Chasing down late payments while trying to keep your business afloat? You’re not alone. Many businesses struggle with slow-paying customers and the cash flow issues they create. Fortunately, there’s a way to take control: improving your accounts receivable (AR) turnover. In this article, we’ll explore how you can improve AR turnover with factoring to achieve faster payments and stronger financial stability.

Accounts Receivable Turnover Explained

AR turnover is a core element of cash flow management for any business offering credit terms to its customers. Think of it as the heartbeat of your business’s financial health. It tells you how efficiently your business is converting credit sales into cash. If your AR turnover isn’t where it should be, your business could struggle to maintain the cash flow needed to pay employees, cover operating expenses, or seize new growth opportunities.

What is AR Turnover?

At its core, AR turnover reflects how often your business collects on its outstanding invoices within a specific period, such as monthly, quarterly, or annually. It’s an indicator of how quickly customers pay you for goods or services they bought on credit. A higher turnover means your business collects receivables quickly, while a lower turnover may signal delays in payments or inefficiencies in your credit policies.

Why AR Turnover Matters

The importance of AR turnover cannot be overstated. Your AR turnover doesn’t just measure collections. It affects nearly every aspect of your operations. Here’s why it’s so crucial.

- Cash Flow Stability: A steady AR turnover ensures you have the cash to cover expenses like payroll, rent, or inventory purchases. Slow collections, on the other hand, can leave you scrambling to fill financial gaps.

- Business Growth: A healthy AR turnover frees up working capital that can be reinvested into your business, whether that’s expanding operations, upgrading equipment, or boosting marketing efforts.

- Credit Risk Management: AR turnover can highlight potential risks in your customer base. If turnover slows, it might indicate that some customers are struggling financially or that your credit policies need tightening.

- Customer Insights: Tracking AR turnover can also reveal trends in customer behavior. Are certain industries or client types slower to pay? Do seasonal patterns affect collections? These insights can help you adapt your strategy.

Factors Affecting Receivable Turnover

A variety of factors can influence how quickly your business collects payments.

- Credit Terms: The terms you set for payment will naturally impact turnover. Shorter payment windows often lead to faster collections but may deter some customers.

- Customer Base: Your turnover can depend on the financial health and habits of your customers. A business serving larger corporations may face longer payment cycles due to bureaucratic processes, while smaller clients may pay faster.

- Industry Norms: Some industries, like construction or government contracting, tend to have longer payment cycles baked into their norms. Others, like retail, often involve faster collections.

- Billing Processes: Clear and accurate invoices sent promptly are key. Delays or errors in invoicing can slow down payments and hurt turnover.

- Collections Practices: Businesses with consistent follow-up, automated reminders, and clear payment policies tend to see faster turnover than those relying on reactive collection efforts.

Common AR Management Challenges

Managing AR efficiently can be a headache, especially when juggling multiple customers and invoices. Here are a few common obstacles businesses face.

- Late Payments: One of the most persistent challenges is customers not paying on time, whether due to financial struggles, inefficiencies on their end, or simply neglect.

- Disputes and Errors: Inaccurate or unclear invoices can lead to payment disputes, slowing down the entire process. Even minor errors can cascade into weeks of delays.

- Seasonal Cash Flow Gaps: Businesses with seasonal revenue often struggle to maintain consistent AR turnover during slower periods.

- Overextending Credit: Offering generous credit terms to attract customers can backfire if clients struggle to pay on time, leaving you with a pile of overdue invoices.

- Lack of Automation: Many businesses still rely on manual processes for invoicing and collections instead of leveraging software like QuickBooks or Xero, which can lead to inefficiencies, missed follow-ups, and slower turnover.

Accounts Receivable Turnover Ratio Explained

When you’re managing your business’s financial health, understanding how to measure performance is just as important as knowing what to measure. That’s where the accounts receivable (AR) turnover ratio comes in. This financial ratio offers a clear snapshot of how efficiently your business collects on its outstanding invoices, and it’s a critical metric for assessing your cash flow health and credit practices.

