Around 40 percent of small businesses apply for funding each year, according to the Small Business Credit Survey. However, only around half are fully approved, and many don’t bother applying because they don’t expect to be approved or are debt-averse. Alternative financing options can help bridge this gap. On this page, we’ll be comparing factoring and microloans, two common options within this bracket. You’ll learn how each works independently and then get a detailed factoring vs. microloans comparison, making it easier to see which solution best aligns with your business needs.

Invoice Factoring

Invoice Factoring, also known simply as factoring, is a financial transaction where a business sells its accounts receivable (invoices) to a third party (a factoring company) at a discount. This allows the business to receive immediate cash flow instead of waiting for the invoice payment terms, which can often be 30, 60, or 90 days.

How Factoring Works

Factoring is straightforward and involves just a few steps.

- Invoice Issuance: A business provides goods or services to a customer and issues an invoice.

- Selling the Invoice: The business sells the invoice to a factoring company.

- Advance Payment: The factoring company advances a percentage of the invoice value (usually between 70% and 90%) to the business.

- Customer Payment: The customer pays the invoice amount directly to the factoring company.

- Remainder Payment: Once the customer pays the invoice in full, the factoring company releases the remaining amount to the business, minus a factoring fee.

Typical Factoring Terms

Factoring is unique in that the size of your invoice essentially sets your limits. This means the amount you can receive automatically scales with your business. Below, we’ll cover additional factoring terms that will help shape your agreement.

- Advance Rate: The percentage of the invoice value the factoring company advances to the business (typically 60 to 95 percent).

- Factoring Fee: The fee the factoring company charges is often a percentage of the invoice value (usually one to five percent).

- Recourse vs. Non-recourse: In recourse factoring, the business is responsible for any unpaid invoices. In non-recourse factoring, the factoring company assumes the risk of non-payment.

Getting Approved for Factoring

Approval for factoring essentially depends on the creditworthiness of the business’s customers rather than the business itself. Factors considered include:

- The credit history of the customers.

- The age and amount of the invoices.

- The industry in which the business operates.

Benefits of Invoice Factoring

There are many invoice factoring benefits to consider. A few that resonate with most business owners are highlighted below.

- Improved Cash Flow: Immediate access to cash helps maintain steady cash flow and meet operational expenses.

- No Debt Incurred: Unlike loans, factoring doesn’t add debt to the business’s balance sheet.

- Credit Protection: Factoring companies check the creditworthiness of your customers, which reduces the risk of late payments and non-payment. Non-recourse factoring offers additional protection against customer non-payment.

- Growth Facilitation: With immediate cash, businesses can take on new orders and grow without waiting for invoice payments.

- Outsourced Collections: Your factoring company collects balances for you, freeing you from chasing invoices.

Example of Factoring in Action

Picture a small manufacturing company in Michigan that produces custom parts for automotive companies. They issue invoices with 30-day payment terms. To manage their cash flow, they partner with a factoring company. Here’s how it works:

- The company delivers $100,000 worth of parts and issues an invoice.

- They sell this invoice to a factoring company, which advances 85 percent of the invoice value ($85,000).

- The factoring company collects the full $100,000 from the automotive company after 30 days.

- After deducting a two-percent factoring fee ($2,000), the factoring company pays the remaining $13,000 to the manufacturer.

This immediate access to $85,000 allows the manufacturer to purchase raw materials, pay employees, and take on new orders without waiting for the 30-day payment term.

Microloans

Microloans are small, short-term loans designed to meet the financial needs of small businesses and entrepreneurs who may not qualify for traditional bank loans. Typically, microloans range from a few hundred to a few tens of thousands of dollars. They are often provided by or through nonprofit organizations, community-based lenders, and government programs such as the U.S. Small Business Administration (SBA).

How Microloans Work

Microloans provide small amounts of capital to businesses that need financing for various purposes, including startup costs, working capital, inventory purchases, and equipment. These loans often come with more flexible terms and lower borrowing thresholds compared to traditional loans.

Typical Microloan Process

It can take anywhere from a couple of weeks to months to be funded through microloans. Although each microlender follows a unique process, the steps below are a typical journey.

