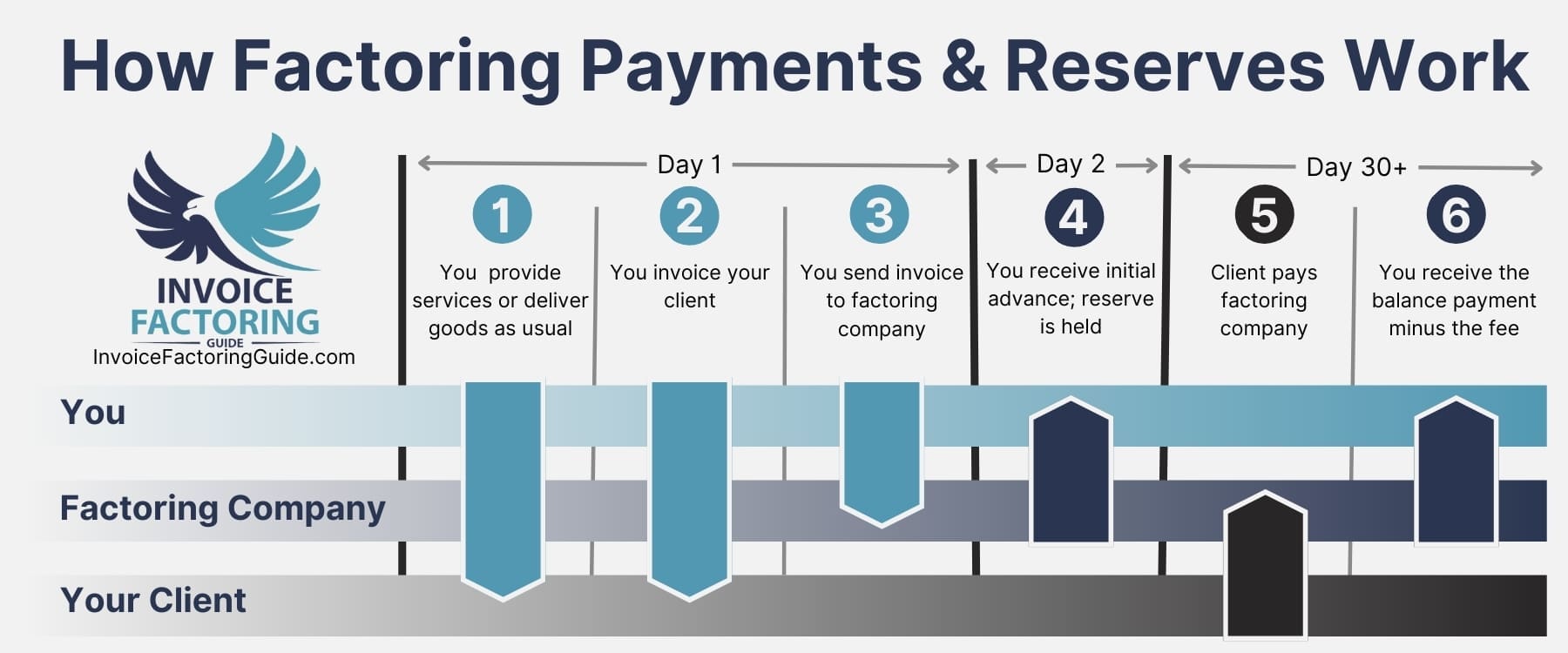

Reserved funds in factoring are often misunderstood, but they’re integral to the process and play a crucial role in your approval as well as your costs. On this page, we’ll walk you through how factoring reserves work and when you’ll get paid so it’s easier to see how the solution fits into your business’s financial plan.

Understanding Reserved Funds in Factoring

Reserved funds in factoring, also known simply as reserves, are a portion of the invoice value that the factoring company holds back when it advances funds to a business. This reserve acts as a safeguard against potential non-payment or disputes related to the invoices.