What is an AR Turnover Ratio?

The AR turnover ratio is a specific financial ratio that tells you how many times your business collects its average accounts receivable within a given period, typically a year. It’s a direct reflection of how quickly your customers are paying their invoices and how effectively your credit and collections policies are working.

In simple terms, this ratio answers a key question: How often does your business convert credit sales into cash?

- A higher ratio suggests your customers pay quickly, which usually indicates strong cash flow and efficient credit management.

- A lower ratio might signal delayed payments, potential issues with credit policies, or that your customer base is slow to pay.

This ratio is a lens into your business’s overall efficiency and financial stability. If you’re evaluating financial ratios and business health, the AR turnover ratio is one of the most telling indicators.

How to Calculate Receivable Turnover Ratio

Calculating the AR turnover ratio is straightforward, but it’s important to understand each piece of the formula. Here’s how you do it.

AR Turnover Ratio Formula

Accounts Receivable Turnover Ratio = Net Credit Sales ÷ Average Accounts Receivable

Breaking Down the Calculation

- Net Credit Sales: This is your total sales made on credit (not cash sales) for the period, minus any returns or allowances. If your business doesn’t differentiate between cash and credit sales, it’s worth starting to track this to get an accurate ratio.

- Average Accounts Receivable: To calculate this, add the beginning and ending balances of accounts receivable for the period and divide by two. This gives you a clearer picture of what your receivables looked like throughout the time frame.

Example Calculation

Let’s say your business has:

- Net credit sales of $500,000 for the year

- Beginning AR balance of $40,000 and ending AR balance of $60,000

First, find the average AR:

- Average AR = ($40,000 + $60,000) ÷ 2 = $50,000

Next, calculate the ratio:

- AR Turnover Ratio = $500,000 ÷ $50,000 = 10

This means your business collects its accounts receivable 10 times per year, or approximately once every 36.5 days (365 days ÷ 10).

What is a “Normal” AR Turnover Ratio?

The ideal AR turnover ratio can vary depending on your industry, business size, and the credit terms you offer. However, as a general rule:

- Higher Ratios (12 or more): These are common for businesses with shorter payment terms, such as Net 15, or industries like retail, where customers typically pay quickly.

- Moderate Ratios (6–12): This range is typical for many B2B companies offering Net 30 or Net 45 terms. It suggests efficient collections while accounting for reasonable payment cycles.

- Lower Ratios (below 6): These could indicate extended payment terms, poor collections processes, or issues with customers delaying payments.

It’s important to compare your ratio to industry benchmarks. For instance, construction businesses often see lower AR turnover due to longer project timelines, while industries like tech or manufacturing might aim for higher ratios to maintain cash flow.

If your AR turnover ratio seems out of sync with your industry, it could be a sign to re-evaluate your credit policies, customer relationships, or collections processes.

How to Improve Accounts Receivable Turnover with Factoring

If your AR turnover isn’t as strong as it should be, your business may face cash flow bottlenecks, delayed growth, and even difficulty meeting operating expenses. This is where invoice factoring comes in. Factoring not only helps improve AR turnover but also brings additional benefits that can strengthen your overall business operations.

What is Invoice Factoring?

Invoice factoring is a funding solution that allows your business to sell its unpaid invoices to a factoring company, sometimes called a factor, in exchange for immediate cash. Instead of waiting for customers to pay, you receive a significant portion of the invoice value upfront, usually around 80 to 90 percent, while the factor takes over the responsibility of collecting payment from your customers.

How Factoring Works

- Perform Work: You deliver goods or services to your customer and issue an invoice.

- Sell the Invoice: Instead of waiting weeks or months for payment, you sell the invoice to a factoring company.

- Get Advance: The factor advances most of the invoice’s value to you almost immediately.

