You may be aware that invoice factoring can provide upfront cash when you’re in a pinch, but that’s only the tip of the iceberg when it comes to the benefits of small business factoring. When you leverage it effectively, factoring can also help you strengthen your company and grow faster. Give us a few moments to walk you through the basics.

How Invoice Factoring for Small Businesses Works

Invoice factoring is a process in which you sell your outstanding invoices to a third party known as a factoring company. The factoring company provides you with a cash advance for most of the value of the invoice, waits for your client to pay, then remits the remaining portion to you minus a nominal factoring fee.

The concept is similar to invoice financing. However, when you work with an invoice financing company, you get a loan that uses your unpaid invoices as collateral. Factoring is distinct from business loans because you don’t have to pay the balance back. Your client clears the balance by remitting payment for the invoice to the factoring company.

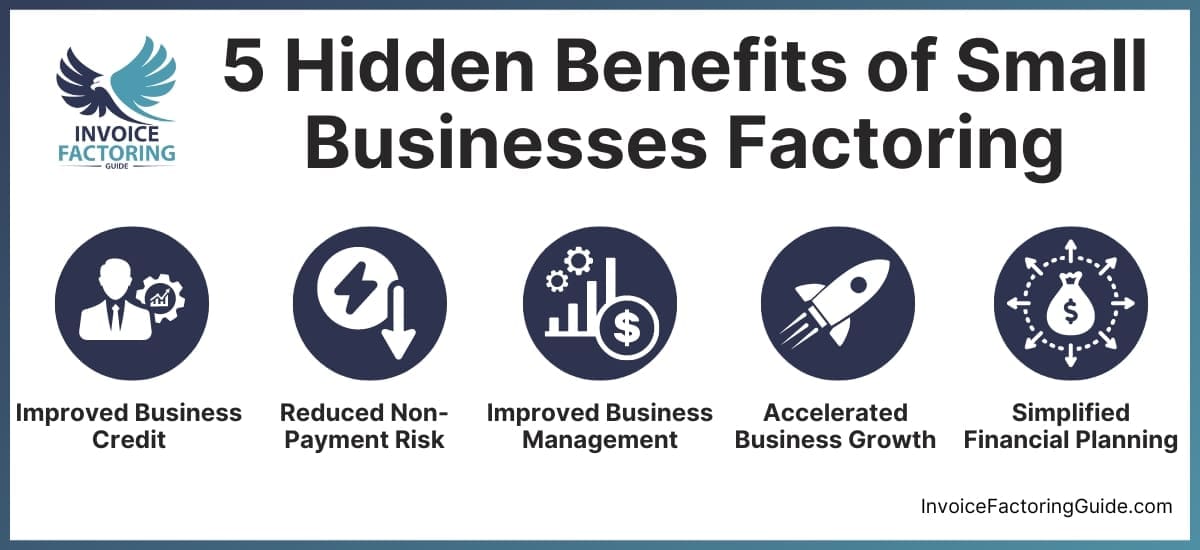

5 Hidden Benefits of Small Businesses Factoring

You can probably already imagine many instances in which leveraging invoice factoring services might be beneficial. Yet, most of these likely surround access to cash. Let’s take a deeper look at some of the other things that can happen when you factor.

1. Your Business Credit Score Can Improve

Whereas personal credit scores range from 300 to 850, business scores range from 0 to 100. A score of 0 to 10 is considered “high risk,” and 11 to 25 is medium to high risk, according to Experian. About eight percent of firms are regarded as high risk, which is the industry term for having bad credit. Less than a quarter of small businesses in this category that apply for traditional loans are fully funded.

If you have a credit score of 50-79, you’re considered “medium risk.” Roughly 28 percent of businesses fit into this category. The odds of receiving a bank loan that matches your request climb up a bit to 39 percent, but the odds still aren’t great.

If your credit rating hits at least 80, you’re considered a “low-risk” borrower. In all, 65 percent of businesses can claim this title, which increases the odds of being fully funded to 62 percent.

Clearly, getting a credit score of at least 80 is essential for loans. It also impacts trade credit, insurance coverage, and other aspects of running your business.

Factors Involved in Your Credit Score

- Number of trade experiences (reported instances of working with vendors/ suppliers)

- Outstanding balances

- Payment habits

- Credit utilization (under 30 percent utilization is expected)

- Trends in your behavior over time

- Public records, such as bankruptcies, judgments, and liens

- Business demographics (years on file, business size, etc.)

Invoice Factoring Boosts Your Business Credit Score

Factoring provides upfront cash, so it’s easier to pay any outstanding balances and keep up with payments. It’s also debt-free, which keeps your credit utilization low. These things impact your trends and the likelihood of having a public record. That means factoring can influence almost every aspect of your credit rating.

2. The Risk of Non-Payment Reduces

Five percent of accounts receivable become uncollectable on average, according to FreshBooks. That can quickly add up to tens or hundreds of thousands in lost revenue for a typical small business.

Invoice Factoring Reduces the Risk of Non-Payment

There are two main types of invoice factoring: recourse and non-recourse. The type determines what happens if a client does not pay their invoice. With non-recourse factoring, the factoring company bears the risk. Your business keeps the cash advance if your client does not pay their invoice. Factoring fees tend to be a bit higher because of this. With recourse factoring, your business assumes the risk and must pay back the cash advance if your client does not pay their invoice.

