If you’re trying to dig yourself out of debt, a business consolidation loan may seem like the best route. However, they can be difficult to obtain once your credit is damaged, and fixing a debt problem by creating more debt is rarely a good idea. On this page, we’ll walk you through how to know if you need to address your debt, when consolidation works best, and business consolidation loan alternatives that may be a better fit for your needs.

How Much Business Debt is Too Much?

Nearly three-quarters of all small businesses carry some debt, according to the latest Small Business Credit Survey. The total owed tops $100,000 for two in five. Yet, these figures alone don’t signify that debt is a problem for small-business owners. A few calculations and watching for warning signs can help you identify if you’re carrying too much business debt.

Your Debt Service Coverage Ratio (DSCR) is Below 1.25

Debt Service Coverage Ratio = Monthly Operating Profit / Monthly Debt Payments

Investors and lenders often use the debt service coverage ratio (DSCR) to determine if a business has sufficient cash inflow to pay its debts. A DSCR of 2.0 or greater is considered very strong and signifies that a business can cover twice its current level of debt. If a business dips below 1.25, it indicates it might not be able to cover its debt payments if there’s a slight shift in inflows or outflows.

Your Working Capital Ratio is Less Than 1.0

Working Capital Ratio = Current Assets / Current Liabilities

A working capital ratio is also used to identify if a business can manage its debt obligations. A 2.0 ratio indicates the business is in a strong position. A 1.0 is a warning that the business might be unable to meet its obligations.

In this equation, “current” refers to the next 12 months or operating cycle. For instance, current liabilities include rent, loan payments, wages, and accounts payable. Current assets will include things like accounts receivable, cash, and pre-paid expenses.

You’re Experiencing Financial Struggles

Aside from performing these calculations, businesses can often tell if they’ve taken on too much debt when:

- It’s difficult to cover short-term expenses such as inventory and payroll.

- The business no longer qualifies for financing, or lenders expect personal guarantees.

- The business is losing profitability because its funding is too expensive.

What to Watch Out for When Consolidating Business Debt

Many small business owners turn to debt consolidation to simplify their finances, but a few common mistakes can turn a smart move into a costly one.

One of the biggest errors is choosing a loan with a longer repayment period just to get lower monthly payments. While this can ease short-term cash flow, it often means you’ll pay more in interest over time.

Another pitfall is focusing only on rates and terms without considering the total loan amount, fees, or whether collateral is required. Secured loans may help you qualify for a loan, but put business assets at risk if you fall behind.

Business owners also sometimes skip comparing lenders, which can lead to higher interest rates or working with a questionable debt relief company.

If you’re looking to consolidate debt, take time to understand the structure of your existing business obligations. The right strategy can save money on interest, protect your credit, and truly simplify repayment into one monthly payment, not just delay it.

How to Consolidate Your Business Debt

If a business consolidation loan seems like your ideal solution, follow the steps below.

List Your Debts

Grab a pen and paper or Excel spreadsheet and list all your debts, including the creditor’s name, total owed, monthly payment, interest rate, and other pertinent details.

Check for Prepayment Penalties

Review the repayment terms on each of your existing loans. Sometimes, loan terms include prepayment penalties. If any of yours do, consolidating those loans may be more expensive than paying them off on your specified timeline.

Tally Your Amounts and Calculate Your APR

Add up all your debts and calculate your average APR across all loans.

Check Your Own Credit

The major credit bureaus will provide you with at least one free credit report per year. Find out where you sit before you apply.

Business credit scores run from 0 to 100. An 80 or above is considered low risk, and 50 to 79 is medium risk. If you fall below 50, you’re considered a high-risk borrower, and your consolidation options will likely be limited.

Explore Business Consolidation Loan Options

Explore your options online, but hold off on applying for loans now. Virtually all lenders will say they offer competitive interest rates, but the lowest interest rates are typically reserved for those with excellent credit.

Gather as much information as you can and experiment with different breakdowns. For instance, if one or more of your current loans already have a lower rate than what’s being offered or have prepayment penalties, see if you’ll qualify without including those loans to save money.

