Traditional lending options don’t cut it for roughly half of all small businesses, according to the latest Small Business Credit Survey. Whether due to red tape, rigid requirements, or slow funding, millions of businesses are left in a lurch every year. Thankfully, there are alternative funding solutions that can fill these gaps. Two of the most common are invoice factoring and asset-based lending. In this guide, we’ll explore how both work and compare factoring vs. asset lending, so it’s easier to see which aligns most with your business needs and goals.

How Invoice Factoring Works

Invoice factoring is a flexible funding solution designed for businesses that invoice customers on net terms, such as 30 or 60 days. Instead of waiting for payment, you sell those invoices to a factoring company in exchange for immediate cash. This gives your business a steady flow of working capital without taking on debt.

Think of it as outsourcing your accounts receivable, but with financial benefits. Many businesses in industries like transportation, staffing, and manufacturing rely on factoring to cover payroll, buy supplies, or take on new opportunities.

Getting Approved for Factoring

Approval for factoring is often quicker and less stringent compared to traditional loans. Factoring companies focus more on your customers’ creditworthiness than your business’s financial history. Here’s what they typically look at:

- Your Customers’ Payment History: Do they pay invoices on time?

- Invoice Details: Are the invoices free of liens or disputes?

- Your Business Operations: Is your business established and operating consistently?

Small or newer businesses often find factoring easier to qualify for, as there’s no need for strong credit scores or years of financials.

The Factoring Process

Factoring is straightforward. Here’s how it usually goes:

- Submit Invoices: You send unpaid invoices to the factoring company.

- Receive an Advance: The company provides an upfront payment, typically 80 to 90 percent of the invoice value.

- Factoring Company Collects: They follow up with your customer for payment.

- Get the Remainder: Once your customer pays, you receive the rest of the invoice amount, minus the factoring fee.

For example, let’s say you run a trucking company that’s waiting on a $10,000 payment. With factoring, you could get $8,500 upfront, ensuring you have cash on hand to fuel your fleet, pay drivers, or expand your routes. Once the client pays, the factoring company gives you the remaining $1,500 minus their fee.

How Asset-Based Lending Works

Asset-based lending (ABL) is a financing option where your business secures a loan or line of credit using its assets as collateral. Common assets include accounts receivable, inventory, equipment, or real estate.

Unlike traditional loans that rely heavily on credit scores or long financial histories, ABL focuses on the value of your assets. It’s a practical solution for businesses needing significant capital to fund growth, manage cash flow, or handle seasonal demands.

Getting Approved for Asset-Based Lending

Approval for ABL depends on the quality and value of your assets. Lenders will conduct an in-depth assessment of the collateral to determine its liquidity and reliability. Here’s what they typically evaluate:

- Accounts Receivable: Are your customers creditworthy? Are invoices current and free of disputes?

- Inventory: Is your stock easy to sell and accurately valued?

- Equipment or Real Estate: Does the appraised value match the lender’s risk expectations?

Lenders may also review your business’s financial stability and operational history, but these play a smaller role than the assets themselves. ABL is often more accessible to mid-sized or larger businesses with substantial collateral.

The Asset-Based Lending Process

Here’s a breakdown of a typical ABL arrangement:

- Asset Valuation: The lender evaluates your assets to determine their worth and liquidity.

- Establishing the Loan Amount: You receive a credit line or loan based on a percentage of the asset value, usually 50 to 80 percent for inventory or up to 90 percent for receivables.

- Using the Funds: You can access the funds as needed to cover expenses, seize opportunities, or stabilize cash flow.

- Ongoing Monitoring: The lender may perform regular audits or require updates on the collateral, such as aging reports for receivables.

For instance, a distributor with $500,000 in inventory and $1 million in receivables might secure a $1.1 million line of credit to handle operating expenses and prepare for peak season.

