One of the most common questions we hear is, “How much does factoring cost?” To speak in general terms, a typical factoring fee, also known as a discount rate, ranges from one to five percent. It’s a fairly wide range because there isn’t a universal answer that applies to every business and every situation.

The best way to determine your cost of factoring is to request a free rate quote. However, if you’d like to ballpark your estimated cost to factor before speaking with any factoring companies, this page will provide the information you need to do it.

How Much Does Factoring Cost?

Invoice factoring accelerates payment on your B2B receivables. Instead of waiting weeks or months for your client to pay, you sell your unpaid invoice to a factoring company, also called a factor, at a discount. The factor sends you most of the invoice’s value right away, then sends you the remaining portion minus a small factoring fee when your client pays.

While this process is relatively standard, how that fee is calculated, and other fees you might pay along the way, will differ.

Base Factoring Fee

When most people ask, “How much does factoring cost?” they want to know the base fee. This is referred to as a factoring fee or a discount rate. It’s the amount the factoring company retains when it sends you the remaining value of an invoice after your client pays. Again, a typical base rate for factoring is between one and five percent of the invoice’s total value.

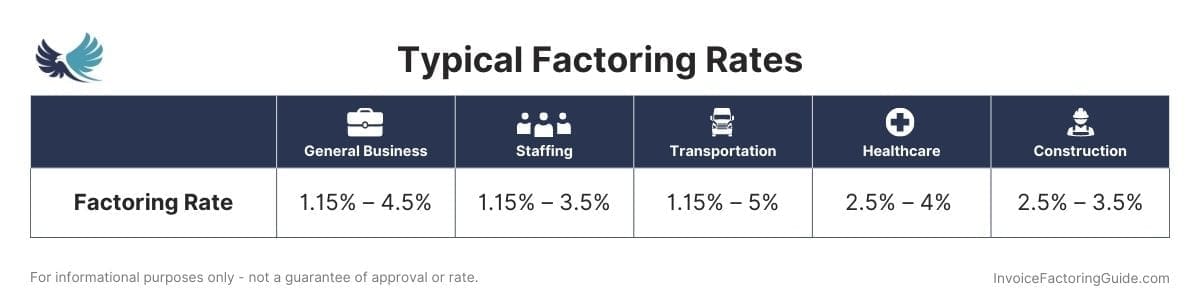

Typical Factoring Fee by Industry

One of the most significant considerations in your factoring rate is your industry. For instance, the typical factoring rate in the trucking industry is between 1.15 percent and 5.0 percent, while the healthcare industry lands between 2.5 and 4.0 percent.

Comparing Factoring Rates and Structures

Choosing the right invoice factoring company involves more than just looking at the base rate. The diversity in factoring rate structures, and the presence of potential additional fees like receivable factoring or non-recourse factoring charges, make it essential to thoroughly compare different providers. Average factoring rates can vary significantly based on industry norms and individual company policies. Furthermore, the method used by factoring companies to calculate these rates—whether it’s based on the total invoice value, the days an invoice remains unpaid, or as a percentage of the invoice—can greatly impact the overall cost. Businesses should also consider the length of the factoring agreement and any associated monthly minimum fees. By taking the time to understand and compare the various rates and fees, businesses can secure the best invoice factoring rates and services tailored to their specific financial needs.

Variables That Impact Factoring Rates

Variations in contract terms also influence your factoring rate.

Customer Credit

One of the many things that distinguishes invoice factoring from other funding solutions is that your client’s credit rather than yours is a major consideration during the approval process. If you’re extending trade credit to companies with an excellent business credit score, you’ll pay less than you would to factor invoices for a company with a fair rating.

Volume

How much you factor every month may also impact your factoring rate. Generally speaking, the more you factor, the lower your rate will be. However, there are some caveats to this. For instance, if you factor a single invoice valued at $25,000, it’s not always treated the same as five invoices worth $5,000 each, even though the total value is the same. For instance, processing five invoices is usually more work for a factoring company, so you may pay a little more in this case. However, if the single client with the large invoice doesn’t have the same creditworthiness as the smaller ones, you’ll likely pay more for the single invoice due to the increased risk.

Advance Rate

When a factoring company sends you your first lump of cash after purchasing an invoice, this is known as an “advance rate.” Advance rates typically vary from around 60 percent to 96 percent. Like your factoring rate, most of this hinges on your industry. For example, advance rates in the healthcare industry usually range from 60 to 80 percent, while the trucking industry often sees advance rates of 90 to 96 percent. However, some factoring companies will advance a little more if you’re willing to pay a slightly higher rate.

