Struggling with slow payments that choke your cash flow? Reverse factoring could offer the relief your business needs. Instead of waiting for buyers to pay, suppliers get early payment—initiated by the buyer—through a trusted financial institution.

In reverse factoring (also called supply chain finance), a third-party financing company steps in once the buyer approves an invoice. The supplier gets paid quickly, often at a discount, while the buyer benefits from extended payment terms. Thanks to the buyer’s stronger credit rating, suppliers typically enjoy better financing terms than with traditional factoring.

Reverse factoring is also often treated as an off-balance sheet solution under certain Financial Accounting Standards Board (FASB) guidelines, making it a strategic tool for improving working capital metrics. However, it’s important to understand both its benefits and its limitations.

In this guide, we’ll walk you through how reverse factoring works, the advantages it offers, and the risks you should consider before choosing this financing option.

How Traditional Factoring Works for Receivables Financing

Traditional factoring, or invoice factoring, is a financial arrangement where a business sells its accounts receivable (invoices) to a third-party company called a factor. This process helps businesses improve their cash flow without waiting for their customers to pay their invoices. Here’s how it typically works:

- Invoice Issuance: A business provides goods or services to a customer and issues an invoice.

- Sale to Factor: Instead of waiting 30, 60, or 90 days for the customer to pay, the business sells the invoice to a factoring company. The factor usually advances a significant percentage of the invoice value, often between 60 and 95 percent.

- Immediate Cash: The business receives immediate cash, which can be used to cover operational expenses, invest in growth, or manage other financial needs.

- Collection: The factoring company takes over the responsibility of collecting payment from the business’s customers.

- Final Payment: Once the customer pays the invoice, the factor pays the remaining balance to the business minus a fee for their services.

Example of Traditional Factoring

Imagine a small manufacturing company in Iowa that provides products to various retailers. They issue invoices with payment terms of 30 days. To maintain smooth operations and manage payroll, they need immediate cash. By selling their $100,000 invoice to a factoring company, they might receive $85,000 upfront. When the customer pays the invoice, the factor gives the manufacturer the remaining $15,000 minus their fee, which might be around two or three percent.

Key Benefits of Traditional Factoring

- Improved Cash Flow: Businesses get immediate access to funds. This is essential, as 68 percent of small businesses suffer from cash flow issues, QuickBooks reports.

- Outsourced Collections: Factors handle the often time-consuming and difficult task of collecting payments. This saves a typical small business around 14 hours per week, per Intuit research.

- Flexible Financing: It’s not a loan, so businesses don’t incur debt or need to worry about repayment schedules.

