Invoice factoring is often favored because it’s a fast and simple way to boost cash flow, but there’s one thing businesses sometimes fail to realize before starting: factoring only works as well as your invoicing process allows.

If your invoices are unclear, inconsistent, or lack key documentation, even the most experienced factoring company will encounter delays. That means slower funding, unnecessary back-and-forth, and potential rejections. On the other hand, when your invoicing process is clear, consistent, and complete, you receive faster approvals, more reliable funding, and often better terms.

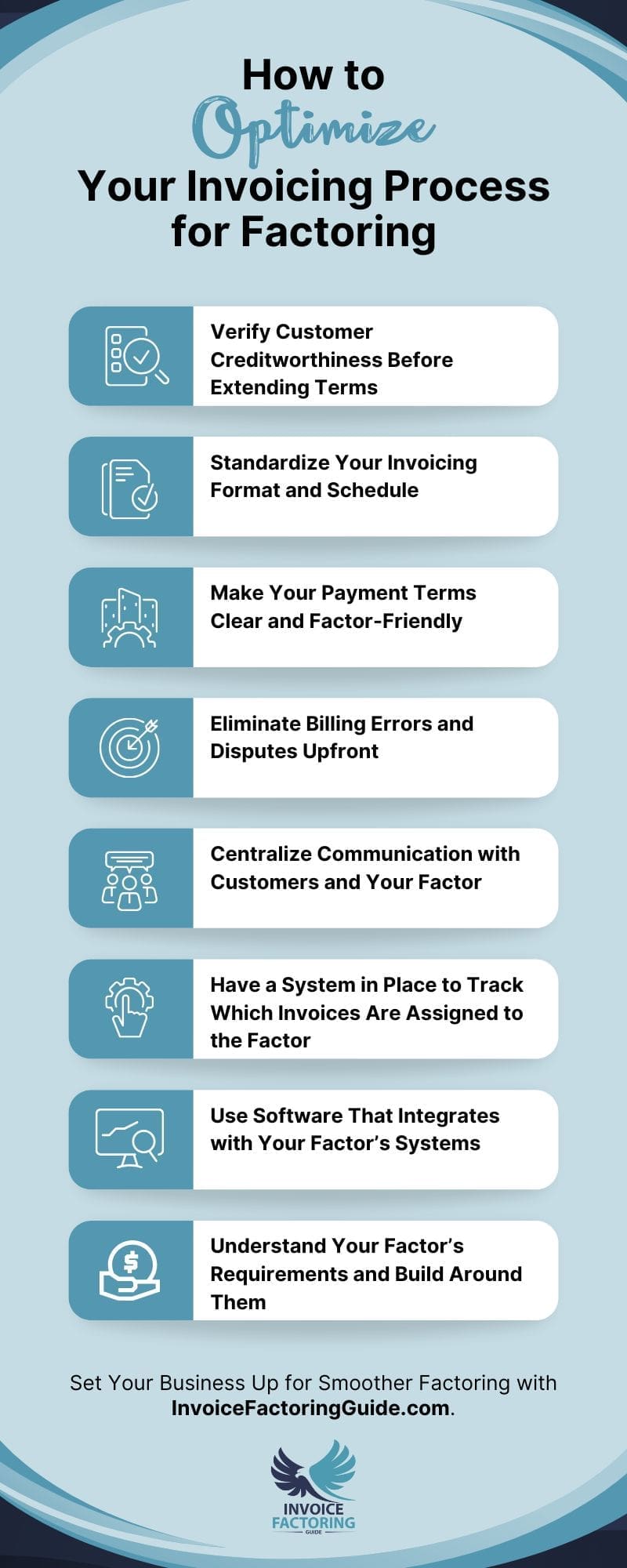

If you’re preparing to leverage factoring, follow the steps outlined on this page to set yourself up for success.

Step 1: Verify Customer Creditworthiness Before Extending Terms

The primary reason factoring tends to be more accessible than traditional loans is that approval is based on the creditworthiness of your customers rather than your credit history. As you onboard with a factoring company, they’ll run credit checks and provide guidance on how much credit you can extend to each customer without accepting any unnecessary risk. This helps ensure all your invoices are paid in full and on time.