- Application: The business owner submits an application to a microloan provider detailing the business plan, financial needs, and intended use of the funds.

- Review: The lender reviews the application, business plan, credit history, and other relevant factors.

- Approval: If approved, the lender provides the loan amount, typically accompanied by counseling or technical assistance.

- Disbursement: The loan funds are disbursed to the business.

- Repayment: The business repays the loan over a set period, usually with monthly payments.

Typical Microloan Terms

The terms you’re offered will vary based on the lender, program, and the strength of your business. To give you an idea, some general microloan terms are provided below.

- Loan Amount: Typically ranges from $500 to $50,000.

- Interest Rate: Generally higher than traditional loans but lower than alternative lenders; rates can range from eight to 13 percent, per the SBA.

- Repayment Term: Usually between six months and six years.

- Collateral: May be required, but the criteria are often more flexible than traditional bank loans.

Getting Approved for Microloans

Approval criteria for microloans can vary by lender but generally include:

- Credit History: Even though credit requirements may be more lenient, a decent credit history is often necessary. When a personal credit score is leveraged, you’ll generally need at least a 620, though some only lend to borrowers with a score of 640 or higher.

- Business Plan: A solid business plan outlining how the loan will be used and how the business will generate revenue.

- Personal Guarantee: Some lenders require a personal guarantee from the business owner.

- Collateral: While not always required, providing collateral can improve approval chances.

Benefits of Microloans

Even though it can be somewhat difficult to obtain a microloan, there are benefits to going this route. We’ll review a few below.

- Access to Capital: Microloans provide funding for businesses that might not qualify for traditional loans.

- Flexibility: Loan terms are often more flexible, catering to the unique needs of small businesses.

- Technical Assistance: Many microloan programs include business training and support services.

- Community Support: Microloans are often provided by organizations focused on community development and economic empowerment.

Example of a Microloan in Action

Picture a small janitorial company in Florida that needs $15,000 to purchase new cleaning equipment and expand its reach. Here’s how a microloan might work:

- Application: The business owner applies for a $15,000 microloan from a local nonprofit lender.

- Approval: After reviewing the business plan and financial statements, the lender approves the loan at a ten percent interest rate with a three-year repayment term.

- Disbursement: The janitorial company receives the loan amount and uses it to purchase new vacuums and floor polishing machines.

- Repayment: The janitorial company makes monthly payments over the next three years, gradually paying off the loan.

This microloan enables the janitorial company to increase production capacity, meet growing customer demand, and ultimately boost revenue, all while benefiting from the flexible terms and support provided by the lender.

