One of the biggest questions newcomers to invoice factoring have is how creditworthiness shapes their terms. The short version is that your business’s credit score and your personal credit score generally don’t impact factoring deals. However, the creditworthiness of your clients does. On this page, we’ll break down the mechanics of it a bit more so it’s easier to see how factoring fits into your financial strategy.

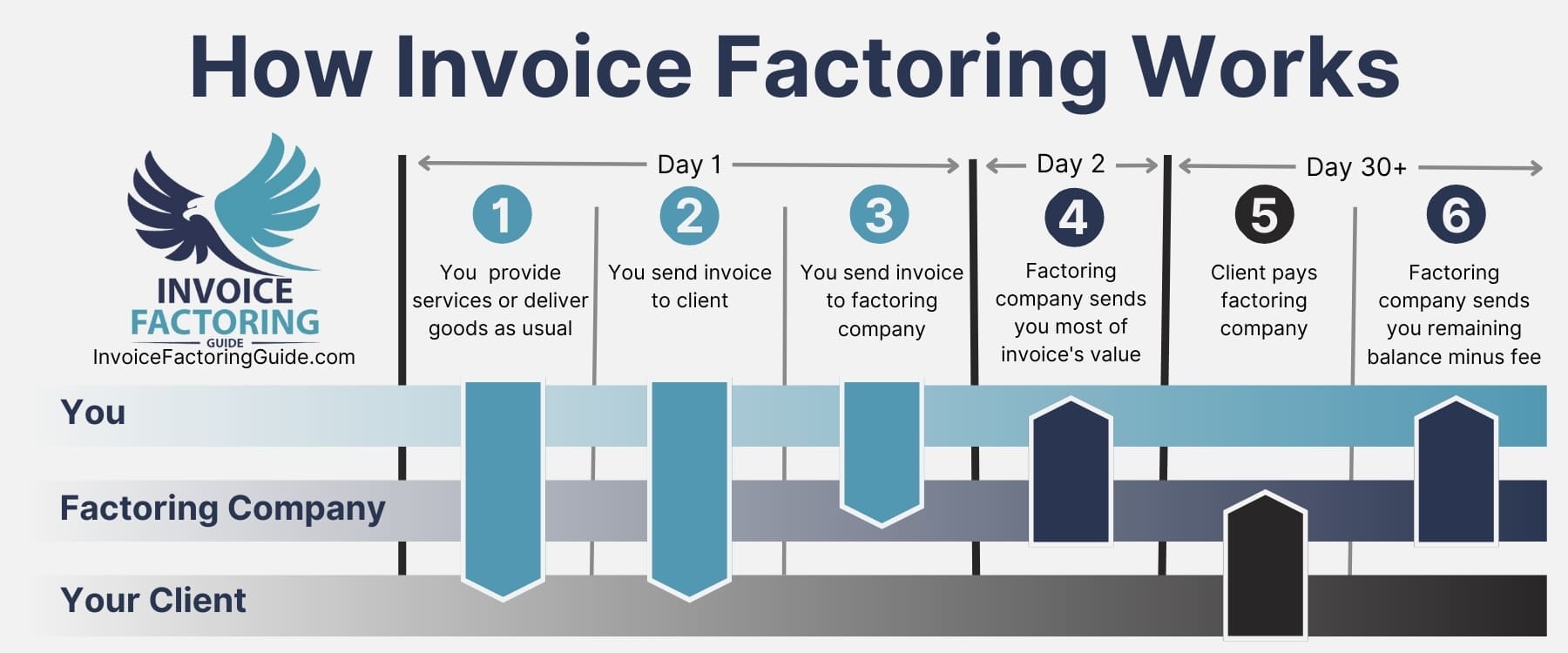

How Invoice Factoring Works

Little more than half of all small businesses that apply for bank loans have their funding needs fully met through them, according to the latest Small Business Credit Survey. One in four receives only partial funding, while one in five is outright denied. Invoice factoring fills a crucial gap for businesses in this situation and those that are debt averse or simply want cash quicker than a bank can provide.

The Factoring Process

With factoring, you sell your unpaid B2B or B2G invoices to a factoring company, also referred to as a factor, at a discount. The factor provides you with most of an invoice’s value immediately, then sends the remaining sum minus a small factoring fee when your client pays.

