Do you know how long it takes to turn your inventory into cash? This often-overlooked metric, known as your operating cycle, could be the key to optimizing your cash flow with invoice factoring. In this guide, we’ll explore the relationship between your operating cycle and factoring rates and provide actionable insights on how to streamline your operations for maximum financial efficiency.

Operating Cycles Explained

The operating cycle of a business refers to the time it takes for a company to purchase inventory, sell it to customers, and collect cash from those sales. It’s a critical measure of a business’s efficiency and financial health.

Breakdown of a Normal Operating Cycle

- Purchase Inventory: The cycle begins when a business buys raw materials or goods for resale.

- Production/Processing: If the business is involved in manufacturing, it will then convert these raw materials into finished products.

- Sales: The finished products are sold to customers.

- Accounts Receivable: After the sale, the business waits to collect payment from customers. This period can vary based on the credit terms extended to customers.

- Cash Collection: Finally, the business collects cash from these sales, which can then be used to purchase more inventory, starting the cycle over again.

Typical Operating Cycles

The length of the operating cycle can vary widely depending on the industry. For instance, in the retail sector, the operating cycle might be very short, as items are sold quickly, and payment is often immediate. In contrast, in manufacturing, the cycle can be much longer due to the time required for production and the extended credit terms typically offered to customers.

Why Understanding Your Operating Cycle is Essential

Understanding the operating cycle is crucial for managing cash flow. Businesses with longer operating cycles may face cash flow challenges as they have to wait longer to convert inventory into cash. This is where invoice factoring can play a pivotal role. Managing your operating cycle for factoring success ensures a smoother cash flow management process.

Operating Cycles vs. Cash Conversion Cycles

The operating cycle and the cash conversion cycle (CCC) are related concepts, but they are not the same. Here’s a breakdown of the differences:

Operating Cycle

As mentioned earlier, the operating cycle is the total time a business takes to purchase, sell, and collect cash from those sales. It focuses on the entire process, from acquiring inventory to collecting receivables.

Cash Conversion Cycle (CCC)

On the other hand, the cash conversion cycle measures the time it takes for a business to convert its investments in inventory and other resources into cash flows from sales. The CCC is a more specific measure that accounts for the timing of payments and collections. It provides a more comprehensive view of a company’s liquidity and operational efficiency.

Invoice Factoring Explained

Invoice factoring is a financial service where a business sells its accounts receivable, or invoices, to a third-party company, known as a factor, at a discount. This allows the business to receive immediate cash, improve its cash flow, and cover ongoing expenses without waiting for customer payments.

How Invoice Factoring Works

- Issuing Invoices: After delivering goods or services, a business issues invoices to its customers with payment terms ranging from 30 to 90 days.

- Selling Invoices: Instead of waiting for these payments, the business sells the invoices to a factoring company.

- Receiving Immediate Cash: The factoring company immediately advances a percentage of the invoice value, usually 60 to 95 percent, to the business.

- Collection by Factor: The factoring company then takes on the responsibility of collecting payment from the customers.

- Final Payment: Once the customer pays the invoice, the factoring company remits the remaining balance to the business minus a factoring fee. This is usually between one and five percent of the invoice’s value.

Uses and Benefits of Invoice Factoring

- Improved Cash Flow: By converting receivables into immediate cash, businesses can manage their cash flow more effectively, ensuring they have the funds needed to cover operational expenses like payroll, rent, and inventory purchases.

- No Additional Debt: Unlike loans, factoring is not a debt. It involves selling an asset (the invoice), so it doesn’t add to the company’s liabilities or affect its credit rating.

- Focus on Growth: With immediate access to cash, businesses can focus on growth opportunities such as expanding operations, investing in new projects, or increasing marketing efforts without worrying about cash flow constraints.

- Outsourced Collections: Factoring companies handle payment collection, saving businesses time and resources while potentially improving collections efficiency due to the factor’s expertise.

