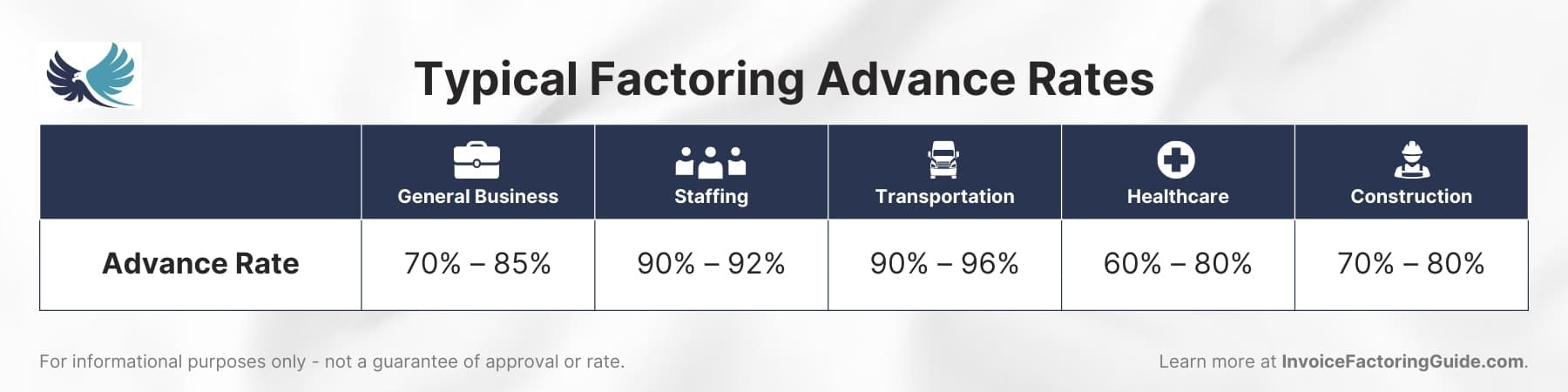

Did you know factoring advance rates vary by around 20 percent depending on your industry? That means when a factoring company promotes a 90 percent advance rate, only certain businesses, such as trucking firms, are likely to qualify. But, that doesn’t necessarily mean they should take the full 90 percent advance or that other businesses genuinely require such high advances. Below, we’ll explore the importance of advance rates in factoring, how to find your optimal rate, and what to do if what you’re offered doesn’t align with your needs.

Advance Rate: Definition and Background

The advance rate is the percentage of an invoice’s value that a factoring company pays you upfront when you sell them an invoice. Think of it as an immediate cash infusion for your business. Advance rates typically range from around 60 to 95 percent, though it’s more common to see them from around 70 to 90 percent.

For instance, if a trucking company has an invoice worth $2,000 and the advance rate is 90 percent, they can get $1,800 upfront from the factoring company.

How Advance Rates Fit into the Factoring Process

To illustrate the idea, let’s take a look at how the factoring process usually goes.

Step 1: You Provide an Invoice

You deliver goods or services to a client and issue an invoice. Instead of waiting 30, 60, or even 90 days for payment, you hand over that invoice to a factoring company.

Step 2: You Get Paid Upfront

The factoring company gives you the agreed advance rate almost immediately. That cash goes straight into your business, ready to cover expenses, payroll, or new projects.

Step 3: The Remainder is Paid

Once your client pays the invoice in full, the factoring company sends you the rest of the money, minus their fees. This second installment is called the reserve release.

Why Does the Advance Rate Matter?

While we’ll dive deeper into this in later sections, the advance rate essentially determines how much working capital you can access right away. For businesses in industries like trucking, construction, or manufacturing, where cash flow timing can make or break operations, having a higher advance rate can have a major impact on business outcomes.

The Advance Rate Is More Than Just a Number

On the surface, it might look like the advance rate is just a fixed figure. But in reality, it’s a reflection of several key factors, each tied to the unique circumstances of your business and industry.

Risk Assessment

Factoring companies consider the risk involved in funding your invoices. The advance rate is directly tied to how confident they are that your client will pay. Here’s what influences that risk:

- Your Client’s Creditworthiness: If your client has a solid payment history and strong financials, the factoring company might offer a higher advance rate, since there’s less risk they’ll default.

- Your Industry: Industries with higher volatility, like construction, might see slightly lower advance rates because of the increased risk of disputes or delayed payments.

For instance, a company in retail with large, established clients like Walmart might secure a 90 percent advance rate, while a startup working with smaller, unknown businesses might get closer to 75 percent.