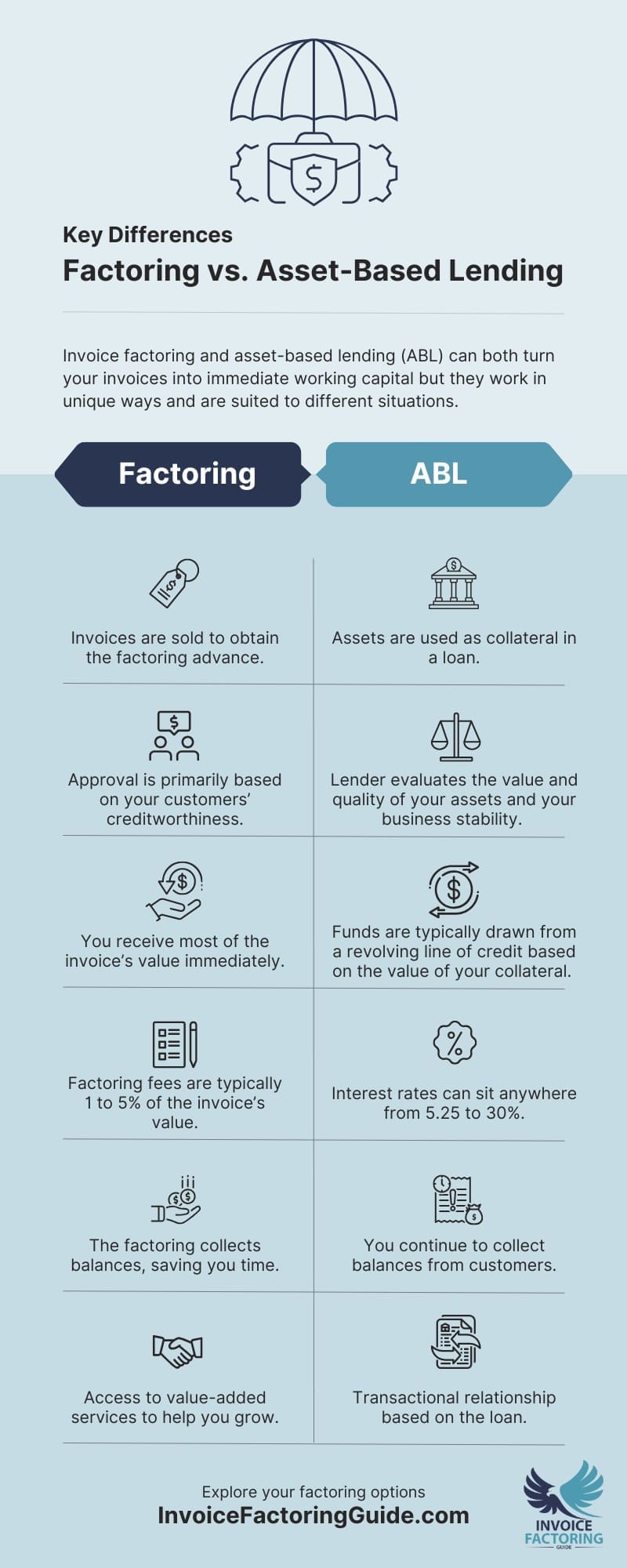

Key Differences in Factoring vs. Asset-Based Lending

When it comes to funding your business, both factoring and asset-based lending (ABL) can help unlock working capital, but they operate in distinct ways. Understanding their differences can help you choose the option that best fits your needs.

1. Collateral Requirements

- Factoring: Your invoices (accounts receivable) serve as the collateral. You sell them to a factoring company, so the risk shifts to your customers’ ability to pay.

- ABL: A broader range of assets can be used as collateral, such as inventory, equipment, or real estate. This flexibility allows businesses with substantial physical assets to secure larger funding.

2. Qualification Process

- Factoring: Approval is primarily based on your customers’ creditworthiness and payment history. Even newer businesses or those with weaker credit can qualify.

- ABL: The lender evaluates the value and quality of your assets. This process can involve appraisals and audits, which may take more time and resources.

3. Access to Funds

- Factoring: You receive a percentage of the invoice value upfront, with the remainder paid after customer payment.

- ABL: Funds are typically drawn from a revolving line of credit based on the value of your collateral. You can borrow as needed within the approved limit.

4. Cost Structure

- Factoring: Fees are often calculated as a percentage of the invoice amount. However, the longer your customer takes to pay, the more you’ll usually pay for the advance.

- ABL: Interest rates and fees depend on the lender and the risk associated with your collateral. The ongoing monitoring requirements can add administrative costs.

5. Customer Interaction

- Factoring: The factoring company typically takes over collections, which can save you time.

- ABL: You retain control over customer relationships and collections, as the lender deals directly with you, not your clients.

6. Additional Services

- Factoring: Factoring companies often provide value-added services, such as invoice preparation and customer credit checks to help streamline your receivables. Industry-specific perks, such as fuel discount cards or tire discount programs for freight factoring clients, are also somewhat common.

- ABL: Lenders are mostly transactional, focusing more on providing you with cash and ensuring repayment in a timely manner.

Factoring vs. Receivables ABL

You might have noticed that asset-based lending sometimes involves using receivables as collateral. This is sometimes referred to as receivables financing, invoice financing, or invoice discounting. Although receivables financing and invoice factoring both provide businesses with immediate capital based on the value of an invoice, they work in unique ways. The key differences covered above apply here, too.

For instance, factoring is not a loan, but receivables ABL is. Factoring does not require you to pay the balance back with interest, but ABL does. Factoring also comes with benefits like collections services, but with ABL, you collect the balances instead. Factoring companies tend to operate more like business finance and growth partners, whereas ABL companies are more transactional.

Situations Where Factoring May Be Best

Factoring shines in scenarios where businesses need fast cash flow without the hassle of traditional loans or strict qualification requirements. Here are the top situations where factoring can be the perfect fit.

Slow-Paying Customers Are Affecting Cash Flow

If your business relies on invoicing customers on net terms, delayed payments can create cash flow gaps. Factoring bridges this gap by providing immediate funds, ensuring you can cover payroll, purchase inventory, or take on new projects without waiting for customers to pay.