- Get Balance: Once your customer pays the invoice, the factor releases the remaining balance, minus their fee.

This approach accelerates your cash flow while ensuring you no longer have to shoulder the burden of chasing late payments.

How Factoring Improves AR Turnover

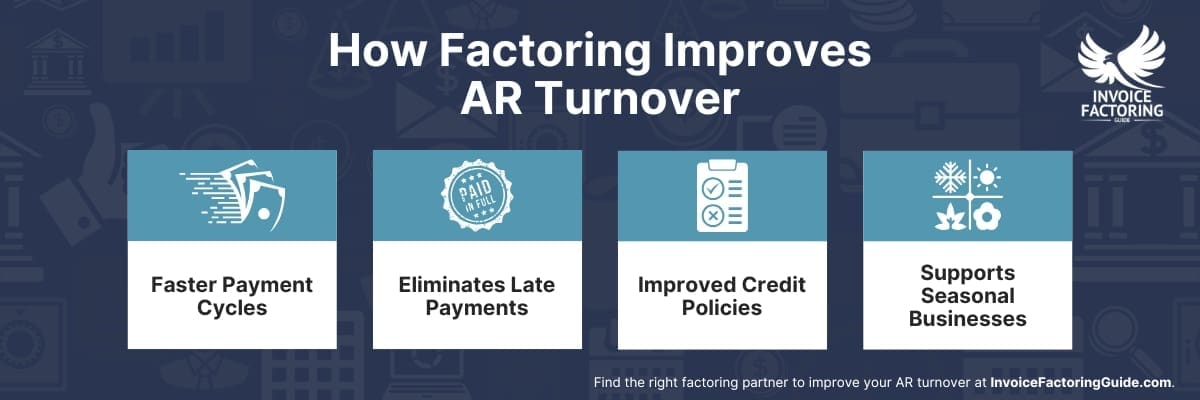

Factoring directly addresses AR turnover by speeding up the cash conversion process. Here’s how.

- Faster Payment Cycles: Since factoring allows you to receive cash as soon as you issue an invoice, it effectively bypasses the traditional waiting period for customer payments. This means your AR turnover improves immediately.

- Eliminates Late Payments: With factoring, late payments from customers are no longer your problem. The factoring company takes on the collection process, so your receivables are turned into cash faster, regardless of your customers’ payment habits.

- Improved Credit Policies: Factoring companies often conduct credit checks on your customers to assess their reliability. This can indirectly help your business tighten its credit policies and ensure you’re working with clients who are more likely to pay on time in the future.

- Supports Seasonal Businesses: If your business experiences slower AR turnover during certain seasons, factoring can provide consistent cash flow regardless of customer payment delays.

Additional Benefits of Factoring

Beyond improving AR turnover, factoring offers several other advantages that can strengthen your business operations.

- Improved Cash Flow Stability: Factoring provides consistent access to working capital, helping you cover payroll, invest in growth opportunities, or purchase inventory without relying on loans or lines of credit.

- No New Debt: Unlike loans, factoring doesn’t add to your debt. You’re simply leveraging your own receivables to access cash, making it a debt-free funding option.

- Time Savings: Chasing unpaid invoices can be time-consuming and frustrating. With factoring, you can offload collections to the factoring company, freeing up time to focus on core business activities.

- Scalable Solution: As your sales grow, so does the funding available through factoring. This makes it an excellent option for businesses in growth phases or those scaling rapidly.

- Customer Relationship Management: Many factoring companies handle collections professionally, maintaining positive relationships with your customers while ensuring timely payments.

Why Factoring Stands Out Over Other Funding Solutions

When faced with a low AR turnover ratio and cash flow challenges, it’s natural to consider other funding solutions like loans or lines of credit. While these options may seem straightforward, factoring often stands out as the better choice for several key reasons.