Ordinarily, only about half of all businesses run these types of checks, according to Sage Network. However, it’s something you can do on your own to help ensure you’re only issuing trade credit to those who are worthy of it, which will help ensure your invoices qualify for factoring when the time comes.

Step 2: Standardize Your Invoicing Format and Schedule

Clear and reliable invoices eliminate confusion and help build trust. Your customers appreciate standardized formatting and dependable cycles because it makes it easier for them to know what to expect and where to find essential details, which helps them pay on time. Factoring companies appreciate it too, in part because it accelerates payments, but also because they process invoices at scale. To do it quickly, you’ll need to provide them with invoices that follow best practices.

Most factoring companies will accept invoices created through standard accounting software, though they may have specific preferences for layout and content. Include core details like the purchase order number, service or delivery date, and payment terms in a consistent location on each invoice. If any of this information is missing or hard to locate, funding may be delayed while the factor waits for clarification.

Once you’ve created a format that works, use it across all customers and send invoices on a predictable schedule. This not only helps your factoring company approve them faster, it also helps your internal team stay organized and ensures your customers receive documentation they can act on right away.

Step 3: Make Your Payment Terms Clear and Factor-Friendly

Payment terms that are easy to understand help your customers pay on time, making it easier for your factoring company to approve the invoice. If the terms are missing, unclear, or unusual, your invoice may not qualify for funding.

Stick with standard terms like Net 30 or Net 45, and place them in the same location on every invoice. Most factoring companies will ask to review your terms during onboarding and may flag anything that could cause confusion or delay payment.

Avoid wording like “Due upon receipt,” “Flexible terms,” or customer-specific arrangements unless your factoring company has already approved them. These types of phrases make it harder to enforce payment timelines and may raise questions about whether the invoice will be paid on time.

If you offer early payment discounts, make sure the factoring company is aware. In some cases, they’ll reduce the advance rate or adjust your agreement to account for the discount.

The goal is to keep your terms simple and consistent, so everyone, including your customer, your factoring company, and your internal team, knows exactly what to expect.

Step 4: Eliminate Billing Errors and Disputes Upfront

Billing errors and invoice disputes are two of the most common causes of delayed funding. If your invoice doesn’t match the purchase order, includes incorrect charges, or is missing essential details, your customer may refuse to pay, or your factoring company may decline to fund it.

The best way to prevent these issues is to build accuracy into the process. Invoicing software can help by pulling data directly from approved quotes or purchase orders, automatically calculating taxes and freight charges, and reducing the need for manual data entry. When these tools are set up correctly, they help ensure that your invoices go out clean the first time.

Even with automation in place, you may still have some errors. Build a quick review step into your workflow to address this. Confirm that the service or delivery date is accurate, that the invoice is addressed to the right contact, and that the terms reflect what was agreed upon. For high-value invoices or new accounts, a second set of eyes can help catch details that software might miss.

Step 5: Centralize Communication with Customers and Your Factor

Questions and disputes are easier to resolve when everyone knows who to contact. If your factoring company has to track down the right person for clarification, or if your customer responds to the wrong department, small issues can lead to funding delays.

Assign a single point of contact for invoicing questions and ensure that person understands both your internal billing process and your factoring company’s requirements. This person doesn’t need to manage collections, but they should be able to answer basic questions about invoice status, supporting documentation, and terms.

If your customers have multiple locations or departments, make sure your contact information appears consistently on every invoice. The same applies to communication with your factor, use a single email address or phone number for submitting invoices and responding to requests.

Step 6: Have a System in Place to Track Which Invoices Are Assigned to the Factor

Once you begin factoring, it’s important to know which invoices have been sold to the factoring company and which ones haven’t. Sending follow-ups or accepting payment directly on an assigned invoice can create confusion, delay funding, or even violate your factoring agreement.

Establish a simple tracking system before you start. This could be as straightforward as a shared spreadsheet or a tagging system in your accounting software. The goal is to ensure your team knows which invoices are assigned, which customers are paying the factor directly, and how to handle any questions that arise.

Keeping this information organized protects your relationship with your factor and helps ensure your internal team isn’t duplicating efforts or collecting payments that should be routed elsewhere.