The Basics of Factoring Reserves

- Initial Advance: When a business sells its invoice to a factoring company, it receives an initial advance, typically around 60 to 95 percent of the invoice’s value. The exact percentage of the advance can vary based on the industry, the creditworthiness of the business’s customers, and other considerations.

- Reserve Fund: The remaining five to 40 percent of the invoice’s value is held in reserve by the factoring company. This reserve is not immediately available to the business.

- Collection and Balance Payment: Once the customer pays the invoice, the factoring company releases the reserve amount to the business, minus any fees for the factoring service. This final payment is known as the balance payment.

The Role of Balance Payments in Factoring

The balance payment is the amount released to the business after the customer has paid the invoice in full. It represents the remaining portion of the invoice value, ensuring that the business ultimately receives the majority of the invoice amount minus the factoring fees.

Example of How Factoring Payments and Reserves Work

Let’s say a small Illinois manufacturing company has an invoice worth $10,000. They enter into a factoring agreement with a company that offers an 80 percent advance rate and a 20 percent reserve.

- Initial Advance: The factoring company advances $8,000 (80 percent of $10,000) to the manufacturer.

- Reserve Fund: The factoring company holds $2,000 (20 percent of $10,000) in reserve.

- Collection: The customer pays the full $10,000 invoice to the factoring company.

- Balance Payment: The factoring company deducts its fees, let’s say five percent or $500 for simplicity, and releases the remaining $1,500 ($2,000 reserve – $500 fees) to the manufacturer.

The Importance of Factoring Reserves

Factoring reserves and balance payments help manage risk for both the factoring company and the small business. For the factoring company, the reserve mitigates the risk of non-payment. For the business, factoring provides immediate cash flow to cover operational expenses without waiting for the invoice payment terms, which can be 30, 60, or even 90 days.

Timing and Management of Factoring Payments

Timing and management of factoring payments are crucial aspects for small businesses to understand, as they impact cash flow and overall financial planning. Here’s a breakdown of these components and when to expect factoring payments.

Advance Payment Timing: Immediate

Typically, once a business submits an invoice to the factoring company, the initial advance is processed and deposited into the business’s account within 24 to 48 hours. This rapid turnaround provides immediate liquidity to the business. Some factoring companies can expedite payment even more and pay out on the day the invoice is submitted.

Customer Payment Timing: 30 to 90 Days After Invoicing

The customer pays the invoice on or before the due date, which can range from 30 to 90 days, depending on the payment terms.

Reserve Release Timing: Upon Receipt of Customer Payment

The timing of factoring balance payments is dependent on when the customer pays, which is usually somewhere between 30 and 90 days after invoicing. Once the factoring company collects the payment from the customer, they release the reserved funds. This process typically occurs within a few business days of receiving the payment. If the customer delays payment, the reserve release is also delayed, which can impact the business’s cash flow.

Real-World Example of a Factoring Payment Timeline

Picture a janitorial company in South Carolina managing cash flow with factoring. The factoring timeline and payments would look something like the example below.

- Day 1: The janitorial company submits a $20,000 invoice to the factoring company.

- Day 2: The janitorial company receives an initial advance of $16,000 (80 percent of the invoice).

- Day 25: The customer pays the invoice.

- Day 26-28: The factoring company processes the payment and releases the reserved $4,000, minus any fees.

The Comprehensive Factoring Settlement Process

Understanding the comprehensive factoring settlement process is crucial for small businesses to navigate efficiently and resolve any disputes or common issues that may arise. Here’s an in-depth look at these aspects:

Invoice Submission

- Creating Invoices: The business creates and submits invoices to the factoring company. These invoices must be accurate and include all necessary details to avoid delays in processing.

- Verification: The factoring company verifies the invoices to ensure they are valid and that the goods or services have been delivered.

Advance Payment

- Initial Funding: After verification, the factoring company provides an initial advance, typically within 24 to 48 hours. This advance is a percentage of the invoice value, usually between 60 to 95 percent.

