Debt is often a necessary tool for growth, but what happens when it becomes a barrier to success? For many growing businesses, managing the fine balance between debt and equity is key to unlocking future opportunities. On this page, we’ll explore improving debt-to-equity ratio with invoice factoring, plus how it can help you keep that balance in check—and your business thriving.

Essentials of Invoice Factoring

While some businesses rely on alternative financing strategies like loans or lines of credit, invoice factoring offers a unique funding solution by allowing companies to sell unpaid invoices to a third-party company at a discount. This allows the business to get cash quickly rather than waiting for the customer to pay. The factor takes on the responsibility of collecting the payment from the customer when it’s due.

The basics are simple:

- Get Paid: You sell your unpaid invoices to a factoring company (typically 60 to 95 percent of the invoice value upfront).

- Factor Collects: The factoring company collects the payment from your customers when the invoices are due.

- Receive Remaining Balance: You receive the remaining balance minus a factoring fee, which is usually one to five percent of the invoice value after the customer pays.

For example, let’s say an Illinois trucking company is waiting on $100,000 worth of invoices from its customers but needs cash to cover fuel costs now. They sell those invoices to a factoring company, which gives them $85,000 immediately. Once the invoices are paid, the factor deducts their fees (say five percent) and releases the remaining $10,000 to the trucking company.

Invoice factoring is especially common in industries with long payment terms, like trucking or construction, where businesses might need cash flow to cover operating expenses while waiting 30, 60, or even 90 days for customer payments.

Key Benefits of Invoice Factoring for Cash Flow and Company Value

Because factoring is a unique funding solution, it comes with many benefits for cash flow and company value.

- Immediate Access to Working Capital: Instead of waiting for 30 to 90 days for customers to pay invoices, factoring provides businesses with instant cash, which helps reduce company debt by avoiding the need for loans. This also allows you to cover day-to-day expenses like payroll, rent, and supplies without having to rely on loans or dip into reserves.

- Smooth Cash Flow Cycles: Factoring is one of the most effective cash flow management techniques to smooth out the peaks and valleys of cash flow. Businesses in industries with long payment cycles, like trucking or construction, often face cash flow gaps. With factoring, cash is more predictable, which helps you plan for upcoming expenses.

- No New Debt Incurred: Unlike loans, factoring doesn’t add to your liabilities. Since you’re selling an asset (the invoice), it doesn’t affect your debt-to-equity ratio, which is crucial for businesses aiming to keep debt manageable while securing liquidity.

- Flexible and Scalable: As your sales grow, factoring scales with you. More sales generate more invoices, which means more cash flow is available without needing to renegotiate or increase credit lines.

- Improved Financial Ratios: Factoring helps in optimizing business financial ratios, particularly the debt-to-equity ratio, without adding debt.

- Increased Business Flexibility and Growth Opportunities: With steady cash flow, you can take advantage of growth opportunities, whether it’s hiring more staff, investing in marketing, or taking on larger projects. Factoring allows businesses to grow without being constrained by limited cash reserves or traditional financing, boosting financial health for small businesses.

- Better Supplier Relationships: When you have reliable cash flow through factoring, you can pay your suppliers on time or even early, leading to stronger relationships and potential discounts for early payments. This can also give you leverage in negotiations.

- Reduction in Administrative Costs: Since the factoring company often takes over the collections process, you save time and resources on chasing down payments. This lets you focus on growth and operations instead of accounts receivable management.

Essentials of Debt-to-Equity Ratios

The debt-to-equity ratio (D/E ratio) is a key financial metric that measures the proportion of a company’s financing that comes from debt versus shareholder equity. It’s calculated by dividing the company’s total liabilities (or debt) by its total shareholder equity. The formula looks like this:

Debt-to-Equity Ratio = Total Liabilities ÷ Shareholder Equity

This ratio is critical because it gives insight into how a company finances its operations and how risky that business might be for investors or lenders. The average debt-to-equity ratio varies by industry, but for small businesses in the U.S., a ratio of 1 to 1.5 is considered fairly standard. Businesses in industries with higher risk tolerance, like construction or manufacturing, often have higher ratios, while service-based industries usually prefer lower ratios.

Why the Debt-to-Equity Ratio is Important

Your debt-to-equity ratio can come into play in a lot of different scenarios. We’ll explore a few below.

- Indicator of Financial Health: A low debt-to-equity ratio suggests that a company is primarily funded through equity, meaning it’s less reliant on debt and likely more stable. A high debt-to-equity ratio indicates a company is heavily reliant on debt, which can increase financial risk, especially if the company struggles to generate enough revenue to meet its debt obligations.

- Risk Assessment for Lenders and Investors: Lenders and investors closely examine the D/E ratio to evaluate how risky it is to lend money or invest in the company. A high ratio might suggest that the company is already burdened with debt, which makes additional borrowing more difficult and expensive. On the other hand, a lower ratio may make the company more attractive for further investment.

