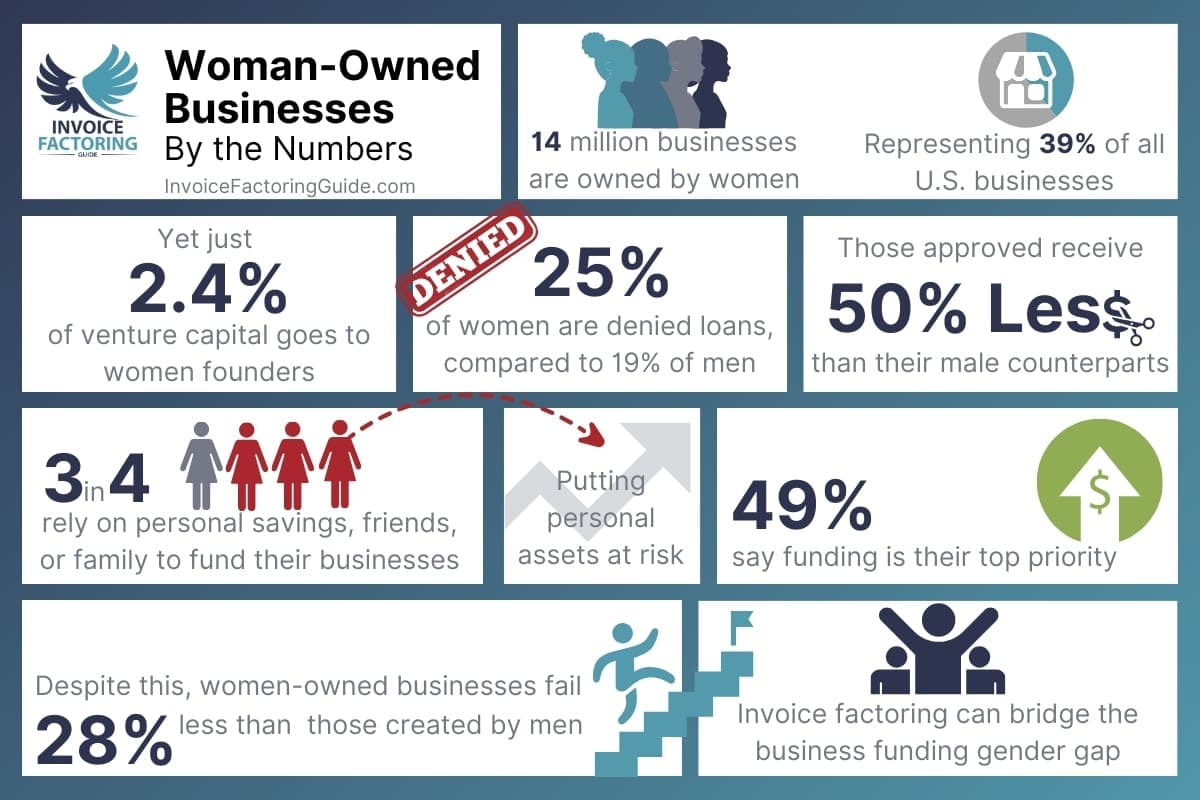

More than 14 million businesses across America are owned by women, WIPP Education Institute research shows. Despite representing 39 percent of all U.S. businesses, women-led firms often struggle to secure the same level of funding as their male counterparts. This significant gap not only points to ongoing equality issues in finance and business but also brings to light the importance of alternative funding solutions. Invoice factoring emerges as a key option, providing a straightforward way to access needed funds and enabling women-led businesses to thrive in today’s competitive marketplace.

Women-Owned and Led Businesses Face a Funding Disparity

It’s easy to forget how recently, in our nation’s history, women have gained equal financial rights. For instance, it wasn’t until The Women’s Business Ownership Act of 1988 that women gained the ability to obtain a business loan without a male co-signer, as Finance Commerce reports. This ruling came little more than a decade after women gained the right to have credit cards in their names. While these are clear steps in the right direction, funding rates and amounts still show major disparities.