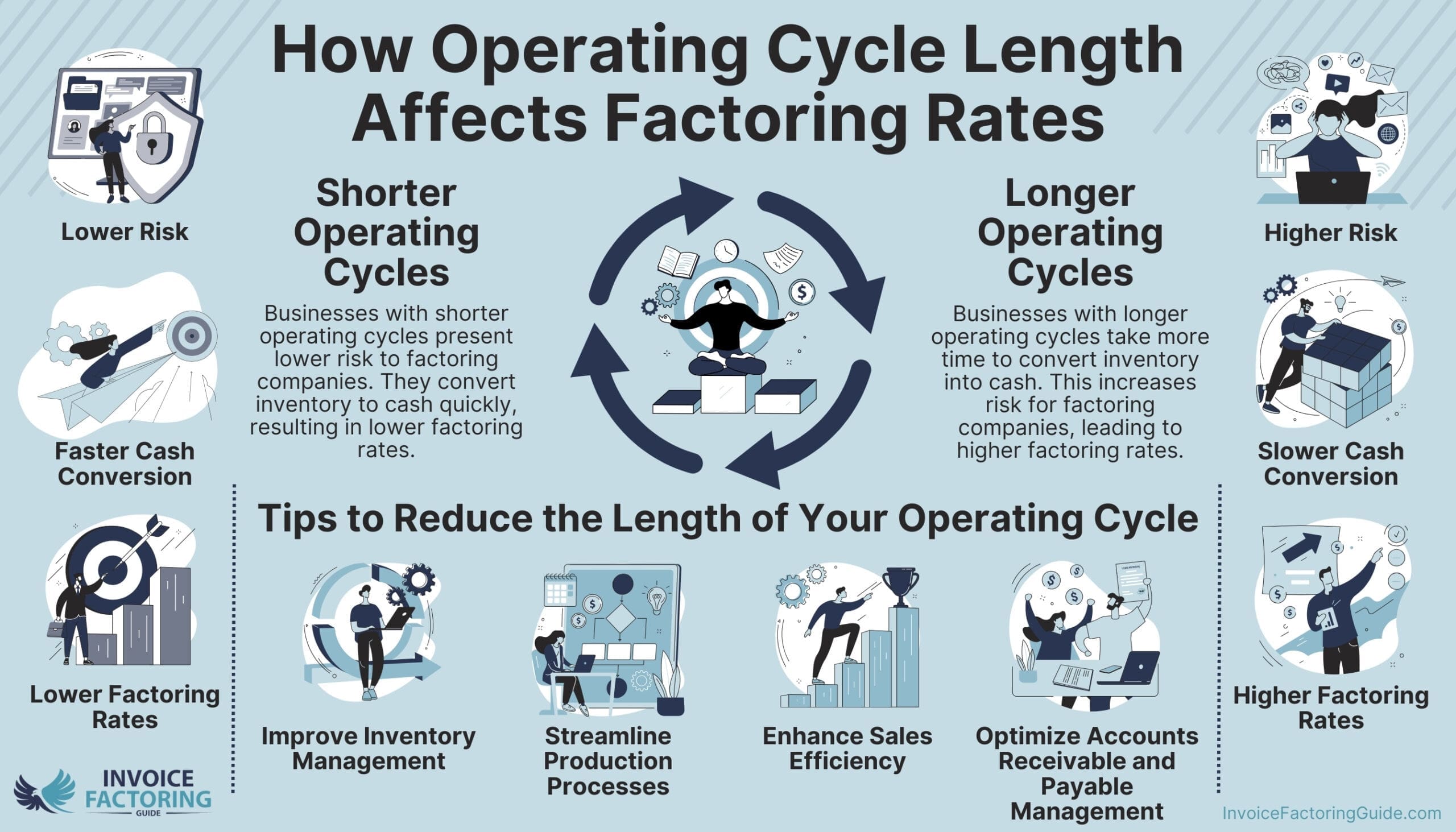

The Role of the Operating Cycle in Factoring Rate Determination

The operating cycle plays a crucial role in determining the factoring rates that a business will receive from a factoring company. Factoring rates, also known as discount rates, are the fees the factoring company charges for cash advances against a business’s accounts receivable. These rates can vary based on several factors, including the length of the operating cycle.

Length of the Operating Cycle

- Shorter Operating Cycles: Businesses with shorter operating cycles typically present a lower risk to factoring companies. These businesses convert inventory to cash quickly, which means the factor can expect faster repayment. Consequently, businesses with shorter operating cycles often receive lower factoring rates.

- Longer Operating Cycles: Conversely, businesses with longer operating cycles take more time to convert inventory into cash. This extended period increases the risk for the factoring company, as there is a greater chance of payment delays or defaults. Factors usually charge higher rates to compensate for this higher risk.

Industry Standards

Different industries have varying standard operating cycles. For instance, the retail industry generally has shorter cycles compared to manufacturing. Factoring companies consider these industry norms when setting rates. Industries known for longer cycles, like construction or manufacturing, might face higher rates.