Customer Payment Collection

- Payment Terms: The customer pays the invoice directly to the factoring company according to the agreed payment terms, which can range from 30 to 90 days.

- Collection Process: The factoring company manages the collection process, ensuring timely payment from the customer.

Reserve Release and Final Settlement

- Payment Received: Once the customer pays the invoice in full, the factoring company releases the reserve amount minus any fees.

- Final Payment: The business receives the remaining funds, completing the factoring process for that invoice.

Navigating the Settlement Process

Many factoring companies offer online portals that allow you to submit your invoices online and monitor the settlement process whenever it’s convenient for you. A few high points of the settlement process are detailed below.

Invoice Management

- Record Keeping: Maintain detailed records of all submitted invoices, payments received, and communications with both customers and the factoring company.

- Automation: Use accounting software to automate and streamline the invoice management process, reducing errors and ensuring timely submissions.

Regular Communication

- Updates: Keep in regular contact with the factoring company for updates on the status of invoices and payments.

- Proactive Approach: Address any potential issues early by maintaining open lines of communication with customers and the factoring company.

Understanding Terms and Conditions

- Contract Review: Thoroughly review the factoring agreement to understand all terms, including advance rates, fees, and reserve policies.

- Clarity: Ensure clarity on all aspects of the agreement to avoid misunderstandings and manage expectations.

Resolving Disputes and Common Issues in Factoring

Businesses sometimes hit roadblocks in the factoring payment process, or the customer disputes the invoice. These situations can have an impact on payment, too.

Dispute Resolution

- Invoice Discrepancies: If there are discrepancies in the invoice, such as incorrect amounts or missing details, the factoring company will typically refer the client back to you to solve the issue.

- Quality Issues: Address any disputes related to the quality of goods or services delivered by providing evidence and maintaining clear communication.

Non-Payment by Customers

- Credit Checks: Factoring companies typically perform credit checks on customers before agreeing to terms to mitigate the risk of non-payment.

- Collection Efforts: If a customer fails to pay, the factoring company will typically handle the collection efforts. Cooperate with them and provide any necessary documentation.

Fee Disputes

- Transparency: Ensure transparency in all fee structures and charges. If there are unexpected fees, discuss them with the factoring company to understand and resolve the issue.

- Negotiation: If fees seem excessive or unclear, negotiate with the factoring company for better terms or seek clarification.

Operational Issues

- System Integration: Ensure your invoicing and accounting systems are compatible with the factoring company’s requirements to avoid operational delays.

- Training: Provide training to your financial staff on the factoring process to ensure smooth operations and avoid common mistakes.

Advantages of Reserved Funds Factoring for Businesses

Reserved funds factoring offers several advantages for businesses, particularly small and medium-sized businesses that want to improve their cash flow and manage their finances more effectively. Let’s explore some key benefits.

Improved Cash Flow

- Immediate Liquidity: By converting invoices into immediate cash, businesses can maintain steady cash flow, which is crucial for covering operational expenses, payroll, and other immediate needs. This is important, as nearly a quarter of businesses say cash flow challenges are their top concern, according to Zebra surveys.

- Reduced Payment Delays: Factoring reduces the impact of long payment terms and late payments from customers, ensuring a more predictable cash flow.

Growth and Expansion

- Funding for Growth: With improved cash flow, businesses can invest in growth opportunities such as purchasing new equipment, expanding operations, or entering new markets.

- Scalability: Factoring grows with the business. As sales and invoice volumes increase, the amount of available funding through factoring also increases.

Credit Protection and Risk Management

- Risk Mitigation: The reserve acts as a buffer against potential non-payment or disputes. This protects the factoring company and ensures the business receives the majority of the invoice value.

- Credit Checks: Factoring companies often conduct credit checks on customers, helping businesses work with creditworthy clients and reduce the risk of bad debts.