When to Consider Business Loan Consolidation Alternatives

You may want to consider a business loan consolidation alternative if:

- Your business doesn’t meet minimum credit score requirements.

- You don’t qualify for a bank loan for other reasons.

- You qualify, but the lowest rates offered won’t help enough.

- You want an option that doesn’t create more debt.

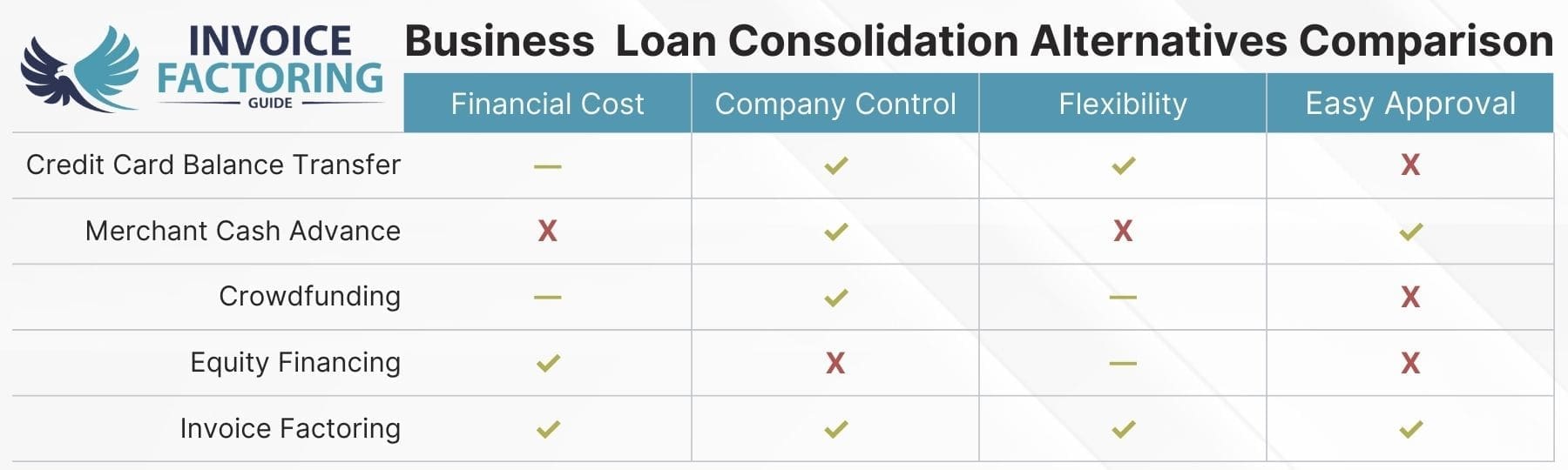

5 Business Consolidation Loan Alternatives

The five alternatives below are often leveraged when traditional consolidation won’t work or isn’t ideal for the business’s needs.

1. Credit Card Balance Transfer

Sometimes, credit cards offer a promotion with 0 percent APR on balance transfers for a period of months. These deals are typically only offered to businesses with excellent credit and can be a good fit if you pay down your balances faster and don’t incur more debt while you’re paying off the old.

Bear in mind, however, that you’ll usually pay a balance transfer fee, which is typically three to five percent of the balance, and you may wind up paying interest on everything you transferred if the balance isn’t paid in full before the promotional period ends. Moreover, a portion of your credit score relates to the age of your accounts. This will be a new account, so the average age of your accounts will be reduced, and this may lower your score a bit.

2. Merchant Cash Advances

If you accept credit card payments, your merchant services provider may be willing to provide a lump sum advance or line of credit based on your anticipated credit card sales. This is known as a merchant cash advance (MCA). Instead of paying it back with interest like you would a loan, your merchant services provider will hold back a percentage of your sales each day. Repayment periods usually last anywhere from three to 18 months.

Calculating the cost of an MCA can be tricky because they use a factor rate rather than an interest rate. It’s usually between 1.2 and 1.5. You’ll convert it to a percentage and multiply it by the amount you’re borrowing to determine your payback amount. For example, if your factor rate is 1.5 and you borrow $50,000, you’ll pay back $75,000. You will not usually receive a discount for paying off the balance early, so your APR could climb well into the hundreds.