How Reverse Factoring Works in Supply Chain Finance

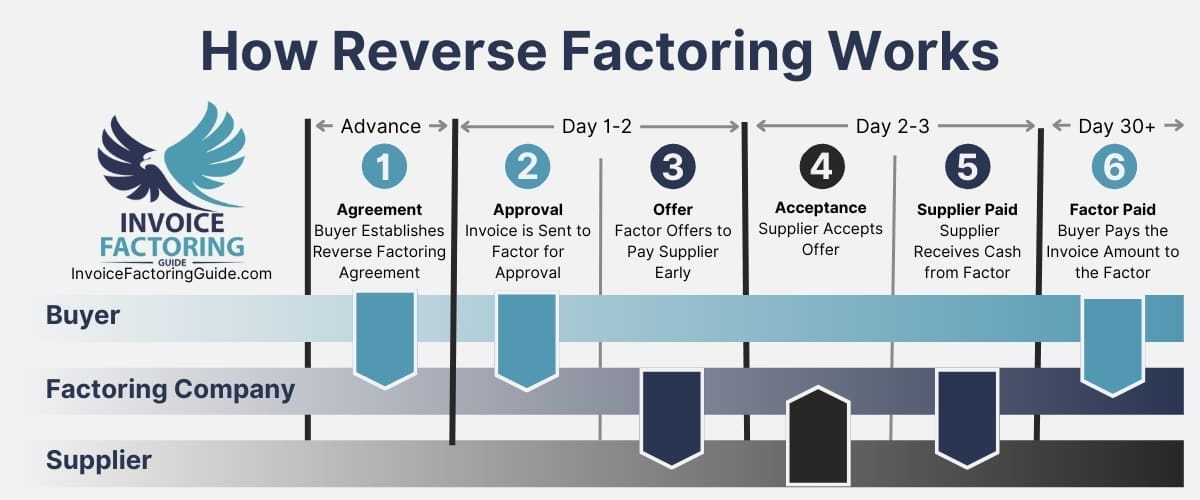

Reverse factoring, also known as supply chain financing, is a financial solution where a third party, typically a factoring company, intermediates between a buyer and its suppliers to facilitate early payment of invoices. Unlike traditional factoring, which the supplier initiates, reverse factoring is initiated by the buyer. Here’s how it works:

- Agreement Setup: A buyer, usually a large company, establishes a reverse factoring agreement with a financial institution.

- Invoice Approval: The supplier delivers goods or services and submits an invoice to the buyer. The buyer then approves the invoice for payment.

- Early Payment Offer: Once approved, the financial institution offers early payment to the supplier, usually at a discount.

- Supplier Choice: The supplier can choose to receive early payment from the financial institution, typically within a few days of invoice approval.

- Buyer Payment: The buyer eventually pays the full invoice amount to the financial institution at the original invoice due date.

Example of Reverse Factoring

Picture a large medical supply chain in Georgia that buys products from multiple small suppliers. The medical supply chain partners with a factoring company for reverse factoring. When a small supplier delivers goods and invoices the medical supply chain, the retailer approves the invoice and informs the factoring company. The factoring company then offers to pay the supplier early, say, 95 percent of the invoice value. The supplier gets quick access to cash, and the retailer pays the bank the full invoice amount on the original due date.

Benefits of Reverse Factoring for Suppliers & Buyers

There are lots of benefits of reverse factoring for businesses.

- Improved Cash Flow for Suppliers: Suppliers receive payments faster, improving their cash flow and reducing the need for borrowing.

- Strengthened Supply Chain: By supporting suppliers with quicker payments, buyers can strengthen their supply chain and potentially negotiate better terms.

- Risk Reduction: Suppliers face less risk of late payments, as the financial institution guarantees early payment upon buyer’s approval.

- Buyer Credit Utilization: The buyer’s creditworthiness supports the transaction, often resulting in lower financing costs for suppliers.

Risks & Pitfalls of Reverse Factoring in Financing Solutions

Despite these benefits, reverse factoring has pitfalls and risks that businesses should be aware of to minimize challenges.

- Dependency on Buyer: Suppliers depend on the buyer’s creditworthiness and timely invoice approval. Businesses can mitigate this risk by partnering with financially stable buyers with strong credit ratings. Regularly reviewing the financial health of their buyers can also help manage this dependency.

- Cost to Suppliers: While beneficial, the early payment often comes at a discounted rate, which can add up over time. Suppliers should evaluate the cost of early payment against their financing costs and cash flow needs. Often, the discount for early payment is lower than the cost of alternative financing options, making it a cost-effective solution.

- Administrative Complexity: Setting up and managing reverse factoring agreements can be complex and require coordination between multiple parties. Specialized software and financial technology platforms can streamline the process, making it easier to manage and coordinate them. Training staff and working with experienced financial institutions can also reduce complexity.

Reverse Factoring vs. Traditional Factoring: Key Differences

Now that you have the background on each, let’s do a detailed comparison of factoring vs. reverse factoring.

Initiation and Process

Traditional Factoring

- Initiated By: Supplier

- Process:

- Supplier provides goods or services and issues an invoice to the customer.

- Supplier sells the invoice to a factoring company.

- Factoring company advances a percentage of the invoice value to the supplier.

- Factoring company collects payment from the customer.

- Upon collection, the factoring company pays the remaining balance to the supplier, minus a fee.

Reverse Factoring

- Initiated By: Buyer

- Process:

- Buyer establishes a reverse factoring agreement with a financial institution.

- Supplier delivers goods or services and submits an invoice to the buyer.

