“It is the part of a wise man to keep himself today for tomorrow, and not venture all his eggs in one basket.” This timeless wisdom from Miguel de Cervantes’ Don Quixote serves as a powerful reminder of the importance of diversification. Yet, when it comes to the customers a business relies on, this principle is often overlooked. Below, we’ll explore why your business should keep an eye on customer concentration and how it can influence your factoring agreement.

Customer Concentration Explained

Customer concentration is a measure of how reliant your business is on a small group of customers. In essence, it’s how many “eggs” you’re willing to place in one basket.

Customer concentration looks at what percentage of your total revenue comes from your largest clients. For example, if one customer accounts for 50 percent of your revenue, that’s a high customer concentration. In contrast, if your top five customers collectively make up only 25 percent of your revenue, you have a much more balanced client base.

How Customer Concentration is Calculated

Customer concentration is usually expressed as a percentage. The calculation is straightforward.

Step 1: Identify Your Top Customers

Look at which clients contribute the most to your sales, either individually or as a group.

Step 2: Divide Their Total Revenue by Your Overall Revenue

Let’s say your top client generated $500,000, and your business made $1 million in total revenue:

($500,000 ÷ $1,000,000) × 100 = 50% customer concentration.

Why Customer Concentration Matters in Business

Customer concentration is a double-edged sword.

- High Concentration: While landing a “big fish” client can be exciting, relying too much on one or two customers can put your business at risk. If a major client leaves, delays payment, or goes bankrupt, your cash flow and profitability could take a hit.

- Low Concentration: Diversifying your customer base for factoring success spreads risk. If one customer drops off, it’s easier to recover because you’re not overly dependent on them.

Additionally, studies show that customer concentration has been linked to poor corporate performance. While the mechanisms behind this aren’t fully understood, a lack of diversification can signal further research into company performance is warranted.

https://youtu.be/r8R-jZgOYlw?si=QRrQk-XL_PqfmzIk

Customer Concentration Example

Imagine owning a trucking business; your largest client accounts for 70 percent of your revenue. They decide to switch to another carrier. Without that revenue, you might struggle to cover fixed costs like fuel, driver salaries, and truck maintenance.

Why Customer Concentration Matters in Factoring

Factoring companies are essentially buying your invoices, so they’re taking on the customer concentration risk in factoring. Managing risk in invoice factoring becomes especially important when a large portion of revenue comes from a few clients. If one customer makes up the bulk of your sales and doesn’t pay, the factor’s investment is at risk.

For businesses in specialized industries such as oilfield services, customer concentration can have even greater implications. Learn more about how factoring for oilfield services can provide tailored solutions to address unique industry challenges and mitigate risks associated with concentrated client bases.

How Factoring Agreements and High Concentration Are Addressed

To balance high customer concentration, factors may:

- Limit Funding: For example, they might only fund invoices from your top customer up to 40 percent of the total. This highlights the impact of customer concentration on factoring rates, as higher risk often translates to increased fees.

- Charge Higher Fees: If they sense higher risk due to customer concentration, expect that to reflect in the factoring rates.

Example of Customer Concentration Impacting Factoring

Let’s say a construction company is applying for factoring. Their largest client represents 80 percent of their revenue. The factor might cap how much they’re willing to advance on invoices from that contractor.