Creditworthiness of Customers

The creditworthiness of a business’s customers also plays a significant role. If a business sells to customers with strong credit histories who pay promptly, the factoring rate might be lower, even if the operating cycle is longer. Reliable customers reduce the risk for the factoring company.

Invoice Volume and Size

Businesses that generate a high volume of invoices or have larger individual invoices might negotiate better rates. Factors may offer lower rates to secure business with companies that provide significant invoice volume, which can offset the risks associated with longer operating cycles.

Optimizing Your Operating Cycle for Factoring Efficiency

Optimizing your operating cycle for better factoring terms can significantly enhance factoring efficiency, leading to better cash flow and more favorable terms from factoring companies. One strategy that businesses can explore is reverse factoring, a financing solution that allows suppliers to receive early payment while buyers retain extended payment terms. By integrating reverse factoring into their cash flow strategy, companies can streamline payment cycles and improve their working capital position.

Improve Inventory Management

- Efficient Inventory Turnover: Implementing just-in-time (JIT) inventory systems can reduce the amount of capital tied up in inventory. For example, a retail business can optimize stock levels to match demand, thereby reducing the time inventory sits unsold.

- Accurate Demand Forecasting: Using data analytics to predict customer demand can help manage inventory levels more effectively, ensuring that you don’t overstock or understock items.

Streamline Production Processes

- Lean Manufacturing: Adopting lean manufacturing principles can reduce waste and improve efficiency in the production process, shortening the time from raw materials to finished goods.

- Automation: Investing in automation can speed up production, reduce errors, and lower costs. For instance, automated assembly lines can significantly cut down production times.

Enhance Sales Processes

- Effective Sales Strategies: Implementing robust sales strategies that target quick conversion of leads to sales can reduce the time products spend in the sales pipeline.

- E-commerce Platforms: Utilizing e-commerce platforms can speed up the sales process by providing customers with easy access to products and streamlined purchasing options.

Optimize Accounts Receivable

- Incentivize Early Payments: Offering discounts for early payments can encourage customers to pay their invoices sooner, reducing sales outstanding (DSO) days.

- Credit Management: Conducting thorough credit checks on new customers and setting appropriate credit limits can mitigate the risk of late payments and defaults.

- Automated Invoicing: Implementing automated invoicing systems can ensure timely and accurate billing, reducing delays in sending out invoices.

Improve Accounts Payable Management

- Negotiate Better Terms: Working with suppliers to negotiate longer payment terms can help align cash outflows with inflows, improving overall cash flow management.

- Early Payment Discounts: Taking advantage of early payment discounts offered by suppliers can reduce costs and improve relationships with suppliers.

Predicting Factoring Needs Based on Operating Cycle Insights

Operating cycle analysis for factoring is a proactive approach to managing cash flow and ensuring financial stability. By understanding the nuances of your operating cycle, you can anticipate when you’ll need additional liquidity and plan your factoring activities accordingly. Here’s how to use operating cycle insights to predict your factoring needs effectively.

Understanding Your Operating Cycle

- Analyze Historical Data: Review your business’s historical data to identify patterns in your operating cycle. Look at the average time it takes to convert inventory into sales (Days Inventory Outstanding), the average time to collect receivables (Days Sales Outstanding), and the average time to pay suppliers (Days Payable Outstanding).

- Identify Seasonal Variations: Many businesses experience seasonal fluctuations that affect their operating cycle. For example, a retail business may have a longer operating cycle during off-peak seasons and a shorter cycle during peak seasons. Understanding these variations helps in predicting cash flow needs.

- Monitor Key Performance Indicators (KPIs): Track KPIs related to your operating cycle, such as inventory turnover ratio, receivables turnover ratio, and payables turnover ratio. These metrics provide insights into how efficiently your business is managing its operating cycle.

Predicting Factoring Needs

- Forecast Cash Flow: Use your operating cycle data to create a cash flow forecast. This forecast should project your expected cash inflows and outflows over a given period, highlighting when cash shortfalls might occur. Tools like cash flow forecasting software can automate this process and provide more accurate predictions.

- Anticipate Cash Shortfalls: Identify periods when your cash flow forecast indicates potential shortfalls. These are times when factoring can provide the necessary liquidity to cover expenses without disrupting operations.

- Plan for Growth and Expansion: If you’re planning to expand your business or take on large new projects, your cash flow needs will increase. Use your operating cycle insights to estimate the additional working capital required and consider factoring as a way to bridge the gap.