Recourse vs. Non-Recourse

Another area where risk comes into play is who assumes responsibility if your client doesn’t pay their invoice. Factoring companies run credit checks on your clients before factoring an invoice. They’ll usually provide you with information about their creditworthiness, such as how much total credit can be extended to a client without accepting unnecessary risk. This process keeps the risk of non-payment reasonably low, but there’s still always some degree of risk. Whether you or the factoring company assumes the risk is determined by whether you’ve chosen recourse or non-recourse factoring.

- Recourse Factoring: If you leverage recourse factoring, your business must pay the factoring company back when a client doesn’t pay their invoice.

- Non-Recourse Factoring: If you leverage non-recourse factoring, the factoring company absorbs the loss if your client doesn’t pay their invoice.

Most businesses opt for recourse factoring because it’s less expensive, and the risk of non-payment is minimized through credit checks. However, if you work with a company that offers non-recourse factoring and you choose to leverage it, you’ll want to budget for the additional cost.

Fee Structure

Even though the base rate for factoring is a percentage fee, when and how the percentage is added to your balance may vary based on your contract and factoring company. Variable and flat rates are two common ways to calculate factor fees.

- Flat Rate: With a flat rate, it’s easy to calculate your total costs before you factor an invoice. For instance, if your flat rate is two percent and your invoice is $10,000, then your factoring fee is $200.

- Variable Rate: With a variable rate, the percent changes. Often, the variation comes in with the length of time the invoice has been outstanding. For instance, you might have a two percent factor rate for the first 30 days, then add one-half of a percent every two weeks after that.

Days Outstanding

When we look at fee structures, it’s easy to see how slow-paying clients could potentially increase your total cost to factor. However, the average age of invoices can influence your costs regardless. You may want to reevaluate the payment terms you offer your clients to keep your costs low but be mindful of how this impacts service and your ability to secure new clients.

Understanding the True Cost of Invoice Factoring

When exploring the cost of factoring invoices, it’s important to consider not only the base factoring fee but also any hidden fees that might apply. The typical factoring fee, or the invoice factoring rate, is just the starting point in determining the true cost of utilizing a factoring company’s services. While the basic fee often ranges between one to five percent of the invoice value, various other factors, like the invoice amount, the advance rate, and the length of time an invoice remains outstanding can influence the final cost. Factoring companies often have different fee structures, including additional charges for services like invoice processing, making it crucial to understand the complete financial picture. By carefully examining the terms of the factoring agreement, businesses can better understand the cost of invoice factoring, ensuring they make an informed decision when selecting a factoring service provider.

Additional Fees

There may be hidden costs or fees you aren’t aware of until you review your contract. Not every factoring company charges for these things, so they’re simply something to be on the lookout for and keep in mind as you ballpark your costs.

Application Fee

When you first sign up with a factoring company, an application fee may be charged. This gets the ball rolling.

Setup Fee

Sometimes a setup fee is assessed after you’re approved for factoring. This covers the cost of any legal paperwork and setting up your factoring account.

Credit Check Fees

Because factoring companies check the creditworthiness of your clients before factoring any invoices, a fee may be assessed for the service.

Processing Fees

Some factoring companies charge a processing fee for each invoice that is factored.

Payment-Related Fees

There may be charges each time the factoring company sends you a payment or the fee may vary depending on how you receive payment. For instance, you might pay nothing or a minimal fee to receive payment via check, then have a slightly higher wire fee if you want your payment sent via ACH, which usually gets the cash into your account in about two business days. Factoring companies that offer same-day payment will usually charge a higher fee for this service as well.

Monthly or Volume Fees

You may be required to pay a monthly fee or pay a fee only in months that you don’t meet minimum volume requirements, if applicable.

Termination Fees

Fees for ending your contract may apply too. Some factoring companies charge them all the time, while others only charge a termination fee if you leave before your contract term ends.

Other Fees

As you explore factoring companies, you’re likely to find companies that don’t charge any of these fees as well as those that charge all of them and perhaps even more. Keep them in mind as you evaluate contracts.

Find Out Your Factoring Cost with a Free Rate Quote

With so many contributing factors in your overall cost to leverage invoice factoring, it can be difficult even to ballpark your fees. Take the guesswork out of it and find out for sure. Request a complimentary factoring rate quote.

About Invoice Factoring Guide

Related Articles

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300