3. Crowdfunding

Crowdfunding is a broad term that includes everything from rewards-based crowdfunding to peer-to-peer (P2P) lending. Most options in this bracket are ideal for businesses trying to fund growth initiatives and startups. For instance, you might start a rewards-based campaign when you launch a product and give investors your products and swag for helping.

You’re likely looking at P2P lending to pay off debt. With P2P lending, a group of people comes together to fund your loan rather than a single institution. Sometimes, lenders are more interested in seeing an idea succeed thanin scrutinizing a business’s financials. However, most modern P2P networks perform credit checks, evaluate business plans, and review financial documents like traditional lenders do to minimize risk for their investors. Expect to pay your loan back with interest just as you would a traditional loan.

4. Equity Financing

With an equity loan, you give up ownership shares of your business in exchange for working capital. Sometimes, it’s individual investors, such as family and friends, purchasing shares. Angel investors and venture capitalists (VCs) may also work this way. There’s even a form of crowdfunding that works this way, too. Initial public offerings, or IPOs, are arguably more common, though.

Angels and VCs often bring experience and connections to the table, which can be helpful if you want to draw on this as you scale. However, they tend to expect more involvement with your company than IPO, individual, or crowdfunding investors.

There’s not necessarily a limit to the amount of working capital you can gain through equity financing, and you don’t have to pay back the money. However, it can be challenging to secure equity funding, especially to pay off debt rather than invest in growth, and you will be sharing decisions with others from that point forward.

5. Invoice Factoring

Invoice factoring may be ideal if you operate a B2B company that invoices your clients after goods or services are delivered. With factoring, you sell your unpaid invoices at a discount to a third party known as a factor or factoring company. The factoring company provides you with up to 95 percent of the invoice’s value upfront. Then, when your client pays, the factor sends you the remaining sum minus a small factoring fee, which is usually between one and five percent of the invoice’s value.

There’s no debt or interest to pay back, and you can choose which invoices to factor. You can also choose how to spend the cash. For instance, you can use it to pay off your debts quicker, save on interest, or cover payroll and other expenses, so you’re not tempted to take on more debt. Best of all, most businesses qualify regardless of their debt ratio or credit score because it’s ultimately the client that owes payment on the invoice that’s responsible for payment.

Get a Free Invoice Factoring Rate Quote

If a business consolidation loan isn’t right for you or you’re trying to pay off your debt, invoice factoring may be your ideal solution. Check out our Invoice Factoring Guide to learn more, or request a complimentary rate quote to get started.

FAQs on Business Debt Consolidation

Most business leaders have many questions while exploring their debt consolidation options. We’ll address some of the most common below, then walk you through how to consolidate business debt afterward.

Do Debt Consolidation Loans Hurt Your Credit?

There are pros and cons to taking out a business debt consolidation loan. Often, the business’s credit score improves because it makes it easier to pay off debts and manage finances. However, it could potentially hurt your credit if the lender performs a hard credit inquiry when you apply, as these appear on your credit reports. You’ll also likely see a drop if you don’t make payments on time or rack up more debt while paying off your loan.

Are Debt Consolidation Loans Worth It?

Debt consolidation loans can be worth it, especially if you’re paying off high-interest debt like credit cards or lines of credit, as they can reduce your overall cost to borrow. However, consolidation will not solve the underlying issue that got you into debt in the first place. Because of this, many businesses find that their problem is not solved with consolidation alone. Be sure to review our business loan consolidation alternatives at the end and consult a financial professional if you’re unsure if consolidation is the right move for your business.

How is Debt Consolidation Different from Debt Settlement?

Although consolidation and settlement are often used interchangeably, they’re two very different things. Debt consolidation is typically a service that banks, credit unions, and online lenders offer. It involves combining all your debts into one loan. You eventually pay off all your debts, and your credit will generally improve if you stick to your payment plan.

Conversely, a debt settlement company may offer to negotiate a lower payoff with your creditors on your behalf. This is different because you’re not actually paying off what you owe, and your credit will likely be damaged in the process

About Invoice Factoring Guide

Related Insights

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300