- Debt Management and Growth Capacity: A company’s D/E ratio directly impacts its ability to grow. If a business is already heavily leveraged, meaning it has high debt compared to equity, it may struggle to take on more debt without risking financial instability. This could hinder expansion opportunities, making it harder to secure loans or new investors.

- Interest Payments and Cash Flow: A high debt load results in higher interest payments, which can erode profits and negatively impact cash flow. If too much of your revenue is going toward paying down debt, it leaves less available for reinvestment into the business. This could also lead to cash flow issues, making it harder to cover day-to-day expenses.

- Impact on Business Valuation: Businesses with lower debt-to-equity ratios are often seen as more valuable because they’re less risky and financially stable. This is particularly important for small business owners who may eventually want to sell their company or bring in new investors.

- Resilience During Economic Downturns: Companies with lower debt levels are generally more resilient during tough economic times because they’re not burdened by heavy interest payments or looming debt obligations. High-debt companies, on the other hand, might struggle to stay afloat if their revenue dips and they can’t meet their debt payments.

How Factoring Works for Improving Debt-to-Equity Ratios

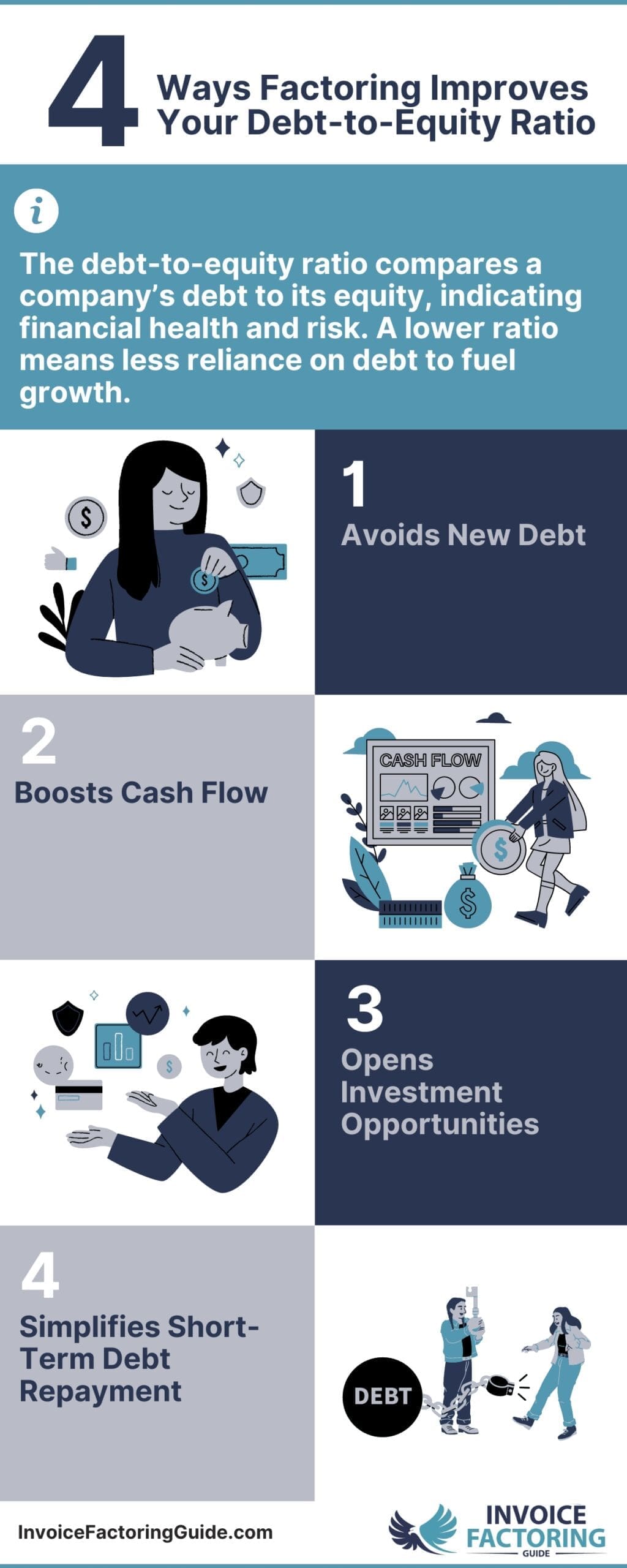

Invoice factoring offers businesses a way to access working capital without taking on additional debt. This is crucial because, unlike loans or lines of credit, factoring doesn’t add a liability to your balance sheet, which directly helps maintain or even improve your D/E ratio. Here’s how.

- No New Debt: Since factoring involves selling your unpaid invoices (an asset) rather than borrowing money, it doesn’t increase your liabilities. In contrast, taking out a loan would boost your debt, negatively impacting your D/E ratio by increasing the numerator (total liabilities).

