Did you know little more than half of all small businesses have their funding needs completely met through traditional lending, according to the latest Small Business Credit Survey? Simply put, traditional lending comes with significant hurdles that many small businesses can’t overcome. The challenges are so great that many don’t even bother applying because they’re sure they’ll be denied or are understandably concerned about taking on more debt. Invoice factoring doesn’t have these same concerns and can help when traditional lending isn’t a fit. Below, we’ll compare factoring vs. traditional lending, so it’s easier to see how they fit into your overall business strategy.

How Invoice Factoring Works: A Quick Overview

Invoice factoring is a straightforward process that helps businesses convert unpaid invoices into immediate cash. Instead of waiting weeks or months for your clients to pay, you sell those invoices to a factoring company at a discount and get most of the cash upfront. Here’s a step-by-step overview.

- You Deliver the Goods or Services: Your business provides goods or services to your clients as usual and issues an invoice.

- You Sell the Invoice to a Factoring Company: Instead of waiting for the client to pay, you transfer the invoice to a factoring company. Think of it as unlocking cash tied up in receivables.

- Get Immediate Cash: The factoring company advances you a percentage of the invoice value to give you the working capital you need to keep operations running smoothly. This is usually 70 to 90 percent, though can sometimes be a little more or less.

- Client Pays the Factor: When your client eventually pays the invoice on the original terms, the factoring company deducts their fee and remits the remaining balance to you.

Why Businesses Choose Factoring

Factoring is especially appealing for companies that:

- Operate in Industries with Long Payment Cycles: Businesses like trucking, manufacturing, or staffing often face delayed payments, making factoring a practical solution.

- Need to Cover Immediate Expenses: Whether it’s payroll, inventory, or unexpected costs, factoring provides quick cash to keep operations running.

- Lack of Credit History or Collateral: Companies without a strong credit profile or substantial assets can still secure funding through factoring.

For example, a small trucking company can’t afford to wait 60 days for payment from a freight broker. By factoring, they can pay for fuel, maintenance, and driver wages without missing a beat.

Key Benefits of Factoring

- Fast Access to Cash: Unlike loans, which can take weeks or months to process, factoring can put cash in your hands in as little as 24 hours.

- No New Debt: Since factoring isn’t a loan, it doesn’t add to your liabilities or affect your credit score.

- Flexible Growth Support: As your invoices grow, so does your access to funding, which is perfect for scaling businesses.

How Traditional Lending Works: A Quick Overview

Traditional lending, like bank loans and lines of credit, involves borrowing money from a financial institution with the expectation of repaying it over time with interest. It’s a more familiar route for many business owners, but it comes with certain challenges. Here’s how it generally works.

- You Apply for a Loan or Credit Line: Businesses apply to a bank or lender, often including financial statements, credit scores, and collateral details.

- Lender Assesses Risk: The lender evaluates your creditworthiness, business performance, and the value of any collateral offered. This can take days to weeks.

- Approval and Loan Disbursement: Once approved, the lender provides funds, which must be repaid with interest over a set term or as a revolving credit line.

- Repayment with Interest: You make regular payments, which include the principal amount borrowed and interest until the debt is fully repaid.

Common Reasons Businesses Turn to Traditional Lending

- Funding for Long-Term Projects: Ideal for significant investments like purchasing property or equipment.

- Building Credit History: Helps establish a strong credit profile for future borrowing.

- Lower Interest Rates: Often offers lower rates compared to alternative financing options, depending on the borrower’s creditworthiness.