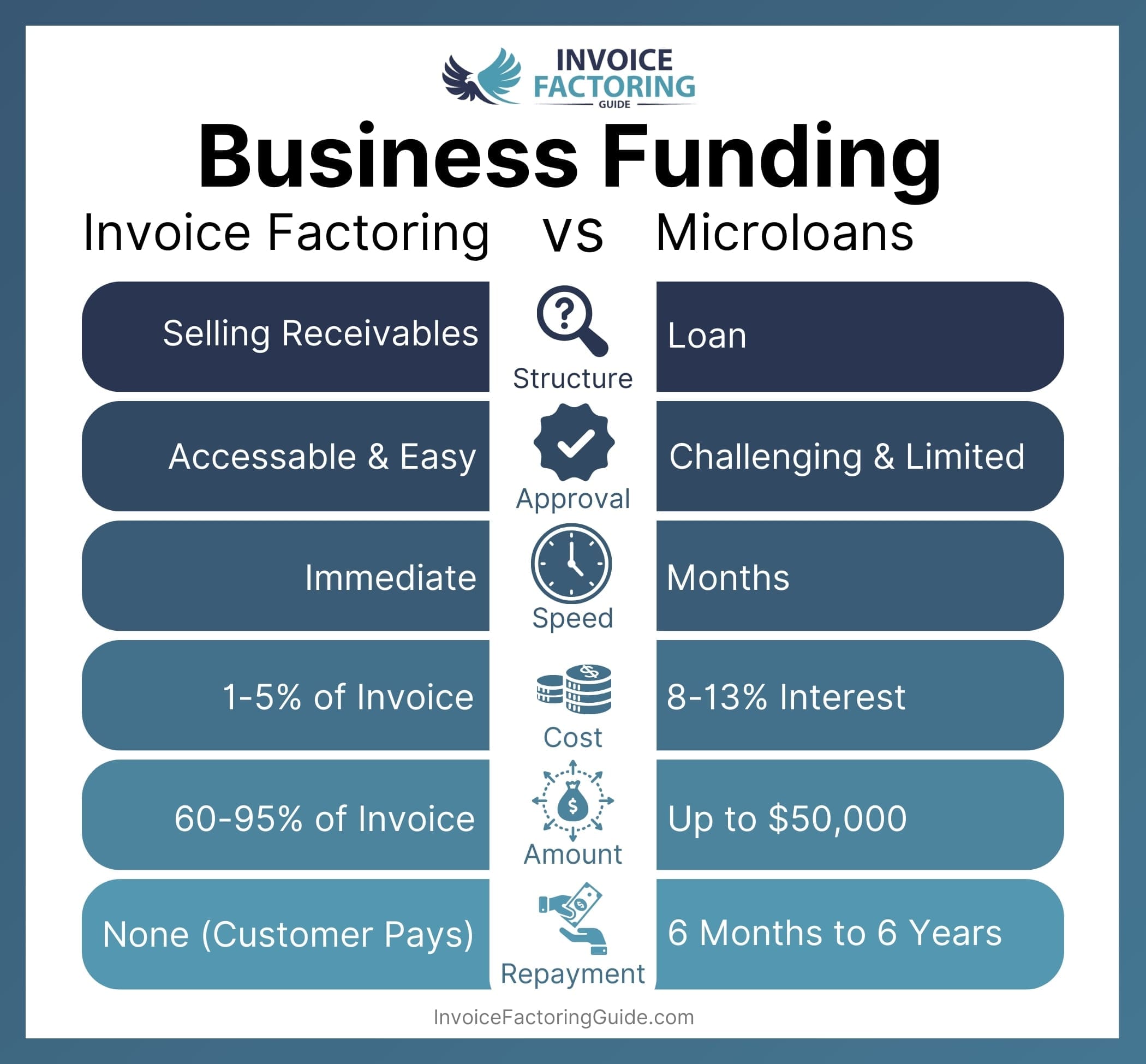

Factoring vs. Microloans: Key Differences

Now that we’ve explored how each funding solution works independently, let’s take a closer look at how they differ.

Funding Source and Structure

- Factoring: Involves selling accounts receivable to a factoring company. It’s not a loan, so it doesn’t add debt to the business’s balance sheet.

- Microloans: Are small loans provided by nonprofit organizations, community lenders, or government programs. These loans must be repaid with interest, adding debt to the business’s financial obligations.

Approval Criteria

- Factoring: Approval is largely based on the creditworthiness of the business’s customers, not the business itself. This makes it an attractive option for businesses with poor or limited credit history.

- Microloans: Approval depends on the business’s credit, and sometimes the business owner’s credit history, the strength of the business plan, and, often, the availability of collateral. Businesses with poor credit may find it challenging to secure a microloan.

Speed of Funding

- Factoring: Offers rapid access to cash, often within 24 to 48 hours after submitting invoices to the factoring company. Some offer same-day payouts. This is ideal for businesses needing immediate liquidity.

- Microloans: The application and approval process can take several weeks, making it less suitable for urgent cash flow needs.

Repayment and Financial Obligation

- Factoring: Since it’s not a loan, there are no repayment schedules or interest payments. The factoring company collects payment directly from the business’s customers.

- Microloans: Require regular repayment with interest, which can strain cash flow, especially for new or struggling businesses.

Use of Funds

- Factoring: Funds obtained through factoring are tied to specific invoices, meaning the business receives cash against work already completed. This is useful for ongoing operational expenses, though it’s up to the business how it wants to spend the cash.

- Microloans: Can be used for a broader range of purposes, such as purchasing equipment, inventory, or other business needs. However, the amount is typically smaller and may not cover extensive funding requirements.