Industry Norms

Advance rates often follow trends specific to industries. For example:

- Trucking and Freight: High advance rates, often in the 90 percent range, because invoices are generally straightforward and tied to delivered loads.

- Healthcare: Lower advance rates, sometimes 60 to 80 percent, because insurance billing can involve delays or disputes.

Understanding these norms helps you benchmark what to expect and negotiate effectively.

Your Business Needs

Factoring companies sometimes adjust the advance rate to meet your cash flow needs or align with your agreement terms. If you need as much upfront capital as possible, you might prioritize a higher advance rate. Keep in mind that it could come with slightly higher fees, though.

The Importance of Optimal Advance Rates in Factoring

An optimal advance rate is the sweet spot where the percentage of your invoice value advanced upfront aligns perfectly with your business’s financial needs and cash flow goals. It’s not always the highest rate available. It’s the rate that makes the most sense for your situation while balancing costs and flexibility.

For example, if you’re in a stable financial position, a slightly lower advance rate might result in lower fees to save you money. On the other hand, if you need immediate cash to cover payroll or seize an opportunity, a higher advance rate might be worthwhile.

Key Benefits of Optimal Advance Rates

When your advance rate is well suited to your business needs, it can unlock a range of advantages.

Improved Cash Flow

Nine in ten small businesses experience cash flow issues, according to recent reports. The most obvious benefit to factoring advances is that they address this by providing immediate access to working capital. An optimal advance rate ensures you have the liquidity to cover essential expenses like:

- Payroll

- Rent or lease payments

- Purchasing inventory or materials

- Fuel or equipment costs for industries like trucking or construction

For instance, a trucking company might use an 85 percent advance rate to ensure they have fuel money for the next job while waiting for a customer to pay their invoice.

Reduced Financial Stress

A well-chosen advance rate can reduce the pressure of unpredictable cash flow. This allows you to focus on running your business rather than worrying about when invoices will be paid.

Tailored Flexibility

An optimal advance rate gives you the flexibility to choose how much immediate cash you need without overcommitting. Some factoring companies allow you to negotiate advance rates, ensuring you’re not borrowing more than necessary and incurring unnecessary fees.

A lower advance rate means more reserve funds are left to cover potential deductions, which can save you from surprises if any adjustments arise, such as client disputes or short payments.

Maximized Cost Efficiency

Balancing advance rates and fees is critical. A higher advance rate often comes with higher factoring fees, while a lower advance rate could save on costs if you don’t need the extra cash upfront.

For example, a manufacturer with stable recurring revenue may opt for an 80 percent advance rate to minimize fees while keeping reserves for minor invoice adjustments.

Business Growth Opportunities

With an optimal advance rate, you can seize growth opportunities without overextending your finances. Whether it’s taking on a big project, launching a new product, or expanding your fleet, the right advance rate ensures you have the capital to act.

For instance, picture a small business that lands a large contract but needs to buy materials upfront. With a high advance rate, they can fund the order and fulfill the contract, boosting revenue and reputation.

Calculating Your Ideal Advance Rate

Determining your ideal advance rate is all about understanding your business’s financial needs, factoring costs, and cash flow priorities. While the highest rate might seem appealing, it’s not always the most cost-effective choice. Here’s how you can calculate what’s best for you.

Step 1: Assess Your Cash Flow Needs

Start by asking: How much cash do I need upfront to cover my immediate expenses?

Common needs include:

- Payroll

- Inventory or raw materials

- Rent or lease payments

- Fuel or equipment for operations

For example, if you’re waiting on $100,000 in invoices and need $70,000 for immediate costs, an advance rate of 70 percent or higher ensures you’ll have enough liquidity.

Step 2: Factor in the Reserve Release

The reserve amount (the portion not advanced upfront) will be released once the invoice is paid, minus the factoring fees. If your industry or clients tend to have small deductions, such as discounts or adjustments, leaving more in reserve can save you from surprises.

If your clients have a history of consistent, full payments, you might feel more comfortable with a higher advance rate. However, if there’s a risk of deductions, consider a lower advance rate to avoid potential cash flow disruptions.

Step 3: Balance Costs with Benefits

Higher advance rates often come with slightly higher factoring fees. Ask yourself:

- Is the extra cash worth the added cost?

- Can I negotiate lower fees for a smaller advance rate?

For instance, a company considering a 90 percent advance rate at three percent fees might opt for an 80 percent rate at 2.5 percent fees, saving money if the extra ten percent isn’t critical for operations.

Step 4: Understand Industry Norms

Knowing your industry’s norms helps you benchmark what’s realistic and ensures you’re getting a competitive deal.