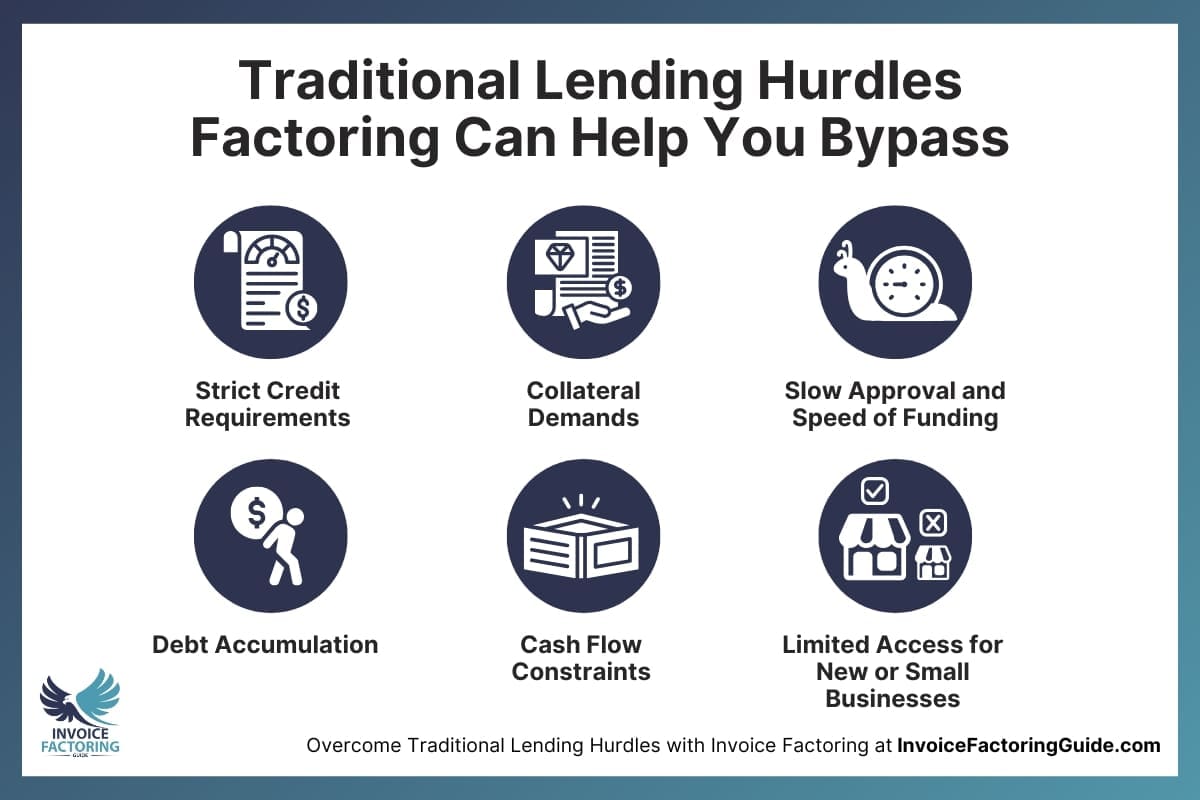

Common Hurdles in Traditional Lending Factoring Bypasses

You’ll find many differences when comparing factoring vs. traditional lending. However, what really sets factoring apart is that it allows you to bypass many of the hurdles associated with traditional lending. Let’s take a look.

Strict Credit Requirements

Traditional lenders often require a solid credit history and high credit scores. This can be a significant barrier for startups or businesses recovering from financial setbacks. Factoring doesn’t have the same credit requirements. Instead, factoring companies assess the creditworthiness of your customers, not your business. If your clients have a strong payment history, you can qualify for funding even with weak credit.

Collateral Demands

Banks typically demand collateral, such as property, equipment, or other valuable assets, as security for a loan. This limits access for businesses without substantial assets. Conversely, factoring uses your invoices as collateral. This means you don’t need to risk your property or other assets to secure funding.

Slow Approval Processes and Speed of Funding

Loan applications require extensive documentation, financial reviews, and approvals, often taking weeks or months. On the other hand, factoring is fast. Once the process is set up, you can receive funds in as little as 24 hours after submitting invoices. This speed is crucial for businesses needing immediate working capital.

Debt Accumulation

Loans add liabilities to your balance sheet, which can strain your financial position and deter future lenders or investors. On the flip side, factoring isn’t a loan. It provides cash without increasing your debt load, allowing your business to maintain a healthier financial outlook.

Cash Flow Constraints

Loan repayments are fixed, meaning you must meet payment deadlines regardless of cash flow fluctuations. This rigidity can be particularly challenging for seasonal businesses. On the other hand, factoring aligns with your receivables. As your invoices grow, so does your funding. There are no repayment schedules to worry about since the factor collects directly from your clients.

Limited Access for New or Small Businesses

Banks often hesitate to lend to businesses without a long financial track record, leaving new or small businesses struggling to secure loans. Conversely, factoring companies work with businesses of all sizes, making it a viable option for startups and smaller enterprises with a growing client base.

Overcome Traditional Lending Hurdles with Invoice Factoring

Whether your business doesn’t qualify for a bank loan, you need cash quicker than traditional lending options will pay out, or you simply want to avoid debt, factoring can accelerate your cash flow and bridge funding gaps. To be matched with a vetted factoring company that can expedite the process, request a complimentary factoring estimate.

Factoring vs. Traditional Lending FAQs

Is invoice factoring better than traditional lending?

Factoring is ideal for businesses needing quick cash without adding debt or undergoing lengthy approval processes. Traditional lending options like loans, however, are better for long-term projects or significant investments. The choice depends on your needs, creditworthiness, and how quickly you need funding.

Why might a business choose factoring over traditional lending options like loans?

Factoring is faster, doesn’t require good credit, and avoids adding debt to your balance sheet. It’s perfect for covering immediate cash flow gaps, especially in industries with long payment cycles, like trucking or manufacturing.

Does factoring require a good credit score like traditional lending does?

No, factoring focuses on your customers’ credit, not yours. This makes it accessible to businesses with poor credit or limited financial history, as long as your clients have a strong payment track record.

What industries benefit most from factoring instead of loans?

Industries with long payment terms, like trucking, staffing, manufacturing, and construction, benefit the most. Factoring helps bridge cash flow gaps while waiting for client payments, ensuring smooth operations.

What are the risks of factoring compared to traditional loans?

The main risk is the cost. Factoring fees can be higher than loan interest rates. Additionally, if your clients don’t pay their invoices, you may still be responsible, depending on the factoring agreement.

How quickly can I get cash with factoring versus traditional lending?

Factoring can provide cash in as little as 24 hours after approval, while traditional lending options often take weeks or months due to lengthy approval processes and credit checks.

About Invoice Factoring Guide

Related Articles

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300