With that in mind, non-recourse factoring eliminates the risk of non-payment entirely, but even recourse factoring has its benefits. For instance, most factoring companies run credit checks on your clients for you and will advise you on their creditworthiness. That way, you can make informed decisions that minimize your risk.

3. The Management of Your Business Improves

Around a quarter of small-business owners clock 60 or more hours per week, according to Inc. The time investment is understandable, considering all the jobs a typical business owner does. For instance, an average owner spends nearly five hours each pay period calculating, filing, and remitting taxes, according to Bloomberg. Around a quarter lose more than ten hours per month dealing with regulatory compliance issues, per Kansas City Journal. Invoice management eats away another 12 hours per month, Smart Company research shows. Logging this kind of time at work comes with consequences. It’s hard on your health and relationships. It can even be bad for your business.

Invoice Factoring Makes it Easier to Manage Your Business

Many invoice factoring companies offer invoice preparation and collections services, which frees you up to focus on the core areas of your business and managing daily activities. Depending on your industry, you may also qualify for value-added services that make managing your business easier. For instance, trucking companies can receive fuel discount cards, roadside assistance, and access to load boards through their factoring company.

4. Your Business Growth May Accelerate

There are lots of ways to grow your business. You can accept more orders or accept larger orders, develop new products or services, reach new markets, and more. However, all these things require quick access to cash. Even if your business is growing purely based on word-of-mouth marketing, there will likely be a period of time in which your ramped-up expenses outpace revenue.

Most businesses apply for a bank loan, line of credit, or merchant cash advance to cope with these issues. However, only about half receive the level of funding they need, according to the latest Small Business Credit Survey. One in five doesn’t receive any funding at all.

This only speaks to access to funding. Speed is also a significant issue, as a bank loan can take weeks or months to clear. That gives competitors that can access cash quickly a huge advantage. Cost is another consideration. While traditional loans may be the more affordable way to go, merchant cash advances can have an APR of 200 percent.

Invoice Factoring Accelerates Business Growth

Having fast and reliable financing options at your fingertips in these situations makes all the difference in the world. Invoice factoring has an easy approval process. You can get set up with an invoice factoring company whenever you like and not tap into the funding until you need it to keep your costs low too. Some can even provide funding the day you submit your invoice, while others pay out in about two business days. Any way you look at it, the timeline is much shorter than it would be with bank loans and can help ensure you can tap into funding to grow your business whenever needed.

5. Your Financial Planning Ability May Improve

Four in five business closures are tied to cash flow issues or poor cash management, Forbes reports. Between slow-paying clients, seasonality, growth challenges, and all the other things thrown at small businesses, it’s tough to adapt on the fly.

Invoice Factoring Improves Financial Planning

Getting paid right after completing work or delivering goods eliminates guesswork and makes cash flow predictable. Factoring can also help with emergencies, so you’re better prepared to cope with the unexpected.

How Invoice Factoring Enables Strategic Business Investments

While the immediate cash flow improvement from invoice factoring is well-known, its impact on facilitating strategic business investments is often underappreciated. For small business owners, every decision to spend money is significant. With the flexible and quick financing that invoice factoring offers, businesses are not just bridging cash flow gaps; they are also gaining the ability to make timely investments in technology, staff training, and market expansion efforts that are crucial for staying competitive. This financing option allows business owners to capitalize on opportunities at the right moment, rather than waiting for traditional loan approvals or cash flow normalization. By providing funds without the usual delays or collateral requirements associated with other financing methods, factoring companies empower small businesses to invest in their futures, ensuring long-term growth and sustainability. This proactive approach to business finance helps SMEs not only maintain but also expand their market presence by enabling strategic decisions that align with current market demands and future growth objectives.

Why Invoice Factoring Surpasses Traditional Bank Loans for Small Business Financing

For many small business owners, navigating the complexities of financing can be daunting, particularly when it comes to choosing between invoice factoring and traditional bank loans. While both options provide vital cash flow solutions, invoice factoring often emerges as the superior choice due to its streamlined loan approval process and immediate financial relief. Unlike bank loans, which can involve lengthy processing times and stringent credit requirements, factoring companies typically offer a quicker and more accessible financing option. This is especially beneficial for businesses that may not qualify for bank loans due to less-than-perfect credit or those in need of swift funding to seize growth opportunities. Additionally, invoice factoring aligns perfectly with the business needs of small business owners, providing them with the flexibility to manage cash flow without incurring debt. By selling their invoices to a factoring company, businesses receive an advance on up to 90 percent of the invoice amount, allowing them to reinvest in their operations and grow while the factoring company handles the collections. This not only simplifies the financial management of a business but also enhances their ability to plan financially and respond to market demands promptly.

Experience the Benefits of Small Business Factoring for Yourself

Whether you need a quick cash injection to cover everyday expenses, want to boost your business credit score, or have goals that align with any of the benefits outlined here, invoice factoring can help. Check out our invoice factoring guide for additional details, or request an invoice factoring quote to get started.

About Invoice Factoring Guide

Related Articles

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300