Step 5: Use a Simple Formula

Here’s a quick formula to help calculate your advance rate:

Ideal Advance Rate = (Immediate Cash Needs / Invoice Value) × 100

For instance, if your immediate cash needs are $50,000 and your invoice value is $75,000:

67 = ($50,000 / $75,000) × 100

In this case, you’d want a rate of at least 67 percent, though rounding up to 70 percent would provide a buffer.

Step 6: Consult with the Factoring Company

Many factoring companies are flexible and willing to discuss your specific needs. Be upfront about your cash flow requirements and ask them to tailor the advance rate accordingly.

Questions to Ask:

- Can I negotiate fees based on a lower advance rate?

- How does my industry or client history affect the advance rate?

- Are there options for adjusting rates on a case-by-case basis?

Comparing Factoring Companies by Advance Rates

When choosing a factoring company, the advance rate is one of the most important factors to consider. But it’s not just about finding the company with the highest rate—it’s about understanding the full context of what that rate includes and how it fits your business needs. Here’s how to compare factoring companies effectively, focusing on advance rates.

Step 1: Look Beyond the Rate

While it’s tempting to go with the company offering the highest advance rate, there’s often more to the story. A high advance rate might come with:

- Higher factoring fees that cut into your reserves.

- Stricter terms for qualifying invoices or clients.

- Hidden fees for additional services like credit checks or reporting.

For example, Company A offers an 85 percent advance rate with three percent factoring fees. Company B offers a 90 percent advance rate but charges four percent. That extra five percent upfront might cost more in the long run but it could be worth it if you’re funneling the money into growth-related activities.

Step 2: Evaluate the Advance Rate Against Industry Norms

Ensure the rates offered are competitive for your sector. If a company’s rate is significantly lower than the industry average, it might be a red flag about their flexibility or risk tolerance.

Step 3: Understand What the Advance Rate Covers

Ask each company:

- Does the advance rate apply to all invoices or only specific ones?

- Are there limits on invoice values or client types for the advance rate to apply?

- Is the advance rate customizable based on my cash flow needs?

Note that some companies may offer tiered advance rates. For example, you might get 90 percent on invoices under $10,000 but only 80 percent on larger ones.

Step 4: Compare Reserve Release Terms

The advance rate is only half the equation. The reserve release determines how much of the remaining invoice value you’ll receive after fees.

- Quick Reserve Release: Some companies release reserves as soon as payment is received, which is ideal for cash flow.

- Delayed Release: Others might hold reserves for longer to ensure payment clears, adding to the wait time.

For example, Company A offers a 90 percent advance rate but releases reserves 15 days after invoice payment. Company B offers an 85 percent rate but releases reserves immediately. If cash flow speed is critical, Company B might be the better choice.

Step 5: Consider Fees and Discounts

High advance rates often come with trade-offs. Compare the following:

- Factoring Fees: Higher advance rates may mean higher fees, typically two to five percent of the invoice value.

- Additional Fees: Watch for charges like setup fees, minimum volume fees, or charges for early termination.

- Discounts for Lower Rates: Some companies offer reduced fees if you opt for a lower advance rate.

For instance, a company offering a 75 percent advance rate at two percent fees might end up being more cost-effective than one offering 90 percent at four percent.

Step 6: Factor in Customer Service and Technology

The advance rate isn’t the only thing that impacts your experience. Consider:

- Ease of Use: Does the company offer an online portal for tracking advances and reserves?

- Responsiveness: How quickly can they process invoices and deposit advances?

- Client Communication: Will they handle your clients professionally to maintain your relationships?

Quick Checklist for Comparing Advance Rates

Here’s a checklist to use when evaluating factoring companies:

- What’s the standard advance rate?

- Does the rate vary by invoice size, client, or industry?

- How quickly are reserves released?

- What are the associated factoring fees?

- Are there additional fees or restrictions?

- How does the company handle communication with your clients?

- Are their terms flexible if your needs change?

Challenges with Low Advance Rates

Low advance rates might seem manageable at first glance, but they can introduce a variety of challenges for businesses that rely on factoring to maintain healthy cash flow. Here’s an in-depth look at the potential downsides of low advance rates and how they can impact your operations.

Strained Cash Flow

A low advance rate means less immediate cash to cover your business’s day-to-day expenses. This can create bottlenecks in essential areas like:

- Payroll: Meeting payroll deadlines becomes harder when only a small portion of your invoice value is advanced.

- Inventory Purchases: Limited cash flow could mean delaying orders or missing out on bulk discounts.