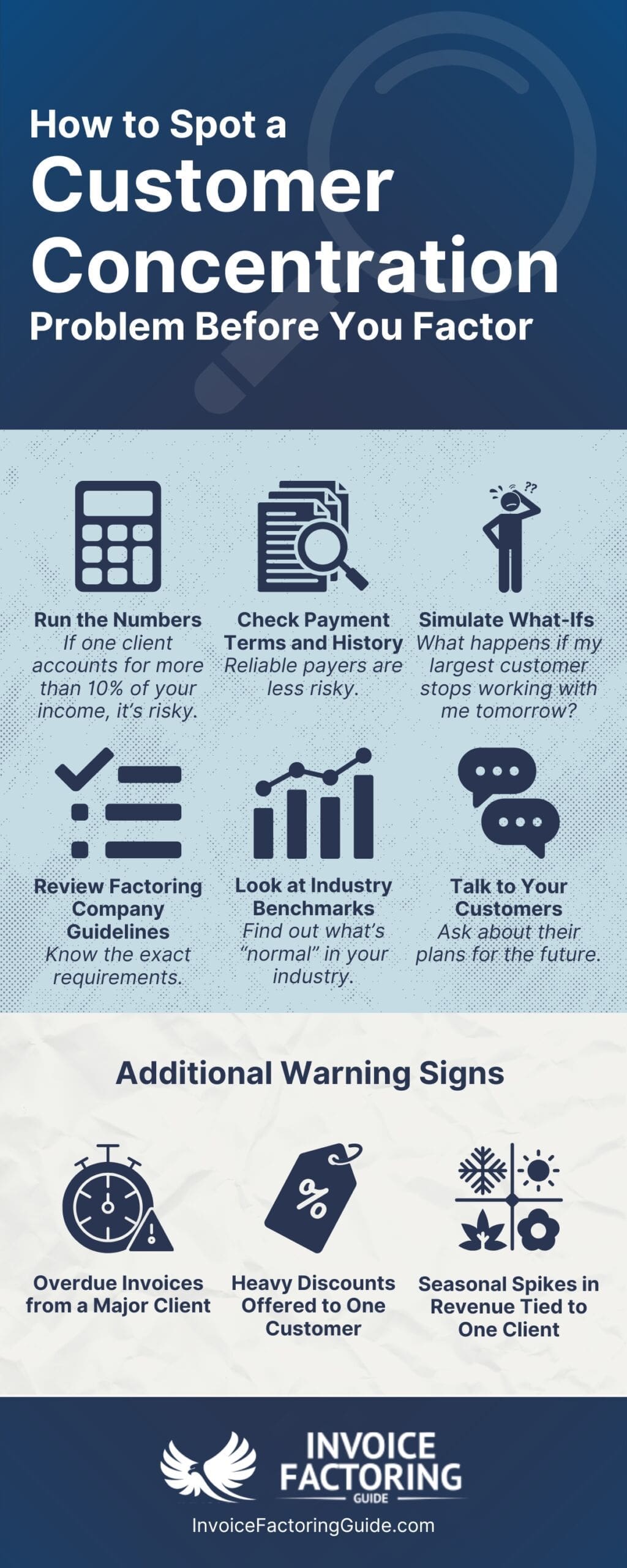

How to Spot a Customer Concentration Problem Before Applying for Factoring

Identifying a customer concentration problem early can save you from surprises during the factoring application process. Here’s how to assess whether it might be an issue for your business.

1. Run the Numbers

Start by analyzing your revenue sources:

- Top Customer Contribution: Calculate what percentage of your revenue comes from your top customer(s). For the sake of business health, it should be no more than ten percent. If a client accounts for significantly more than this, most factoring companies will flag this as a high concentration.

- Group Analysis: Look at your top five or ten customers combined. If they make up over 40 percent of your revenue, your overall concentration is significant.

2. Check Payment Terms and History

Even if one customer dominates your revenue, it may not be an issue if they’re a reliable payer. Here’s what to check.

- Payment History: Are they paying invoices on time? Consistent delays can amplify concentration risks.

- Terms Alignment: If your terms differ widely between customers, it might create cash flow gaps that affect your business operations.

Use accounting software or customer reports to easily generate insights into customer payment behaviors.

3. Simulate “What If” Scenarios

Ask yourself: What happens if my largest customer stops working with me tomorrow?

- Could you still cover operating costs like payroll, rent, or supplies?

- Do you have other clients who could fill the revenue gap in a reasonable timeframe?

If losing one or two clients puts your business in jeopardy, it’s a sign to diversify your customer base.

4. Review Factoring Company Guidelines

A clear understanding of factoring terms and conditions can help you spot red flags and align your application with a factor’s expectations. For example, some factors won’t fund invoices if a single client represents more than 50 percent of your receivables. Others might impose stricter terms (higher rates or reserves) if your customer concentration is considered risky.

5. Look at Industry Benchmarks

Certain industries naturally have higher customer concentration. For example, a freight broker may send loads primarily to a few large carriers, or a government contractor might rely heavily on one agency for projects. Knowing whether your business falls within typical industry norms can help you anticipate potential challenges.

6. Talk to Your Customers

If your top customers are open to it, ask them about their future plans:

- Will their purchasing needs remain steady?

- Are there upcoming policy changes, market shifts, or budgets that could reduce their orders?

This insight can help you predict potential risks and plan accordingly.

Additional Warning Signs You Have a Customer Concentration Problem

In addition to following the steps outlined above, you may be able to spot a customer concentration problem based on some of the warning signs covered below.

- Overdue Invoices from a Major Client: A factoring company will scrutinize these closely.

- Heavy Discounts Offered to One Customer: If you’re offering steep discounts to keep a big client, it could reduce your margin and signal dependence.

- Seasonal Spikes in Revenue Tied to One Client: Peaks are great, but they can also highlight vulnerability during off-seasons.