No Debt, No Stress

Unlike loans, factoring doesn’t add debt to your balance sheet. When you sell your invoices to a factoring company, you’re leveraging money that’s already owed to you. This keeps your business financially lean and avoids the burden of monthly loan repayments, which can be stressful if your cash flow remains inconsistent.

Approval Based on Customer Credit

If your business has a low AR turnover ratio, lenders may view you as a higher risk, making it harder to secure financing or get favorable terms. Factoring works differently. Approval is based on your customers’ creditworthiness, not your business’s financial history. This makes factoring accessible even to businesses with poor credit or those just starting out.

Immediate Cash Flow Relief

Loans can take weeks or even months to secure, especially if you’re navigating complex approval processes or providing collateral. Factoring, on the other hand, gets you cash fast. You can typically receive funds within 24 to 48 hours of submitting your invoices, making it an ideal solution for urgent cash flow gaps.

No Fixed Repayment Obligations

With loans, you’re locked into fixed repayment schedules that don’t account for fluctuations in your cash flow. This can create financial strain during slower months. Factoring eliminates this concern because the funds are tied to your invoices, not a repayment schedule. The factoring company collects directly from your customers, so you’re not responsible for paying the money back.

Works Alongside Growth

If your business is growing quickly, loans can feel restrictive because they’re often capped at a specific amount and require additional applications to increase your limit. Factoring is inherently scalable—your access to cash grows alongside your sales. The more invoices you generate, the more funding becomes available.

Minimal Impact on Operations

Loans often require you to jump through hoops, such as extensive paperwork, credit checks, and lengthy negotiations, while factoring is a straightforward process. Plus, factoring companies often handle collections, freeing up your time and resources to focus on your core operations.

Improve Your AR Turnover with Factoring

Take control of your cash flow and say goodbye to slow-paying invoices. With invoice factoring, you can speed up your AR turnover, unlock working capital, and focus on growing your business instead of chasing payments. Discover how fast, flexible funding can transform your business and request a complimentary rate quote today.

FAQs on Improving Your AR Turnover with Factoring

Why is factoring a better option than waiting for customers to pay?

Factoring eliminates delays caused by slow-paying customers, providing immediate cash flow to cover expenses or invest in growth. Unlike waiting for payment, factoring reduces financial uncertainty, improves cash flow predictability, and frees businesses from chasing overdue invoices.

Can invoice factoring reduce late payments and speed up collections?

Yes, factoring reduces the impact of late payments by giving businesses immediate access to cash. Additionally, the factoring company handles collections, often with professional processes that encourage timely payments from customers, further improving AR turnover.

What role does factoring play in addressing low AR turnover ratios?

Factoring directly addresses low AR turnover by speeding up the cash conversion process. Instead of receivables remaining outstanding for weeks or months, factoring turns them into near-instant cash, helping businesses maintain a healthier turnover ratio and better manage cash flow.

How quickly can factoring improve cash flow for businesses with slow AR turnover?

Factoring can improve cash flow within 24 to 48 hours of submitting invoices. This immediate access to working capital helps businesses bridge gaps caused by slow AR turnover, keeping operations running smoothly without waiting for customer payments.

Does factoring work for businesses struggling with slow-paying customers?

Absolutely. Factoring is ideal for businesses dealing with slow-paying customers. It provides upfront cash for unpaid invoices, so businesses can maintain financial stability while the factoring company handles collections, mitigating the impact of late payments.

What types of invoices are eligible for factoring to improve AR turnover?

Invoices eligible for factoring typically involve business-to-business (B2B) or business-to-government (B2G) transactions with established credit terms. These invoices should be for completed goods or services with clear payment terms, making them ideal for accelerating AR turnover.

How does factoring impact customer relationships while improving AR turnover?

Factoring companies often handle collections professionally, ensuring customer relationships remain positive. By outsourcing collections, businesses avoid awkward payment reminders and maintain a strong rapport with customers, all while improving AR turnover and cash flow.

About Invoice Factoring Guide

Related Insights

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300