- Operational Costs: Expenses like rent, utilities, and equipment maintenance might pile up without enough liquidity.

For example, if your business invoices $100,000 but receives only a 70 percent advance rate, you’re left with $30,000 tied up in reserves, which might not be released for 30-60 days.

Increased Reliance on Other Financing

When advance rates are too low, businesses often turn to alternative financing methods to bridge the gap. This can lead to:

- Higher Interest Costs: Credit cards or short-term loans may have higher interest rates compared to factoring fees.

- Debt Accumulation: Relying on multiple financing sources can increase your overall debt burden and complicate financial management.

Lost Opportunities

Low advance rates can limit your ability to act quickly on growth opportunities, such as:

- Expanding your fleet, team, or inventory.

- Taking on larger or more profitable contracts.

- Investing in marketing or technology to drive growth.

Unpredictability of Reserve Releases

Reserves are only released once the client pays. If your client’s payment is delayed, you could face a longer cash flow gap than expected. A low advance rate amplifies this issue because most of your cash is tied up in the reserve.

Impact on Financial Planning

When working with low advance rates, budgeting and financial planning become more complex. Challenges include:

- Managing Unpredictable Cash Flow: With less upfront cash, forecasting becomes harder, especially in industries with fluctuating revenues.

- Difficulty Handling Emergencies: Unplanned expenses like equipment repairs or rush orders can derail your budget.

Potential for Higher Fees Elsewhere

Some factoring companies compensate for low advance rates by adding fees for things like:

- Early funding requests.

- Higher costs for small invoices.

- Additional charges for credit checks or reports.

If a company offers a low advance rate, closely review its fee structure to ensure you’re not overpaying in other areas.

How to Mitigate the Challenges of a Low Advance Rate

If you’re working with a factoring company offering a low advance rate, here’s how to navigate it.

- Negotiate: Ask if the advance rate can be adjusted based on your clients’ creditworthiness or industry norms.

- Compare Options: Shop around to find a factoring partner that aligns with your business’s cash flow needs.

- Improve Client Payment Terms: Encourage faster payments from your clients to minimize the reliance on reserves.

- Prioritize High-Margin Invoices: Factor invoices that generate the most profit to maximize the value of the advance.

Get a Tailored Factoring Quote

An experienced factoring company can help you find your optimal advance rate—one that strikes the perfect balance between meeting your needs and minimizing costs. To be matched with a factoring company that can help, request a complimentary rate quote.

FAQs on the Importance of Advance Rates in Factoring and Finding Your Optimal Rate

How does the advance rate contribute to business stability when using factoring?

An optimal advance rate ensures your business has enough cash to maintain operations without overextending finances. By providing predictable liquidity, it helps stabilize cash flow, supporting payroll, supplier payments, and growth initiatives.

What are typical advance rate percentages for different industries?

Advance rate percentages vary by industry. Trucking often sees rates of 90 percent or more, while manufacturing ranges between 80 to 85 percent, and healthcare typically falls at 60 to 80 percent due to invoice complexities like insurance processing.

How can I determine the right advance rate percentage for my business?

Assess your immediate cash needs, factoring costs, and client payment reliability. Use this formula:

Ideal Advance Rate = (Immediate Cash Needs / Invoice Value) × 100

This ensures your advance rate aligns with operational priorities.

What factors influence advance rate calculations in invoice factoring?

Advance rates are based on your clients’ creditworthiness, invoice size, and industry risks. Companies assess the likelihood of full payment to set rates that balance risk and reward.

Are higher advance rates always better for business stability?

Not always. While higher rates provide more upfront cash, they may come with higher fees. Balancing your advance rate with manageable costs is key to maintaining stability.

How do factoring agreements define advance rates and reserve releases?

Factoring agreements outline the advance rate percentage, timing of reserve releases, and associated fees. These terms dictate how and when you’ll receive your funds, so review them carefully before signing.

What are the pros and cons of negotiating a higher advance rate percentage?

Higher advance rates provide more immediate cash but may increase fees. They’re beneficial if you need liquidity for critical expenses but could reduce your reserve payout after factoring costs.

How does a factoring company calculate the advance rate for my invoices?

Companies evaluate client credit history, payment trends, and your industry’s risk profile. These factors determine the advance rate, balancing their risk and your cash flow needs.

What role does advance rate percentage play in choosing the best factoring agreement?

The advance rate percentage is a key factor in ensuring the agreement meets your cash flow needs. Compare rates, fees, and reserve terms to find a factoring partner that aligns with your business goals.

About Invoice Factoring Guide

Related Articles

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300