Step 7: Use Software That Integrates with Your Factor’s Systems

Some factoring companies integrate directly with accounting platforms like QuickBooks, Xero, or NetSuite. These integrations can simplify the submission process, reduce errors, and provide your factoring company with real-time access to the data they need to quickly approve and fund invoices.

Before you choose a platform or before you finalize your factoring relationship, ask whether integrations are available and how they work. In some cases, your factor may be able to retrieve invoice data and documentation directly from your system, eliminating the need to email files or manually upload documents.

Even if full integration isn’t an option, using compatible formats and cloud-based tools can help streamline communication and reduce processing time. The closer your systems align, the easier it is to maintain a smooth workflow and avoid unnecessary delays.

Step 8: Understand Your Factor’s Requirements and Build Around Them

Every factoring company has its own set of requirements. Some will ask for specific documents with each invoice. Others may have rules about when invoices can be submitted or how payment terms should be worded. Taking time to understand these expectations early on helps you avoid surprises and build a process that supports faster funding.

During onboarding, ask your factoring company for a checklist or submission guide. This will give you clarity on what’s needed and allow you to set up templates, file naming conventions, and internal workflows that align with their system.

Requirements can shift over time, especially if your customers change or if your agreement is updated, so it helps to revisit these guidelines occasionally and make adjustments as needed. Staying aligned will reduce back-and-forth and keep your funding process consistent.

Set Your Business Up for Smoother Factoring

Optimizing your invoicing processes will help you kick off your factoring relationship strong. The next step is finding a factoring company that understands how your business operates and can support your needs. If you’d like to streamline the search and be matched with an experienced and reputable factoring company, request a complimentary rate quote.

FAQs on Optimizing Your Invoicing Process for Factoring

What do factoring companies look for in an invoice?

Factoring companies look for invoices with clear terms, no disputes, and reliable customers. The invoice should reflect work that’s been completed or goods that have been delivered, and it should include accurate billing details and payment terms the customer has agreed to.

How do I make sure my invoices qualify for factoring?

Use standard formats and terms, double-check for billing accuracy, and only submit invoices for completed work or delivered goods. If possible, verify the customer’s credit in advance or ask your factoring company to do it for you before issuing terms.

What documents do I need to submit with a factored invoice?

Most factoring companies ask for the invoice itself, the purchase order, and proof of delivery or service completion. Some industries require additional documents, such as signed logs or rate confirmations. Check with your factoring company for a full list of requirements.

How do I format invoices for a factoring company?

Use a consistent layout that includes your business name, the customer’s contact details, the invoice number, date, due date, itemized charges, and payment terms. Avoid clutter, and make sure key details are easy to find. Many companies use accounting software templates.

Do I need to change my invoicing process to work with a factor?

You may need to make small adjustments, such as using standard terms, submitting invoices more regularly, or including extra documentation. These changes help ensure your invoices are approved quickly and reduce the risk of delays or funding issues.

How do I know if my invoices are factoring-ready?

Your invoices are factoring-ready if they’re accurate, complete, clearly formatted, and backed by documentation. They should be issued for completed work or delivered goods and billed to customers with strong payment histories. If you’re unsure, your factoring company can review them.

What disqualifies an invoice from being factored?

Common issues include billing errors, missing documentation, unclear payment terms, and disputes with the customer. Invoices to customers with poor credit or unpaid balances may also be rejected. Factoring companies only fund invoices they believe will be paid on time.

What invoice information is required for factoring approval?

At minimum, include the invoice number, customer name and contact info, issue date, due date, payment terms, and a breakdown of charges. Your factoring company may also require reference numbers, purchase order details, or customer-specific fields depending on the agreement.

Do I need to submit invoices manually to a factoring company?

Some factoring companies accept manual submissions by email, but many offer portals or accounting software integrations that streamline the process. It’s best to ask during onboarding and choose the method that works best with your current systems.

Do I need to change how I track invoices when factoring?

Yes. You’ll need a system to track which invoices have been assigned to the factor and which are still being paid directly to your business. This prevents double collection, protects your relationships, and helps you stay compliant with your factoring agreement.

About Invoice Factoring Guide

Related Articles

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300