Costs

- Factoring: The cost is typically in the form of a discount on the invoice value, ranging from one to five percent. While this can be higher than some microloan interest rates, the absence of debt and immediate cash availability can offset the cost.

- Microloans: Interest rates can range from eight to 13 percent, and there may be additional fees. Over time, interest payments can accumulate, potentially making the loan more expensive than anticipated.

Benefits of Factoring Over Microloans

While there’s certainly a time and place for microloans and other funding options for small businesses, factoring may be the better solution for your business if you require one or more of the following benefits.

- Immediate Cash Flow: Factoring provides quick access to cash, which is crucial for businesses facing immediate expenses or growth opportunities.

- No Added Debt: Factoring doesn’t add debt to the balance sheet, preserving the business’s credit capacity for other needs.

- Simpler Approval Process: With a focus on customer creditworthiness, factoring is accessible even to businesses with poor credit.

- Ongoing Support: Factoring companies often provide credit checks and collection services, reducing administrative burdens on the business.

Explore Factoring for Your Business

If you like the idea of an easy approval process, fast payouts, and debt-free working capital, invoice factoring is likely your best option. The next step is to speak with a factoring specialist who can review your information and let you know which programs are a good fit for you. Request a complimentary factoring quote to get started.

Invoice Factoring vs. Microloans FAQs

What is the difference between invoice factoring and microloans?

Invoice factoring involves selling invoices to a factoring company for immediate cash, while microloans are small, short-term loans. Factoring is based on your customer’s creditworthiness, whereas microloans depend on creditworthiness and a business plan.

How does invoice factoring work for small businesses?

Factoring provides immediate cash by selling your unpaid invoices to a factoring company. They advance a percentage (usually 60 to 95 percent) of the invoice value and collect the full payment from your customer, deducting a small fee.

What are the benefits of factoring over taking out a microloan?

Factoring offers quick access to cash without adding debt to your balance sheet, relies on customer credit rather than yours, and simplifies cash flow management. Microloans, while useful, involve debt and longer approval times.

How do I qualify for invoice factoring?

Qualification is based on the creditworthiness of your customers rather than your business. You’ll need to provide details of your invoices and customers for the factoring company to evaluate.

What are typical terms and fees associated with factoring?

Factoring terms include an advance rate of 60 to 95 percent of invoice value and fees ranging from one to five percent. The factoring company collects payment directly from your customers, deducts their fee, and pays you the remainder.

How quickly can I get funding through invoice factoring?

Factoring provides funds quickly, often within 24 to 48 hours after submitting your invoices. This is ideal for businesses needing immediate cash flow to manage operations or seize growth opportunities.

Can businesses with poor credit qualify for factoring?

Yes, because factoring is based on the creditworthiness of your customers, not your business. This makes it an accessible option for businesses with poor or limited credit histories.

What are microloans, and how can they help small businesses?

Microloans are small, short-term loans for small businesses, typically ranging from $500 to $50,000. They help cover startup costs, inventory, and equipment. However, factoring might be a better option for immediate cash flow needs.

What are the interest rates and repayment terms for microloans?

Microloan interest rates range from eight to 13 percent, with repayment terms typically between six months and six years. While useful, they add debt and have longer approval processes compared to factoring.

Which is better for immediate cash flow needs: factoring or microloans?

Factoring is better for immediate cash flow needs because it provides funds quickly based on your invoices. Microloans take longer to approve and involve debt repayment, which can strain cash flow.

What are the advantages of microloans for startups?

Microloans provide accessible funding for startups to cover initial costs. However, startups with immediate cash flow needs may find factoring a more efficient alternative, as it offers quick, debt-free financing.

What are the typical microloan eligibility and terms for small businesses?

Microloan eligibility depends on your credit history, business plan, and, sometimes, collateral. Terms usually include loan amounts from $500 to $50,000, interest rates of eight to 13 percent, and repayment periods of up to six years.

What should I consider when choosing between factoring and microloans?

Consider your immediate cash needs, credit history, and willingness to take on debt. Factoring provides quick cash without adding debt, based on customer credit, while microloans require good credit and involve longer approval times and repayment obligations.

About Invoice Factoring Guide

Related Articles

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300