necessary raw materials and labor without waiting for existing clients to pay their invoices.

2. Reduction of Credit Risk

Factoring companies run credit checks on the company’s clients prior to accepting invoices for factoring. By only extending trade credit to creditworthy clients and ensuring credit limits within the client’s ability to pay are established, businesses naturally reduce the risk of serious delinquencies and non-payment.

Additionally, businesses have the option of leveraging non-recourse factoring. It differs from traditional recourse factoring because the factoring company absorbs the debt rather than the business if a client does not pay. This can be particularly beneficial in industries where customer defaults can be a significant risk.

For instance, a small supplier working with larger retailers might use factoring to mitigate the risk of a big client delaying payment or facing bankruptcy.

3. Growth Enablement without Debt

Factoring provides businesses with capital without the need to take on debt. This means companies can pursue growth opportunities, like expanding their product lines or entering new markets, without the constraints or financial burden of traditional loans.

A tech startup, for instance, could use factoring to finance the development of a new app without diluting equity or taking on additional debt.

4. Flexible Funding

Unlike loans, which often have fixed terms and amounts, factoring is tied to the business’s sales and can scale with the company’s growth. As sales increase, more or larger invoices can be factored, providing greater amounts of financing. This scalability makes it an ideal tool for seasonal businesses or companies experiencing rapid growth.

A seasonal retailer, for example, could use factoring to stock up before the high season and then scale back in the off-season.

5. Improve Focus on Core Activities

Factoring companies typically handle collections, freeing up the business’s resources to focus on core activities rather than managing accounts receivable. This can lead to more efficient operations and a stronger focus on growth and innovation. Some will also prepare invoices and address other back-office tasks.

A small but growing food distribution company could use factoring not only for quick access to cash but also to offload the time-consuming process of invoice collection, allowing them to focus on expanding their distribution network. This operational efficiency also highlights a key advantage of factoring: its ability to strengthen a company’s competitive position by freeing resources for innovation and growth.

Boost Your Business Resilience with Factoring

Invoice factoring is a versatile and efficient financial tool that can help you improve your resilience by enhancing liquidity, managing credit risk, supporting growth without additional debt, providing scalable financing solutions, and allowing you to focus on your core operations. If you’d like to boost your business resilience with factoring, request a complimentary rate quote.

FAQs About Invoice Factoring and Business Resilience

Can factoring protect my business from customer payment disruptions

Yes. Factoring helps build financial resilience against payment delays and defaults. Invoice factoring provides immediate access to funds within 24-48 hours, eliminating dependence on customer payment timelines. Additionally, factors conduct credit checks on your clients, helping you avoid high-risk customers. Many factoring companies offer non-recourse options where they absorb losses from customer defaults, transferring credit risk away from your business. This protection allows you to maintain a steady cash flow even when clients face their own financial difficulties.

What makes factoring more adaptable than traditional financing during growth phases?

Factoring offers scalability that conventional loans cannot match. As your sales increase, available funding automatically grows since it's tied directly to invoice volume rather than fixed borrowing limits. This flexible business financing supports rapid expansion, seasonal demand spikes, or unexpected opportunities without lengthy reapplication processes. You can access more capital during busy periods and scale back naturally during slower times, maintaining financial stability throughout business cycles without the rigid constraints of debt-based funding.

How does factoring support business continuity during operational challenges?

When disruptions strike, such as supply chain issues, natural disasters, or market shifts, invoice factoring can help maintain operations by providing immediate liquidity. Converting unpaid invoices to a factoring company ensures you keep your business running even when circumstances prevent customers from paying promptly. This reliable cash flow lets you address urgent needs, seize business opportunities during recovery periods, and invest in adaptations required for new market conditions. The financial flexibility strengthens your ability to navigate crises without depleting reserves.

Why is choosing the right factoring partner essential for long-term resilience?

A reliable factoring company is crucial for building sustainable financial resilience. The best factoring benefits come from partners who understand your business needs and industry challenges. Different types of factoring arrangements offer varying levels of support—from basic funding to comprehensive back-office services that free resources for strategic initiatives. An established partner provides consistent working capital, professional collections management, and guidance through market changes, creating a foundation for long-term business success and competitive positioning.

About Invoice Factoring Guide

Related Insights

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300