- Buyer approves the invoice for payment.

- Financial institution offers early payment to the supplier.

- Supplier receives early payment at a discount if they choose.

- Buyer pays the full invoice amount to the financial institution at the due date.

Cash Flow Impact on Suppliers & Buyers

Traditional Factoring – Immediate Cash for Suppliers

- Supplier: Receives immediate cash flow, which helps manage working capital and operational expenses.

- Buyer: No direct impact on the buyer’s cash flow.

Reverse Factoring – Delayed Buyer Payment

- Supplier: Receives early payment, improving cash flow and reducing the need for borrowing.

- Buyer: Pays the financial institution on the original due date, potentially improving supplier relations and stability.

Cost & Interest Rate Considerations

Traditional Factoring – Fees Based on Invoice Amount

- Supplier: Pays a fee to the factoring company, usually a percentage of the invoice value. This fee can vary based on the creditworthiness of the customer and the volume of invoices factored.

- Buyer: No direct costs, but may indirectly bear costs if suppliers increase prices to cover factoring fees.

Reverse Factoring – Discounted Early Payments

- Supplier: Pays a discount fee for early payment, which is often lower than traditional factoring fees due to the buyer’s creditworthiness.

- Buyer: May incur fees for setting up and managing the reverse factoring program, but benefits like stronger supplier relationships and better payment terms usually offset these costs.

Risk & Suitability for Different Businesses

When to Choose Traditional Factoring

- Supplier: Risk of customer non-payment is partially transferred to the factor, depending on whether it’s a recourse or non-recourse arrangement.

- Buyer: Minimal direct risk, but could face reputational risks if suppliers struggle with cash flow issues due to factoring arrangements.

When Reverse Factoring Is a Better Fit

- Supplier: Reduced risk of late payment as the financial institution guarantees early payment once the buyer approves the invoice.

- Buyer: Takes on the obligation to pay the financial institution, but this is typically a managed risk due to the buyer’s financial stability.

Suitability

Traditional Factoring

- Ideal For: Small to medium-sized businesses with limited access to credit, needing immediate cash flow, and having customers with strong credit profiles.

- Examples: Manufacturing companies, service providers, wholesalers, trucking companies.

Reverse Factoring

- Ideal For: Large companies with strong credit ratings that want to support their supply chain, improve supplier relationships, and stabilize their own operations.

- Examples: Retail chains, large manufacturers, and companies with extensive supply chains.

Control and Relationship

Traditional Factoring

- Supplier: Loses some control over the collection process to the factoring company.

- Buyer: May have less visibility into the supplier’s financial arrangements and could face disruptions if the supplier has cash flow issues.

Reverse Factoring

- Supplier: Retains more control over their cash flow and benefits from the buyer’s creditworthiness.

- Buyer: Gains more control and visibility into the supply chain, fostering stronger relationships with suppliers.

Why Reverse Factoring Matters for Supply Chain Finance

Reverse factoring plays a crucial role in supply chain finance by providing liquidity to suppliers, allowing them to get paid faster for outstanding invoices. This reduces financial strain, enhances stability, and ensures uninterrupted operations. At the same time, buyers can extend their payment terms without negatively impacting suppliers, optimizing accounts payable management.

A key advantage of reverse factoring is that it leverages the buyer’s creditworthiness, enabling lower interest rates and off-balance sheet financing—a strategy that improves financial reporting. Additionally, reverse factoring supports debtors and suppliers by financing their receivables, mitigating supply chain risks, and strengthening long-term business relationships.

While reverse factoring contracts offer significant benefits, it’s important to note that reverse factoring may also have drawbacks, such as potential risks related to financial accounting standards and factoring service fees. However, as reverse factoring emerged and evolved, it has become a widely used solution for stabilizing supply chains, improving cash flow, and supporting both buyers and suppliers in global markets.

Find Your Ideal Factoring or Reverse Factoring Partner

Traditional factoring and reverse factoring offer valuable financial solutions but cater to different needs and circumstances. Traditional factoring is supplier-initiated and helps businesses improve cash flow by selling their invoices. In contrast, reverse factoring is buyer-initiated and designed to support suppliers with early payments, leveraging the buyer’s strong credit rating to reduce financing costs and risks.