- Adjust for Changes in Credit Terms: Changes in credit terms, either from your suppliers or offered to your customers, can impact your operating cycle. For example, extending longer credit terms to customers can increase your DSO, necessitating factoring to maintain liquidity.

Practical Steps for Predicting Factoring Needs

- Create a Factoring Plan: Develop a plan that outlines when and how you will use factoring based on your cash flow forecasts. Include details such as the amount of receivables you plan to factor, the expected advance rate, and the factoring fees.

- Maintain a Flexible Agreement: Work with your factoring company to establish a flexible agreement that allows you to factor invoices as needed. This flexibility ensures you can access funds quickly when cash flow gaps arise.

- Integrate Factoring with Financial Planning: Integrate factoring into your broader financial planning and budgeting processes. By doing so, you can ensure that factoring is aligned with your overall financial strategy and growth objectives.

Take Control of Your Cash Flow

Invoice factoring is a powerful tool to improve your cash flow and keep your business running smoothly. By converting your receivables into immediate cash, you can cover operating expenses, invest in growth, and navigate financial challenges with ease. Operating cycle considerations in factoring help you manage your operating cycle more efficiently, providing the flexibility needed to thrive in your industry. Invoice Factoring Guide can match you with a factoring company that understands your unique needs and industry dynamics. To take the first step towards optimized cash flow management, request your complimentary rate quote now.

Operating Cycle and Factoring Terms FAQs

How does the operating cycle affect cash flow?

The operating cycle affects cash flow by determining how long a company’s cash is tied up in the production and sales process. A longer operating cycle means cash is tied up for a longer period, potentially leading to cash flow challenges. Conversely, a shorter operating cycle allows for quicker cash recovery, improving liquidity and enabling the business to cover its expenses more effectively.

What is the difference between the operating cycle and the cash conversion cycle?

The operating cycle measures the total time it takes to turn inventory into cash through sales. The cash conversion cycle (CCC) is more specific, measuring the time it takes to convert investments in inventory and other resources into cash flows from sales minus the time it takes to pay suppliers. CCC includes Days Inventory Outstanding (DIO), Days Sales Outstanding (DSO), and Days Payable Outstanding (DPO).

How can businesses optimize their operating cycle?

Businesses can optimize their operating cycle by improving inventory management, streamlining production processes, enhancing sales efficiency, and optimizing accounts receivable and payable management. Techniques like just-in-time inventory, lean manufacturing, offering early payment discounts, and automating invoicing can help shorten the operating cycle, thus improving cash flow and operational efficiency. Improving factoring terms with efficient operating cycle management is key.

What role does the operating cycle play in determining factoring rates?

The length of the operating cycle influences factoring rates because it impacts the risk perceived by factoring companies. Businesses with shorter operating cycles typically present lower risk, resulting in lower factoring rates. Conversely, longer operating cycles indicate a longer wait for repayment, increasing risk and leading to higher rates. Factors also consider industry standards and customer creditworthiness. How the operating cycle affects factoring rates is a critical consideration for businesses.

How can invoice factoring improve a business’s cash flow?

Invoice factoring improves cash flow by allowing businesses to convert their accounts receivable into immediate cash. By selling their invoices to a factoring company, businesses receive a cash advance instead of waiting 30, 60, or 90 days for customer payments. This immediate cash can be used to cover operational expenses, invest in growth, and manage financial challenges effectively.

What are the benefits of using invoice factoring?

Benefits of invoice factoring include improved cash flow, no additional debt, outsourced collections, and flexibility to manage operations smoothly. Factoring provides immediate cash, helping businesses cover expenses, invest in opportunities, and avoid cash flow shortages. It also offloads the task of collecting payments to the factoring company, saving time and resources. Factoring terms for different operating cycles can vary, making it important to understand your specific needs.

How can a business predict its factoring needs?

A business can predict its factoring needs by analyzing its operating cycle and cash flow patterns. By reviewing historical data, forecasting cash flow, and identifying periods of cash shortfalls, businesses can anticipate when factoring will be necessary. Creating a factoring plan and integrating it with financial planning helps ensure timely access to needed funds. Managing the operating cycle for factoring success is essential.

What are the common industries that use invoice factoring?

Common industries that use invoice factoring include manufacturing, transportation and logistics, staffing agencies, retail, and construction. These industries often deal with long payment terms and cash flow challenges, making factoring an attractive solution to maintain liquidity and support ongoing operations.

About Invoice Factoring Guide

Related Articles

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300