Challenges in Securing Funding

Women entrepreneurs frequently encounter hurdles when trying to secure funding. Nearly half of all American women entrepreneurs experience a gender bias when trying to raise capital, according to a U.S. Senate report. A quarter of women are outright denied business loans, compared to 19 percent of men. If approved, the average loan size is about 50 percent lower for women, too, per Ecommerce Tips. Those seeking venture capital don’t fare much better, with just 2.4 percent of funds going to female entrepreneurs.

Women of Color Face Additional Barriers

It’s even more difficult for women of color to secure capital when starting or growing a business. For instance, Black business owners are three times more likely to be denied a business loan than White business owners, per Goldman Sachs. Furthermore, just 0.0006 percent of venture capital goes to Black women founders, the Kauffman Foundation reports. Their research further notes that it costs entrepreneurs of color $250,000 more to start businesses than their White male peers. This “double penalty” is systemic, arising from higher interest rates and reduced access to team-based accelerators, which might otherwise pave the way for funding and free or subsidized professional services.

Impact of the Funding Gap

This funding gap means that 74 percent of women rely on personal savings, friends, or family to fund their businesses, potentially putting personal assets at risk and limiting growth. For comparison, just 64 percent of male-owned businesses are in the same situation.

Additionally, four in five small business closures are tied to cash flow issues, per NFIB. Because of this, limited access to capital creates problems that run much deeper than limited growth potential. It puts these businesses at risk of closure.

Seeking Solutions

The search for alternative funding solutions is critical, with 49 percent of women entrepreneurs stating that obtaining more funding and financial help is their top priority, per Ecommerce Tips.

Close the Gender Funding Gap with Factoring

Invoice factoring is a unique form of funding that allows you to sell your unpaid B2B invoices to a factor at a discount. The factor advances up to 95 percent of the invoice’s value immediately and sends the remaining sum minus a small factoring fee after your client pays. Because it works differently than traditional funding solutions, it helps close the gender funding gap in several ways.

Easy Qualification

Unlike traditional loans, factoring decisions are based on the creditworthiness of your clients, not your business or personal credit. This makes it significantly easier for women entrepreneurs, who often face higher denial rates for loans, to qualify.

No Debt

Women, especially women of color, are often hit with much higher interest rates that increase their overall costs. With factoring, there’s no debt or interest to pay back. The balance is cleared when your client pays their invoice.

Scalable Advances

Factoring advances scale with your business. The more your sales grow, the more working capital you can access. This directly counters the challenge of receiving smaller loan amounts, enabling businesses to secure funding proportional to their invoices.

Immediate Cash Flow

Quick access to funds improves liquidity, allowing for timely investment in growth opportunities and operational needs, a crucial advantage for businesses navigating the disparities in funding access.

Streamline Your Factoring Journey

Successfully navigating the factoring process can significantly impact your business’s cash flow and growth. Here’s how to effectively manage the journey.

Understand Your Needs

- Evaluate Cash Flow: Determine how much funding you need and which invoices would be best to factor.

- Identify Financial Goals: Consider how invoice factoring fits into your broader financial strategy.

Prepare Your Application

- Gather Necessary Documents: Have your business financial statements and invoices you wish to factor ready.

- Understand the Process: Familiarize yourself with the application process to ensure a smooth submission.

Find the Right Factoring Company

- Experience and Expertise: Look for a factoring company with extensive experience and a deep understanding of your industry. This ensures they grasp the unique challenges and opportunities your business faces and may be able to offer tailored solutions that will help your business grow.

- Reputation: Research the factoring company’s reputation within the industry. Seek feedback from current and past clients to gauge their satisfaction levels and the company’s ability to deliver on its promises.

Maximize Factoring Benefits

- Reinvest in Growth: Use the funds obtained through factoring to invest in business opportunities or cover essential operating expenses.

- Build a Relationship: Establish a strong relationship with your factoring company, as this can lead to better rates and terms in the future.

- Strengthen Your Credit: While factoring doesn’t directly impact your credit score, it can make it easier to pay vendors early and help you manage debt more effectively. This can help you boost your overall credit score, so you’re more likely to qualify for loans and lower interest rates in the future.

Eliminate Your Funding Gap with Factoring

A lack of adequate funding doesn’t have to be a barrier to growth for your business. Most businesses with B2B invoices qualify for factoring, and funding is fast. To learn more or get started, request a complimentary rate quote.

About Invoice Factoring Guide

Related Articles

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300