What to Do if You Have a Customer Concentration Problem

If you discover your customer concentration is high, don’t panic. There are a few strategies to reduce customer concentration risk.

- Expand Your Client Base: Prioritize marketing efforts to land new clients, even if they start with smaller orders.

- Negotiate Terms with Your Factor: Negotiating factoring agreements with concentration issues can lead to tailored solutions like capping advances on your largest client while funding others more fully.

- Strengthen Relationships with Current Clients: The better your communication and relationship, the less likely a client is to leave unexpectedly.

Explore Your Factoring Options

Factoring companies may have varying opinions on your customer concentration risk. Some specialize in offering factoring solutions for concentrated customer portfolios, tailoring terms to your business’s needs. The best way to know for sure if customer concentration will affect a factoring agreement is to speak with a factoring specialist. To get started, request a complimentary rate quote.

FAQs on Factoring and Customer Concentration

How does high customer concentration impact my chances of getting approved for factoring?

High customer concentration can lead to stricter funding limits, higher fees, or rejection, as factors prefer diversified revenue streams to minimize risk.

What percentage of revenue from one customer is considered high customer concentration?

A good rule of thumb is to try to keep customer concentration under ten percent.

Why do factoring companies care about customer concentration?

Factoring companies assume the risk of collecting payments. High concentration means their investment heavily depends on a few customers, increasing potential losses if those clients don’t pay.

How do I calculate my customer concentration ratio?

Divide the revenue from your top customer(s) by your total revenue and multiply by 100. For example, $500,000 from one customer ÷ $1,000,000 total revenue × 100 = 50%.

Can I get approved for factoring if my business relies on a single large customer?

Yes, but terms may be adjusted. Factors might limit advances on invoices from that customer or charge higher fees to offset risk.

What steps can I take to reduce customer concentration in my business?

Diversify your client base by marketing to new customers, expanding services, or targeting different industries to reduce reliance on a few key accounts.

What happens if a factoring company rejects my application due to customer concentration?

You can seek a factor specializing in high-concentration businesses, renegotiate terms, or focus on acquiring new clients to balance your revenue mix.

Do some industries naturally have higher customer concentration, and how does that affect factoring?

Yes, industries like trucking or government contracting often rely on large clients. Factors in these sectors may offer specialized terms to address this risk.

Are there factoring companies that specialize in high-customer-concentration businesses?

Yes, some factoring companies tailor services to businesses with high customer concentration, though terms may include lower advance rates or higher fees.

Does customer concentration impact other financing options?

Yes, it does. High customer concentration can make banks or lenders hesitant, as it signals cash flow risks. Understanding how customer concentration affects financing options prepares you for better negotiations.

Why is due diligence important in invoice factoring?

Due diligence ensures factors understand your customer base, payment behaviors, and credit reliability. Invoice factoring, due diligence, and customer analysis are critical for securing funding with favorable terms.

How can businesses maximize factoring benefits?

Diversifying your customer base is key. Maximizing factoring benefits with diverse clients reduces risk, leads to better funding terms, and ensures long-term cash flow stability.

What metrics determine factoring eligibility?

Factors analyze customer concentration metrics and factoring eligibility, including how much revenue comes from top clients and their payment reliability. Balanced portfolios improve approval chances.

How does customer concentration affect financial stability?

Financial stability and customer concentration are intertwined. Relying heavily on one or two customers can jeopardize your financial stability if they stop paying or leave. Diversifying your revenue base reduces this risk and improves cash flow consistency.

Can you leverage customer concentration in factoring negotiations?

Yes, leveraging customer concentration in factoring negotiations can be helpful. Strong customer relationships and reliable payment histories can make high concentration less risky. Factors may offer better terms if you can demonstrate that your key customers are financially stable.

How does factoring help optimize accounts receivable?

Factoring ensures faster access to working capital, reducing the time spent waiting for customer payments. Optimizing accounts receivable with factoring improves cash flow and allows businesses to focus on growth.

How do factoring companies assess customer concentration risk?

A risk assessment for factoring companies involves reviewing your revenue sources, customer payment histories, and diversification to ensure safe and reliable funding.

What is the role of assessing debtor quality in factoring agreements?

Factors assess debtor quality to determine payment reliability. Customers with strong credit and consistent payment histories reduce risk and improve funding terms.

Why is diversification important for invoice factoring?

Diversified businesses are less risky for factors because they rely on multiple revenue sources. This makes invoice factoring for diversified businesses more accessible and often leads to better terms, such as lower fees or higher funding limits.

About Invoice Factoring Guide

Related Articles

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300