Focus on Core Operations

- Outsourced Collections: Factoring companies handle the collection process, allowing businesses to focus on their core operations rather than spending time and resources on chasing payments.

- Administrative Efficiency: By outsourcing accounts receivable management, businesses can streamline their administrative processes and reduce overhead costs.

Access to Expertise

- Financial Guidance: Factoring companies provide expertise in credit management and collections, offering valuable insights and support to businesses.

- Improved Financial Management: Businesses can benefit from the factoring company’s experience in managing receivables and improving overall financial health.

Flexibility and Speed

- Quick Access to Funds: Nine in ten small businesses report experiencing a financial or operational challenge in the past year, per a Fed Small Business report. Factoring provides faster access to cash compared to traditional bank loans, which can have lengthy approval processes.

- Flexible Terms: Factoring arrangements can be tailored to meet the specific needs of the business, including varying advance rates and fee structures.

Get Tailored Invoice Factoring Services

Invoice Factoring Guide can match you with a reputable factoring company to ensure you find a provider that understands your industry and offers favorable terms, enhancing your cash flow without excessive costs. To take the next step, request a complimentary factoring quote.

Reserved Funds Factoring FAQs

How does the factoring settlement process operate?

The factoring settlement process involves submitting invoices to a factoring company, receiving an initial advance, and the factoring company collecting payment from the customer. Once payment is received, the reserve funds are released to the business minus any fees. This process helps businesses maintain cash flow without waiting for customer payments.

What is the typical advance rate in factoring?

The typical advance rate in factoring ranges from 60 to 95 percent of the invoice value. The exact rate depends on factors such as industry, the creditworthiness of the business’s customers, and the specific terms negotiated with the factoring company.

Why do factoring companies hold a reserve fund?

Factoring companies hold a reserve fund to mitigate the risk of non-payment or disputes related to the invoices. The reserve acts as a safeguard, ensuring the factoring company can cover potential losses and providing a layer of security for both the company and the business.

How long does it take to receive the initial advance from a factoring company?

Typically, businesses receive the initial advance from a factoring company within 24 to 48 hours after submitting their invoices, though some factoring companies pay out on the same day. This quick turnaround provides immediate liquidity, helping businesses manage their cash flow effectively.

What happens if a customer doesn't pay the invoice on time?

If a customer doesn't pay the invoice on time, the factoring company will usually handle the collection efforts. Depending on the terms of the agreement, the business may be required to repay the advance, or the factoring company may adjust future advances to cover the unpaid invoice.

What are the advantages of using reserved funds factoring for small businesses?

Reserved funds factoring offers immediate cash flow, reduces the impact of long payment terms, and allows businesses to focus on core operations. It provides financial flexibility, mitigates credit risk, and supports growth by converting invoices into immediate cash without incurring debt.

How can a business resolve disputes related to factored invoices?

To resolve disputes related to factored invoices, businesses should maintain clear communication with both the factoring company and the customer. Providing accurate documentation, addressing any quality issues promptly, and working collaboratively to resolve discrepancies can help ensure timely payment and release of reserve funds.

Why should I use a matching service to find a good factoring company?

A matching service helps identify factoring companies that understand your industry and offer favorable terms, saving you time and effort. These services leverage their expertise and network to find the best fit, ensuring you get the most suitable partner for your specific needs and providing ongoing support throughout the process.

What fees are associated with factoring, and how are they calculated?

Factoring fees typically include a percentage of the invoice value, often ranging from one to five percent, and may also include other charges such as setup fees or additional service fees. These fees are usually deducted from the reserve funds when they are released to the business after the customer pays the invoice.

Can my factoring reserve amount be changed?

You do have some control over the amount that’s held as a reserve. For instance, those who pay higher factoring fees can sometimes have lower reserves. The creditworthiness of your clients, industry, and other details impact the reserve amount, too. Speak with your factoring company about your goals to find out which options will work best for you.

About Invoice Factoring Guide

Related Articles

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300