You Don’t Have High-Value Assets

Factoring doesn’t require physical collateral like inventory, equipment, or real estate. Instead, your invoices act as the collateral. This makes factoring an excellent option for service-based businesses or those without significant assets to leverage.

Your Business is New or Has Poor Credit

Traditional lenders often require years of financial history and strong credit scores. Factoring companies focus on your customers’ creditworthiness, not your own, making it easier for startups and businesses with less-than-perfect credit to qualify.

You Need Quick Access to Funds

The approval process for factoring is usually faster than asset-based lending or traditional loans. Once approved, you can receive funds in as little as 24 to 48 hours.

You Want to Outsource Collections

Factoring companies often handle collections for the invoices they purchase. If your business struggles with chasing payments or lacks a dedicated collections team, factoring can save time and reduce stress.

You Don’t Want to Take on Debt

Balances are cleared when your customer pays their invoice with factoring, so you don’t need to pay anything back. It doesn’t add debt to your balance sheet or credit report.

Your Industry Has Predictable Receivables

Industries with consistent invoicing and payment cycles are great candidates for factoring. If your business regularly generates receivables, factoring can provide a steady cash flow.

Situations Where Asset-Based Lending May Be Best

Asset-based lending (ABL) is a robust funding option for businesses with valuable assets and larger, ongoing capital needs. Here are the scenarios where ABL may be the strongest choice.

You Have High-Value Assets

ABL is ideal for businesses with significant physical or financial assets, such as inventory, equipment, or real estate. These assets are used as collateral to secure funding.

You Need Larger or Ongoing Credit Lines

ABL offers access to substantial capital. Depending on the value of your asset, this may be more than you can get through factoring. However, factoring advances scale with your business, meaning you have access to more cash as your invoices grow.

Your Business Is Established and Stable

ABL lenders look for businesses with consistent operations and financial history, in addition to strong assets. If your business is well-established and has a solid track record, you’ll likely qualify for ABL with favorable terms.

You’re Comfortable with Ongoing Monitoring

ABL lenders often perform regular audits and require detailed reporting on collateral, such as inventory counts or aging reports for receivables. If your business has the infrastructure to handle this, ABL can provide a reliable funding source.

Combining Factoring and Asset-Based Lending for Flexible Business Financing

Some businesses find that using factoring and asset-based lending (ABL) together provides a more flexible approach to managing working capital. Factoring offers fast access to cash by selling receivables, while ABL secures larger credit lines with assets such as inventory or equipment.

When structured strategically, these methods complement each other. Factoring can cover immediate needs like payroll or vendor payments, while ABL supports longer-term investments such as inventory purchases or facility expansion. This combined approach helps balance day-to-day cash flow with scalable capital for growth, without relying solely on slower, more rigid bank financing.

Because factoring approval is tied to customer creditworthiness and ABL depends on physical collateral, using both can support companies at different stages of growth. Factoring provides immediate liquidity, while ABL delivers scalable financing as assets accumulate. Together, they create a more adaptable funding model for evolving business needs

Get Debt-Free Funding with Factoring

Factoring is ideal for businesses that need fast, flexible funding without taking on debt or securing assets. It’s especially useful if slow-paying customers are holding back your cash flow or you’re looking for an easier way to manage accounts receivable. If these situations resonate with your business, factoring might just be the solution to keep your operations running smoothly. To explore the fit more, request a complimentary rate quote.

Factoring vs. Asset Lending FAQs

Which is better for small businesses: factoring or asset-based lending?

Factoring is often better for small businesses with slow-paying customers and no significant physical assets, as it provides quick cash without strict credit requirements. ABL suits businesses with high-value assets needing larger, ongoing funding but involves more complex approval and monitoring processes.

What types of assets can be used for asset-based lending?

Common assets include accounts receivable, inventory, equipment, and real estate. Lenders evaluate the value and liquidity of these assets to determine loan amounts. The more substantial and reliable your collateral, the more favorable the terms for asset-based lending.

Is factoring more expensive than asset-based lending?

Costs vary depending on your approach to borrowing and repayment. With asset-based lending, interest rates can sit anywhere from 5.25 percent to 30 percent. Conversely, factoring rates are typically one to five percent of an invoice’s value. This means that, if you are genuinely committed to a short repayment schedule with ABL, such as repaying the full balance in a month, ABL will likely come out cheaper. However, if your plan is to pay a loan back over a period of years, versus using factoring to accelerate cash flow or bridge a gap, you’ll still pay more for ABL.

Can startups use asset-based lending or factoring to get funding?

Startups often struggle to qualify for ABL due to limited assets and financial history. Factoring, however, is more accessible, as approval focuses on customer creditworthiness rather than your business’s credit or operational track record. It’s a common choice for newer businesses.

How does the approval process differ for factoring vs. asset-based lending?

Factoring approval is quicker and focuses on your customers’ payment reliability. ABL requires detailed asset evaluations, including appraisals and audits, which take more time. Factoring is ideal for faster funding, while ABL works better for businesses with high-value assets.

About Invoice Factoring Guide

Related Insights

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300