- Accelerating Cash Flow: Factoring accelerates cash flow by providing immediate funds from outstanding invoices, improving business liquidity without adding debt. Businesses can use that cash to pay down existing debt, which reduces their total liabilities. By paying off debt faster, they can actively improve their D/E ratio.

- Increased Equity Investment: With the improved cash flow that factoring provides, businesses can reinvest in growth and equity-building activities, such as expanding operations, acquiring new assets, or improving infrastructure. This helps grow the equity side of the D/E ratio, further improving the balance.

- Paying Off Short-Term Debt: Businesses often use factoring to pay down more expensive, short-term debts like credit lines or high-interest loans. Since factoring provides quicker cash flow, it helps businesses stay current on their obligations, which can prevent the need for additional borrowing.

Practical Benefits of Factoring for D/E Ratio Improvement

Now that we’ve covered the background, let’s take a look at when leveraging this strategy can help businesses the most.

- Avoiding Debt Accumulation During Growth Phases: Factoring enables businesses to expand or take on larger contracts without needing to rely on loans or credit lines. This is particularly important during high-growth periods when businesses may need to ramp up quickly without adding to their debt.

- Maintaining Flexibility for Future Borrowing: By using factoring instead of loans to manage cash flow, businesses keep their balance sheets clean, making them more attractive to lenders if they eventually need a loan for large investments. A better D/E ratio increases the likelihood of securing future financing on favorable terms.

- Improving Financial Stability: Reducing debt through factoring helps businesses maintain better financial stability, which is important when preparing for unexpected challenges like economic downturns or supply chain disruptions. By keeping debt low and cash flow high, companies can weather challenges without the pressure of heavy debt payments.

Specialized Industries like manufacturing, which often face high operating costs and delayed receivables, can particularly benefit from factoring solutions for manufacturing companies to improve their debt-to-equity ratio and sustain growth.

Kick Off Your Debt-to-Equity Ratio Improvement Strategy Today

Leveraging invoice factoring to improve your debt-to-equity ratio provides a pathway to financial health without the burden of debt accumulation. By converting unpaid invoices into immediate cash, you can reduce their reliance on debt financing, pay off existing liabilities, and strengthen your position. Over time, this approach can help improve your financial standing, making your business more attractive to investors and lenders while also positioning your business for sustainable growth. If you’re ready to kick off your debt-to-equity ratio improvement strategy with invoice factoring, request a complimentary rate quote.

FAQs on Improving Debt-to-Equity Ratio with Invoice Factoring

Is invoice factoring better than taking out a loan for improving debt ratios?

Yes, invoice factoring is generally better for improving debt ratios because it doesn’t add liabilities. Loans increase debt, which can worsen your debt-to-equity ratio. Factoring provides cash flow without incurring new debt, allowing you to cover expenses or pay down existing loans while keeping your debt levels low.

Does invoice factoring count as debt on my balance sheet?

No, invoice factoring does not count as debt. When you factor invoices, you’re selling an asset (accounts receivable) rather than taking out a loan. This means it doesn’t show up as a liability on your balance sheet, helping you maintain a healthier debt-to-equity ratio.

How does invoice factoring affect my company’s financial stability?

Invoice factoring improves financial stability by providing predictable cash flow without increasing debt. This allows businesses to cover expenses, take on new opportunities, and pay down existing debt faster. Factoring can also make it easier to manage slow-paying clients and reduce cash flow gaps, providing financial flexibility.

Can factoring help reduce my company’s reliance on debt?

Yes, factoring can reduce your reliance on debt by providing immediate cash from unpaid invoices. Instead of taking out loans to cover operating costs, you can use factoring to maintain a steady cash flow. This keeps your debt levels low, helping improve your financial health and debt-to-equity ratio.

What are the costs associated with invoice factoring, and how do they impact profitability?

Factoring fees typically range from one to five percent of the invoice value. While factoring provides immediate cash flow, these fees can affect profit margins, especially for businesses with slim margins. However, for many companies, the benefits of improved cash flow, reduced debt, and faster growth outweigh the costs, especially if used strategically.

Are factoring benefits and invoice financing benefits the same?

No. Factoring involves selling your invoices, which is why there’s no debt. Invoice financing involves taking a loan out that uses your invoices as collateral. With financing, there is debt that must be paid back with interest.

What are the advantages of receivables financing over other forms of funding?

Receivables financing, including factoring, provides immediate cash flow without adding to your debt. This approach improves your financial ratios and keeps your liabilities low, unlike traditional loans, which add debt and interest.

How do factoring services for SMEs work?

Factoring services for SMEs involve selling unpaid invoices to a third-party factor, which advances a percentage of the invoice value upfront. This provides immediate cash flow, helping small businesses cover expenses without taking on new debt.

What is the impact of factoring on financial statements?

Factoring improves cash flow without adding debt to the balance sheet, resulting in better financial ratios. The invoices are recorded as sold assets, and factoring fees are typically recorded as an expense on your income statement.

About Invoice Factoring Guide

Related Insights

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300