How Approval for Invoice Factoring is Determined

Every factor has its own criteria, but generally speaking, it’s easy to qualify for factoring. Most businesses with B2B or B2G invoices can get approved. A few things that factors look for include:

- Current B2B or B2G Invoices: Factoring companies typically only accept invoices that are less than 90 days old and will be paid by another business or a government agency.

- Creditworthy Clients: Your clients are the ones paying the invoices, so their credit is a consideration.

- No Liens on Receivables: Nobody else can have a legal claim to the invoices a factor is purchasing.

- No Open Bankruptcy: If you’re actively filing for bankruptcy, your receivables cannot typically be sold because your creditors have a claim to them. However, if the creditors are agreeable, factoring can sometimes be used in place of DIP financing.

How Invoice Factoring Fees Are Determined

You don’t pay interest with factoring. Instead, you’re charged a factoring fee, which is usually between one and five percent of an invoice’s value. Your industry plays a role in this because payment terms and risk tend to be industry-specific. Invoice volume is another primary consideration.

How Advance Rates Are Determined

The total percentage of an invoice’s value that you can receive upfront is largely contingent on risk and how long it takes your clients to pay.

How Your Client’s Creditworthiness Shapes Factoring Deals

Your clients are the ones paying the invoices, so their creditworthiness plays a role in your factoring deal.

What Factors Look for in an Invoice Payer

Your factoring company will run credit checks on your clients before accepting invoices for factoring to look for signs that they’ll pay the invoice in full and on time.

- Credit Score: Your client’s credit score provides insights into stability and how risky it is to extend trade credit.

- Payment History: Because a client with a history of making payments on time is likely to continue this behavior, their payment history is considered.

- No Bankruptcies or Judgements: Legal issues like bankruptcies and judgments can signify that the business is in financial trouble and may not be able to make payments.

How Client Creditworthiness is Used in Factoring Decisions

Using information from your client’s credit report, the factoring company will determine:

- Acceptance: If your client’s creditworthiness is strong enough, their invoices can be factored.

- Limits: Your factoring company will let you know how much trade credit you can extend to each client without exposing your business to unnecessary risk.

- Rates: If your clients are in a higher risk category for delinquency or non-payment, you may pay more to factor their invoices.

It’s worth noting that you can still work for clients that are not creditworthy. However, you will not be able to factor their invoices.

How Your Creditworthiness Shapes Factoring Deals

Some factoring companies don’t check your credit at all because you aren’t the one paying the invoices. This is why businesses that haven’t established credit yet or don’t have good credit can qualify for factoring but don’t qualify for bank loans.

How the Creditworthiness of Your Business Shapes Factoring Deals

Some factoring companies may check your business credit and take it into consideration when determining your factoring rate. Businesses with poor credit are typically seen as being more risky. Because of this, they may pay slightly higher rates, receive lower advances, have lower overall limits, or have other modifications to their contracts to help reduce risk for the factoring company.

As mentioned earlier, other financial issues may also impact your ability to factor invoices. For instance, if an entity has a legal claim to your invoices due to a judgment, lien, or bankruptcy, you cannot factor them.

How Your Personal Creditworthiness Shapes Factoring Deals

It’s important to note that business credit and personal credit are distinct. The lines sometimes become a bit blurrier when sole proprietors apply for credit because they and their businesses are one and the same. The business owner is not shielded from liability as they would be if they were running an LLC or corporation. Furthermore, sometimes banks are willing to accept personal assets as collateral on loans. For instance, a business owner may pledge their home as collateral on a loan.

Factoring is different because it’s focused on the invoices. Moreover, factoring companies do not usually work with sole proprietorships. Because of this, it’s incredibly rare for a factoring company to be concerned with your personal credit. Although there may be exceptions to this, your personal creditworthiness is unlikely to have any bearing on your factoring deal.

Request a Complimentary Factoring Quote

If you have concerns about whether your business qualifies for factoring or if your creditworthiness will impact your factoring deal, it’s best to get information directly from the factoring company you wish to partner with. At Invoice Factoring Guide, we’re happy to match you with a factoring company that understands your unique needs and offers competitive rates. To learn more or get started, request a complimentary factoring quote.

About Invoice Factoring Guide

Related Articles

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300