Invoice factoring companies can help in either situation, though it’s essential to choose a factoring partner that understands your business and your customers. At Invoice Factoring Guide, we work with factoring companies that offer traditional factoring and reverse factoring, so it’s easy for you to get the right services for your needs. Let us do the heavy lifting and match you with a factoring company. Request a complimentary rate quote to get started.

Reverse Factoring FAQs

What Are the Benefits of Reverse Factoring?

The benefits of reverse factoring include:

- Reverse factoring speeds up payments for suppliers, reducing reliance on loans.

- Buyer's credit rating determines financing costs, leading to lower rates.

- Reverse factoring solutions help businesses manage cash flow while maintaining longer payment terms.

- Supplier finance ensures suppliers get early payments without taking on debt.

- Strengthens the supply chain by improving financial stability across the network.

Reverse factoring is considered an off-balance sheet, meaning it doesn’t appear as debt in financial records, helping buyers optimize financial accounting standards and board compliance.

Reverse Factoring vs. Traditional Factoring: What’s the Difference?

The key difference between factoring and reverse factoring is who initiates the process:

- Traditional AR factoring: The supplier sells invoices for immediate cash.

- Reverse factoring arrangement: The buyer initiates the process, working with a financial partner to pay suppliers early.

Unlike reverse factoring, traditional factoring is considered off-balance sheet only under specific conditions.

How Does Reverse Factoring Affect Interest Rates & Costs?

Reverse factoring costs depend on the buyer’s credit rating. Since financing is based on the credit of the buyer rather than the supplier, it often results in lower interest rates compared to loans or nonrecourse factoring.

However, suppliers may receive an early payment discount, meaning they pay the financing partner a small percentage for faster payments. The cost is usually charged by the financial institution managing the arrangement.

Is Reverse Factoring Suitable for Small Businesses?

Reverse factoring is used by companies of all sizes, but it is most effective for suppliers working with large, creditworthy buyers.

For small businesses, reverse factoring can be used to:

- Reduce dependency on bank loans.

- Gain early payment discount advantages.

- Improve financial stability without taking on debt.

However, especially if the buyer has weak credit, reverse factoring may not be the best option.

How Do Businesses Use Reverse Factoring to Improve Cash Flow?

Companies use reverse factoring to transform cash flow management. The reverse factoring transaction allows suppliers to receive early payments, improving working capital and reducing the risk of late payments.

This reverse factoring solution is a long-term trading arrangement that ensures steady cash flow, making it a valuable supplier finance tool.

How Do Factoring and Reverse Factoring Benefit Different Businesses?

Factoring and reverse factoring help businesses in different ways:

- Factoring financing methods benefit suppliers needing immediate cash.

- Reverse factoring arrangements support buyers by allowing extended payment terms.

- The reverse process stabilizes supplier payments while helping buyers maintain liquidity.

Both methods help finance teams optimize cash flow and strengthen supply chain management.

Why Is Reverse Factoring Important for Businesses?

Reverse factoring is important because it supports a sustainable supply chain, ensuring that suppliers receive timely payments. It also plays a key role in global trade finance, allowing businesses to scale operations while maintaining financial stability.

By using reverse factoring, companies can:

- Ensure a long-term trading arrangement with reliable partners.

- Avoid cash flow disruptions that could weaken supply chain management.

- Transform finance operations by reducing reliance on traditional loans.

How to Choose the Right Factoring Solution for Your Business

The best factoring financing method depends on:

- Company size: Small businesses may prefer factoring, while large buyers benefit from a reverse factoring arrangement.

- Buyer’s credit rating: If the buyer is creditworthy, reverse factoring can provide lower costs.

- Financial goals: If you need immediate cash, selling your unpaid invoices via factoring may be ideal.

A forward-thinking finance team will evaluate these factors to select the most effective financing arrangement.

About Invoice Factoring Guide

Related Articles

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300